Truck tonnage rebounds in September

ATA’s adjusted index up 6.1 percent year-to-date

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index increased 1.7 percent in September after falling a revised 2.8 percent in August. The latest gain put the adjusted index at 108.7 in September from 106.9 in August. The nonadjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 112.4 in September, down 0.9 percent from the previous month.

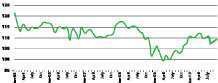

ATA’s Truck Tonnage Index (Seasonally Adjusted; 2000=100) Despite recovering a bit from its August decline, the American Trucking Associations’ seasonally adjusted for-hire tonnage index shows that demand has softened since a springtime surge.

ATA’s Truck Tonnage Index (Seasonally Adjusted; 2000=100) Despite recovering a bit from its August decline, the American Trucking Associations’ seasonally adjusted for-hire tonnage index shows that demand has softened since a springtime surge.Compared with September 2009, adjusted tonnage climbed 5.1 percent, which was well above August’s 2.9 percent year-over-year gain. Year-to-date, tonnage is up 6.1 percent compared with the same period in 2009.

Truck tonnage over the last few months fits with an economy that is growing very slowly, says ATA Chief Economist Bob Costello. “While I am glad to report that tonnage grew in September, the fact remains that truck freight volumes leveled off over the summer and early autumn,” he says. “This is a reflection of an economy that is barely growing.” Costello noted again this month that the trucking industry is significantly smaller than it was prior to the recession, but as a result, it is better equipped to deal with slower-than-normal tonnage growth.

ATA calculates the tonnage index based on surveys from its membership. The report includes month-to-month and year-over-year results, relevant economic comparisons and key financial indicators. The baseline year is 2000.

Trucking job growth appears to stall

Trucking companies added 300 new employees on a seasonally adjusted basis in October, according to preliminary payroll employment figures released by the U.S. Department of Labor’s Bureau of Labor Statistics. BLS also revised its September figures upward by 400 jobs and its August figures downward by 200.

After strong employment growth in spring and early summer, trucking companies have added just 2,300 jobs in the past three months.

After strong employment growth in spring and early summer, trucking companies have added just 2,300 jobs in the past three months.According to the latest estimates, trucking companies have added 15,900 jobs since March, but most of that growth occurred this spring and early summer. In the last three months, trucking companies have added only 2,300 jobs, according to BLS figures.

For the first time since the recent downturn in trucking jobs began, payroll employment was up year over year in October. The for-hire trucking industry employed 2,300 more people in October than in October 2009, according to the latest data. Total employment was 1.243 million – down 210,100, or 14.5 percent, from peak trucking employment in January 2007. The BLS numbers reflect all payroll employment in for-hire trucking, but they don’t include trucking-related jobs in other industries, such as a truck driver for a private fleet. Nor do the numbers reflect the total amount of hiring since they only include new jobs, not replacements for existing positions.

Nationwide, the economy added 151,000 nonfarm payroll jobs in October, according to BLS estimates. The unemployment rate was unchanged, however.

IN BRIEF

* TransCore’s North American Freight Index showed a 69 percent increase in spot-market freight availability in October over October 2009. The October level marks the third consecutive month when spot freight achieved the highest year-over-year growth since 2005, which was a peak year for spot market volume.

* The Freight Transportation Services Index rose 1.0 percent in September from its August level after a one-month decline, the U.S. Department of Transportation’s Bureau of Transportation Statistics reported.

* The ratio of inventories to sales throughout the economy on a seasonally adjusted basis held steady in September at 1.27 – below both the 1.33 average over the past decade and the 1.30 ratio in September 2009. A lean inventories-to-sales ratio generally is good news for trucking as it makes it more likely that businesses will need to replenish supplies and stocks in the event of an uptick in demand.

* Permits authorized for housing construction were at a seasonally adjusted annual rate of 550,000 in October – 0.5 percent below September and 4.5 percent below October 2009, the U.S. Census Bureau reported. Housing starts were 11.7 percent below September and 1.9 percent below October 2009.

* Trade using surface transportation between the United States and its North American Free Trade Agreement partners Canada and Mexico was 25.3 percent higher in August 2010 than in August 2009, according to the Bureau of Transportation Statistics of the U.S. Department of Transportation.

Manufacturing sector shows strength

Manufacturing activity grew for the 15th consecutive month in October and at a faster rate than in September, the Institute for Supply Management reported Nov. 1. ISM’s composite index, the PMI, was at 56.9 percent in October, up from the 54.4 percent recorded for the previous month. The index for new orders – a key component of the PMI and an indicator of near-term shipment volumes – was especially strong at 58.9 percent, which is 7.8 percentage points higher than September. The production index also was strong at 62.7 percent, up 6.2 points.

“Since hitting a peak in April, the trend for manufacturing has been toward slower growth,” said Norbert Ore, chair of ISM’s Manufacturing Business Survey Committee. “However, this month’s report signals a continuation of the recovery that began 15 months ago, and its strength raises expectations for growth in the balance of the quarter.”

Supply management professionals responding to the survey noted the recovery in autos, computers and exports as key growth drivers. “Concerns about inventory growth are lessened by the improvement in new orders during October,” Ore said. “With 14 of 18 industries reporting growth in October, manufacturing continues to outperform the other sectors of the economy.” n