The trucking industry shows a mixed picture as the year unfolds, according to FTR analysts at its State of Freight webinar last week.

FTR CEO Jonathan Starks kicked off the webinar by noting that the 43-day government shutdown brought a lack of economic data, with significant data revisions revealing a weaker industrial economy than previously understood.

Federal Reserve revisions to industrial production data released before Thanksgiving showed that manufacturing output was down 1.6%—a stark difference from the previously estimated 1.4%.

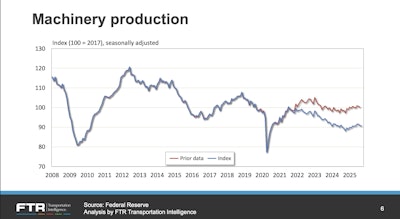

Avery Vise, vice president of trucking, noted that this year’s revision “looks to be much more significant” than last year’s minimal changes, with manufacturing trending “slightly downward” since early 2022.

Machinery production is troubling, Vise noted, as it showed “about a nine-point swing from being up… almost 2% actually, to being down more than 7% versus the [pre-pandemic period].”

Vise said it is a “worrisome indicator regarding what our cap might be for industrial production as we look ahead.”

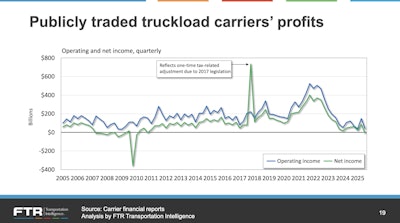

Publicly traded carriers reported their weakest performance since the Great Recession, said Vise, including a small negative net income of $7 million.

Operating income remained positive, though at historically low levels. However, Vise pointed out that recently released Census Bureau data showed a more positive picture. Trucking revenues increased 3.5% quarter-over-quarter, marking the strongest performance since Q4 2022. Year-over-year revenues climbed 4.2%, outpacing the 1.1% growth seen by public carriers.

“It’s some strong performance in what is still a sluggish sector,” Vise said.

The spot market saw unusual strength around Thanksgiving, Vise said, particularly for dry van, which experienced two consecutive weeks of increases exceeding last year’s levels. Vise cautioned that it is likely seasonal volatility.

“Rates are also running stronger than last year,” Vise added.

Vise skipped over discussions regarding volume estimates, as the lack of economic data from the government shutdown has brought forecast distortions.

Truck orders plummeting 36% year over year through November’s order season, combined with backlogs remaining “really low,” presents another alarming factor, Vise said.

“If production is also weaker in 2026 because of lower backlogs and lower orders, then that also is going to put a limit on how much equipment is available from perhaps late 2026 and beyond,” he said.

If disruptions to labor and equipment intensify, Vise pointed out, “This could produce some real issues in terms of the upside of the market, which, of course, carriers would welcome, but shippers would not.”

Capacity remains a central concern, with roughly around 88,000 more carriers in the market than before the pandemic, though mostly small one-truck operations.

November’s new carrier entries hit their lowest level since May 2020 (excluding slow December and January months), which Vise said could potentially be signaling that cost pressures and enforcement actions are impacting new entries to the market.

English language proficiency enforcement has also generated significant impacts, resulting in nearly 10,000 out-of-service violations since late June.

According to FTR, Texas dominates enforcement activity, with Laramie County, Wyoming, appearing as an unexpected hotspot, accounting for 3.4% of all national violations.

Vise said that the estimated maximum annual impact of 25,000 to 35,000 drivers exiting the industry is “not a market-moving number.”

“Frankly, [in] my experience over the years, drivers are not typically deterred by something that might happen. They’re only deterred by something that does happen,” Vise said.

[RELATED: Frequency of lawsuits, size of jury verdicts against motor carriers rising]

Rising insurance premiums pose an emerging threat, Vise said. Commercial auto insurance costs surged at the beginning of the year, but their full impact may only now be materializing as carriers renew annual policies.

Combined with enforcement activity, Vise said rising insurance costs could explain November’s low new carrier entrants and may further constrain capacity next year.