P.A.M. Transportation Services Inc. on Tuesday, Feb. 8, reported a net loss of $1.11 million for the fourth quarter and a net loss of $654,728 for the year both ended Dec. 31, compared to net losses of $3.92 million and $10.85 million for the quarter and year, respectively, in 2009. Operating revenues were $78.2 million for the fourth quarter of 2010, a 3.3 percent decrease compared to $80.87 million. Operating revenues were $331.99 million for the year, a 13.7 percent increase compared to $291.91 million.

“The fourth quarter, like our third quarter, was met with mixed emotions,” said Daniel Cushman, president of the Tontitown, Ark.-based company. “While we are pleased that financial results for each quarter in 2010 improved over the same quarter in 2009 and that we have dramatically reduced the 2010 loss as compared to that experienced in 2009, several factors contributed to a loss of momentum in the third and fourth quarters.”

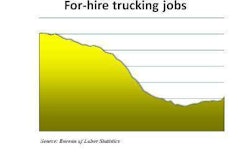

Cushman said that as the year progressed, the company continued to improve its freight mix, walking away from some undesirable freight that it was not able to replace immediately. “The freight we walked away from required a one-year commitment, so we had to make a decision – continue to haul it, or walk away and replace it as quickly and efficiently as possible,” he said. “We hoped we could do both, and replace it immediately with better-paying freight. We eventually got the better-paying freight – it just took longer than we would have liked.”

Cushman said the company’s challenge remains replacing some large customers with a larger number of smaller customers, “which takes time. Several of the customers that are currently small in terms of revenue have significant growth potential. Next year, our growth with these existing customers will be as important, if not more important, than development of additional new business.”

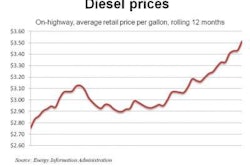

Cushman said P.A.M. has intensified its emphasis on maintenance costs, driver recruitment/retention and fuel. “We deferred the purchase of new tractors during 2010 while new engine technology could be tested by the industry,” he said. “This increased the average age of our fleet by approximately one year, resulting in increased maintenance costs and the addition of maintenance technicians to keep our revenue-producing units in service and compliant with the new Comprehensive Safety Analysis regulations issued by the Federal Motor Carrier Safety Administration. In 2011, we plan to begin retiring older high-mileage equipment and return to a regular equipment replacement cycle.”