Assembling a strong base for freight

Industry fortunes are more tied to manufacturing than ever

Whether they admit or even realize it, most trucking executives probably expect the strength and duration of an economic recovery to match roughly the scope of the downturn. There’s certainly some logic in this way of thinking. An extended recession creates pent-up demand for consumer spending and business investment. Meanwhile, capacity tightens due to failures, consolidation and the inability to finance new equipment. Demand grows, supply falls. Happy days are here again.

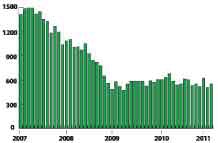

Housing Starts-- Seasonally adjusted annual rate, in thousands

Housing Starts-- Seasonally adjusted annual rate, in thousandsNot exactly – at least not without volatility. The recovery likely won’t meet rosy expectations, and one reason for that is housing, says Noël Perry, principal of Transport Fundamentals and partner in transportation forecasting firm FTR Associates. In a CCJ webinar on the freight outlook last month, Perry said everyone must adjust to the reality that the boom housing market of 1995 through 2006 was significantly above the historical norm. The historical average homeownership rate is about 64 percent, Perry says. But the rate at its peak was 69 percent, and today it is still about 66.5 percent. So there’s still a ways to go toward a normal market.

During the housing boom, we were building about 500,000 more homes a year than the norm of 1.2 million, Perry says. During the bust, we probably will be building only about 700,000 at best until the market reaches equilibrium, which could take several years.

Avery Vise [email protected]

Avery Vise [email protected]But housing isn’t the only construction-related negative, says Perry, pointing to the current political struggle over the deficit. If tax increases are off the table and several line items are sacred or untouchable – such as defense, Medicare/Medicaid, Social Security, pensions and interest on the debt – then we start off in a deficit even before we look at maintaining or increasing our spending on roads, bridges and other big construction projects. But if we don’t fix the problem, the result will be higher interest rates, inflation and another recession.

And yet, business is good for much of the trucking industry. That, according to Perry, results from manufacturing and tight capacity. “In the short term, the news is relatively good,” he says. One phenomenon has been a reversal of the longstanding trend of growth in services outpacing growth in manufacturing, Perry says.

All signs point to continued solid manufacturing growth. The Institute of Supply Management’s composite index, known as the PMI, has indicated growth every month since August 2009. The ratio of inventories to sales throughout the economy is at an all-time low. And durable goods orders remain strong.

Business investment and exports explain the strength in manufacturing, Perry says. In fact, even if foreign investors lose confidence in the United States and the value of the U.S. dollar drops, exports will be even more attractive.

The recovery may be volatile and brief, but credit manufacturing and the driver shortage for the profits you see.

– Avery Vise is executive director, trucking research and analysis for Randall-Reilly and senior editor, industry analysis for Commercial Carrier Journal. E-mail [email protected].

Trucking job market remains strong

BLS estimates show March gain over February surge

The trucking industry added 1,600 jobs on a seasonally adjusted basis in March compared to revised estimates for February, according to the latest report from the U.S. Department of Labor’s Bureau of Labor Statistics. Payroll employment at for-hire trucking companies was 40,000 jobs higher than in March 2010, according to the preliminary figures.

The real story in the March jobs report was that the huge surge reported in February for trucking payroll employment was revised downward by only a small amount.

The real story in the March jobs report was that the huge surge reported in February for trucking payroll employment was revised downward by only a small amount.BLS revised downward by only 800 jobs the huge surge in trucking jobs it initially reported for February. The updated numbers show that the trucking industry added 10,400 jobs in February over January.

Total employment in trucking in March was more than 1.267 million – down 186,000, or 12.8 percent, from peak trucking employment in January 2007. The BLS numbers reflect all payroll employment in for-hire trucking, but they don’t include trucking-related jobs in other industries, such as a truck driver for a private fleet. Nor do the numbers reflect the total amount of hiring since they only include new jobs, not replacements for existing positions.

The job picture throughout the U.S. economy was strong as well in March with the addition of 216,000 nonfarm jobs on a seasonally adjusted basis. Still, the unemployment rate was little changed, dipping only one-tenth of a point to 8.8 percent, as the number of people seeking employment rose at almost the same level as the number of new jobs added.

IN BRIEF

* Freight transportation across all modes was down 1.5 percent in February from January, according to the latest Bureau of Transportation Statistics’ Freight Transportation Services Index.

* The Ceridian-UCLA Pulse of Commerce Index – a real-time measure of the flow of goods to U.S. factories, retailers and consumers – for the first quarter of 2011 was 3.9 percent higher on an annualized basis than in the same 2010 quarter.

* Rail carloads increased 3.4 percent in March compared to the same 2010 month, while intermodal traffic increased 8.5 percent, the Association of American Railroads reported.

* New orders for manufactured goods dipped 0.1 percent in February from January. Excluding transportation equipment, new orders increased 0.1 percent.

* Housing starts occurred at a seasonally adjusted annual rate of 549,000 in March – 7.2 percent above the revised February estimate but 13.4 percent below March 2010.

* Sales of new single-family houses dropped 16.9 percent on a seasonally adjusted basis in February from January levels, according to preliminary estimates. At the current sales rate, the United States has an 8.9-month supply of existing unsold homes.

* Fifteen consecutive months of cargo growth at the Port of Long Beach came to an end as the port reported a 2.5 percent drop in container volume in March compared to the same month a year ago.

Inventories remain lean

The ratio of inventories to sales throughout the U.S. economy remained at just above the record low once again in February, which is generally good news for trucking companies. The ratio was 1.24 on a seasonally adjusted basis – the same as the revised ratio for January. The lowest ratio recorded by the U.S. Census Bureau in the approximately 20 years since it has tracked inventories and sales is 1.23, which was the level in March and April 2010.

Inventories relative to sales are not consistently lean throughout the supply chain, however. At the manufacturer level, the inventories-to-sales ratio was just slightly above the economywide average in February. But the ratio at the retail level was 1.31, while the merchant wholesale ratio was just 1.16. That suggests that stockrooms at department stores remain comfortably supplied, but there isn’t much supply at the wholesale level.

The ratio of inventories to sales is a key metric for the trucking industry because it indicates the extent to which an uptick in demand likely will translate into shipments.

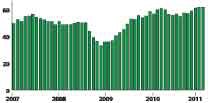

Manufacturing continues to grow; new orders down

The manufacturing sector grew for the 20th consecutive month in March, according to the Institute for Supply Management’s latest Manufacturing ISM Report on Business. The composite index known as the PMI was slightly below the February level at 61.2 percent. Readings above 50 percent indicate growth. The component indexes of most interest to trucking companies – new orders and production – also remained strong.

Although the PMI composite index for March was slightly below the February level, the manufacturing sector grew for the 20th consecutive month.

Although the PMI composite index for March was slightly below the February level, the manufacturing sector grew for the 20th consecutive month.The closest thing to a warning sign is a 4.7 percent drop in the new orders index, suggesting some deceleration in the recent rapid growth. But at 63.3 percent, the new orders index still indicates strong growth.

Although the latest ISM manufacturing report is great news for the transportation sector, it does expose some concerns for shippers. “While manufacturers are benefiting from strength in new orders and production, there is significant concern with regard to commodity prices,” says Norbert Ore, chair of ISM’s Manufacturing Business Survey Committee. “Many manufacturers indicate the prices they have to pay for inputs are rising, and there is concern about the impact of higher prices on their margins.”

For the 18 manufacturing industries tracked by ISM, 16 showed growth in March; only wood products and primary metals experienced contraction.