- Avery Vise — [email protected]

Victory is an ongoing process in trucking

In the 1975 film “Rollerball,” the top spectator sport is an unbelievably violent version of roller derby. It’s 2018, and corporations literally run the world. They sponsor rollerball teams as a way to distract the masses and to show how individuals acting alone are doomed to failure. One particular rollerball athlete, Jonathan E. (played by James Caan), however, has become a major star – a situation that threatens the social order. The team’s corporate owner first tries to persuade Jonathan to retire, but eventually the corporations jointly settle on an extreme tactic: A special match that has no time limit and no substitutions. In other words, it’s a battle to the death – or at least dismemberment. The game ends only when everyone on one team has been neutralized.

Trucking is a lot like that. There is no permanent victory, and you can’t run out the clock. Perhaps the best you can do is luck into an exit strategy that maximizes your return, but how do you know when that opportunity comes? Besides, you spend a lifetime building a business that you or your parents or grandparents started from nothing. It’s difficult to walk away from such an intense emotional investment.

Certainly the past decade shows how success in trucking is a marathon, not a sprint. Following a recession, insurance crisis and terrorism shock early in the decade, the trucking industry generally enjoyed some great times for a couple of years. But things softened after the housing construction market peaked in 2006. By 2008, the U.S. economy was in a recession, inventories swelled relative to sales, and the financial system almost collapsed. Trucking suffered through one of its worst years ever in 2009, but carriers generally saw at least some modest improvement in 2010.

Heading into 2011, expectations were high for industry profitability due to an anticipated combination of a rebounding economy, reduced capacity and significant barriers to entry. For-hire trucking companies cut about 180,000 payroll employees – most of whom are drivers – between the beginning of the downturn and today, so clearly capacity is down substantially. And owing to the fact that the new emissions regulations coincided with the industry downturn, there’s no ready supply of good late-model used trucks.

So the supply side indeed is tight, and demand apparently was strong during the first few months of this year. Although the construction market remains troubled, manufacturing has saved the day – so far. But there are signs of manufacturing growth slowing, or potentially worse. For example, the closely watched Institute of Supply Management index of manufacturing activity known as the PMI retreated sharply in May. Manufacturing still is growing, according to the PMI, but at a much slower rate. Meanwhile, industrial production is flat, and factory orders are down. Throw in anemic job growth and failure of the housing market to rebound, and some people are beginning to talk worriedly about a dreaded “double-dip” recession.

There are other threats to the long-predicted “golden age” of trucking. For example, bank reserves in May topped $1.5 trillion, up from about a consistent $45 billion before the near-collapse of the financial system. Other than the fact that banks aren’t loaning money, these humongous reserves aren’t necessarily a problem if they are just sitting there. But once banks draw down those reserves – due, presumably, to greater confidence in the economy – the increased supply of money in circulation likely will be inflationary.

In other words, the natural consequence of a solid economic recovery could be much higher inflation, which presents different challenges for businesses. Cash long has been king in trucking, but in periods of high inflation, too much cash can be a big problem. And carriers will need to watch interest rates closely, perhaps expediting facilities investments, to lock in low rates.

It might not make you happy, but it’s true: Financial success is an ongoing process, not a final result.

– Avery Vise is executive director, trucking research and analysis for Randall-Reilly and senior editor, industry analysis for Commercial Carrier Journal. E-mail [email protected].

IN BRIEF

* Trucking companies saw a noticeable slowdown in recent freight demand in May compared to April, although that was off a brisk pace, according to the latest TruckGauge MarketPulse report. The report, based on data and comments from 80 senior executives, is available to subscribers of TruckGauge (www.truckgauge.com).

* DOT’s Freight Transportation Services Index dipped 1.0 percent in April from March.

* The Ceridian-UCLA Pulse of Commerce Index fell 0.9 percent on a seasonally and workday adjusted basis in May after falling 0.5 percent in April. The index declined in four of the first five months of 2011 and in eight of the past 12 months.

* Rail carloads in May increased 0.5 percent compared with the same month last year, while intermodal traffic increased 7.5 percent, according to the Association of American Railroads.

* Factory orders dropped 1.2 percent in April from March following a 3.8 percent jump in March over February.

* Permits for residential construction were up 8.7 percent in May over April and up 5.2 percent over May 2010. Housing starts were up 3.5 percent over April but down 3.4 percent from the prior year.

* Industrial production edged up 0.1 percent in May for the second consecutive month with little or no gain.

* Growth in the manufacturing sector slowed in May, according to the latest figures from the Institute of Supply Management. ISM’s composite PMI stood at 53.5 percent – 6.9 percentage points below the April index level of 60.4 percent. A reading above 50 percent indicates expansion.

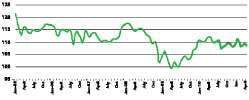

Tonnage index dips in April

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index decreased 0.7 percent in April after gaining a revised 1.9 percent in March. While March’s increase was slightly better than the 1.7 percent previously reported, the latest drop put the adjusted index at 114.9 in April, down from the March level of 115.6.

ATA’s Truck Tonnage Index --ATA Chief Economist Bob Costello says truck tonnage is unlikely to grow every month because of volatile freight volumes.

The nonseasonally adjusted index, which represents the change in tonnage actually hauled by fleets before any seasonal adjustment, equaled 113.6 in April, which was 8 percent below the previous month. Compared with April 2010, adjusted tonnage climbed 4.8 percent; in March, the tonnage index was 6.5 percent above a year earlier.

“The drop in April is not a concern,” says ATA Chief Economist Bob Costello. “Since freight volumes are so volatile, truck tonnage is unlikely to grow every month, even on a seasonally adjusted basis. I expect economic activity, and with it truck freight levels, to grow at a moderate pace in the coming months and quarters.”

Costello says the industry, and the economy at large, should benefit from recent declines in oil and diesel prices. “Lower fuel costs will help freight volumes and motor carrier bottom lines going forward,” he says.

ATA calculates the tonnage index based on surveys from its membership. The report includes month-to-month and year-over-year results, relevant economic comparisons and key financial indicators. The baseline year is 2000.

Swift rings bell at NYSE

Jerry Moyes, chief executive officer of Phoenix-based Swift Transportation, and members of the Swift management team rang the opening bell of the New York Stock Exchange on May 25. In December, Swift (NYSE-listed SWFT) went public for the second time in the company’s history. Earlier this spring, it announced first-quarter 2011 operating revenue of $758.9 million, a 15.9 percent increase from first-quarter 2010, while operating income for the quarter more than doubled to $46.7 million compared to the same period last year.

company drivers and 4,000 owner-operator tractors, and a fleet of 49,400 trailers. It also includes 5,000 intermodal containers from 34 major terminals centrally located near major freight centers and traffic lanes in the United States and Mexico.

Trucking puts brakes on job growth

May hiring flat after big surge

The trucking industry’s recent surge in job growth ended abruptly in May as trucking companies added a mere 100 jobs on a seasonally adjusted basis, according to preliminary estimates released last month by the U.S. Department of Labor’s Bureau of Labor Statistics. Through April, payroll employment in trucking this year had risen by 18,000, including a revised 3,300-job increase in April over March. BLS did revise its initial April estimate upward by 1,100, however. Compared to May 2010, payroll employment in trucking is up 3.2 percent.

Mirroring a slowdown in the manufacturing sector, the recent surge in payroll employment at trucking companies apparently screeched to a halt in May, according to preliminary Bureau of Labor Statistics data.

Job growth in the overall economy slowed dramatically as well. While the economy added 232,000 nonfarm jobs in April, it added only 54,000 net new jobs in May. The unemployment rate ticked up a tenth to 9.1.

Total employment in trucking in May was just over 1.274 million – down 179,100, or 12.3 percent, from peak trucking employment in January 2007. The BLS numbers reflect all payroll employment in for-hire trucking, but they don’t include trucking-related jobs in other industries, such as a truck driver for a private fleet. Nor do the numbers reflect the total amount of hiring since they only include new jobs, not replacements for existing positions.