Adjusted net income for the second quarter of 2011 was $5.6 million, or $0.23 per diluted share, compared to adjusted net income of $2.2 million, or $0.10 per diluted share, for the same quarter in 2010.

The significant improvement in earnings for the second quarter ended June 30, 2011 was driven by a 33.6 percent increase in quarter-over-quarter operating income (after adjusting for the restructuring items) resulting from cost containment initiatives, reduced maintenance and depreciation expenses from the fleet rationalization program begun in 2010, and lower insurance costs. Additionally, debt reduction and redemption activity resulted in a 15.9 percent decrease in net interest expense from the prior year quarter.

“I am very pleased with the Company’s solid earnings this quarter, especially in light of lighter volumes in our core chemical logistics business due to continued driver turnover issues,” said Gary Enzor, chief executive officer. “More importantly, we recently won a multi-year contract with a major energy company to provide full logistics for their 100 truck fresh and disposal water hauling needs in the Marcellus Shale region. The revenues associated with this contract will begin ramping in the second half of 2011 and are expected to be a significant contributor to our top-line in 2012.”

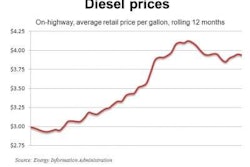

Total revenue for the second quarter ended June 30, 2011 was $190.0 million, an increase of 7.0 percent versus the same quarter last year. Excluding fuel surcharges, revenue for the second quarter of 2011 increased 0.7 percent compared to the prior-year quarter, driven by a 7.1 percent increase from Boasso’s intermodal business. Revenues from the logistics business were flat, as slightly lower volumes in the chemicals business were offset by revenues associated with the frac shale energy market.

Adjusted EBITDA for the second quarter of 2011 was $20.5 million, up 22.6 percent versus the comparable prior-year period, driven primarily from cost containment initiatives, reduced maintenance and depreciation expenses and lower insurance costs. A reconciliation of net income to adjusted EBITDA is included in the attached financial exhibits.