With the changes in hours-of-service rules impacting productivity, carriers are expecting driver wages to climb and more entry-level drivers are going to be recruited, according to Transport Capital Partners’ fourth-quarter survey results.

(Transport Capital Partners)

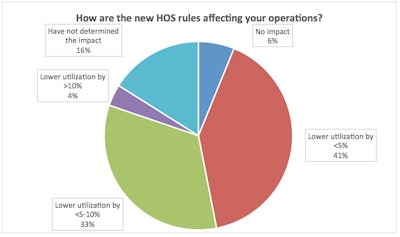

(Transport Capital Partners)Seventy-eight percent of carriers reported the new rules are having some impact on productivity. While 41 percent expect the impact will be less than 5 percent, an almost equal number (37 percent) say the new regulations will have more than a 5 percent impact. Notably, almost six months after the changes were implemented, 16 percent of carriers participating in the TCP survey still have not determined the impact.

Capacity increases and the need to find more drivers will inevitably push carriers to raise wages, the analysis notes. But in this environment of static rates, do carriers really believe they can raise driver wages?

The answer, according to the survey, is “yes.” Seventy-two percent of carriers expect to raise wages, albeit modestly (1-5 percent). The expectations differ according to carrier size: 81 percent of larger carriers think wages will increase 1-5 percent compared to only 50 percent of smaller carriers. Thirty-five percent of smaller carriers think wages will increase 6-10 percent compared with only 14 percent of larger carriers.

“We surmise the pressure of unseated trucks and higher turnover levels may be driving some carriers to higher pay increases,” says Steven Dutro, TCP partner.

With the many changes taking place in the regulatory and economic environment, carriers are also reviewing their labor policies, the survey reports.

Currently, less than 30 percent of carriers hire inexperienced entry-level drivers. Larger carriers are twice as inclined to spend the time, money, and effort to develop entry-level drivers than are smaller carriers (33 percent vs. 15 percent).

RELATED: Hiring CDL school grads? Be careful what you ask for

But that number is set to grow, with slightly over half of all carriers expect to soon be training and utilizing inexperienced, entry-level drivers, according to TCP. Larger carriers expect this option at a rate of more than 2:1 over smaller carriers (64 percent vs. 25 percent).

While a slight majority of carriers are interested in utilizing entry-level drivers, a stunning 84 percent of carriers are willing to support allowing younger, properly trained drivers to enter the driving pool, the report notes.

“We believe this means they support other carriers hiring and training younger driver so that they can then poach them later,” says Richard Mikes, TCP Partner.

Carriers indicating they wish to exit the industry in the next six months remained at 11 percent, the same as last quarter but down slightly from 13 percent a year ago. However, 15 percent of smaller carriers are thinking about exiting the industry in the next six months, if revenues do not improve. This number contrasts with 10 percent of larger carriers.

Those carriers wishing to sell their company in the next 18 months dropped to 11 percent – the lowest it has ever been, TCP reports. More smaller carriers want to sell than do large carriers (19 percent versus 8 percent).

Even with all the reports of carrier acquisitions this quarter, the overall number of carriers wishing to buy a company in the next 12 months dropped slighted from 47 percent to 42 percent, with buyers concentrated among the larger carriers at 50 percent compared to 27 percent of smaller carriers.

“TCP experience shows pricing continues to be a focal point, with buyers remaining conservative and hesitant to pay ‘blue sky’ except for carriers with excellent operations or significant strategic benefits,” says Mikes.

For complete details and graphs, click here.