After nearly three full years of taking a beating from a combination of analysts, investors and irate customers, the light at the end of the tunnel is beginning to shine.

The company reported drastically improved earnings Wednesday, stoked largely by improved sales and aggressive cost cutting. But lower than expected warranty claims certainly played a role.

First, Navistar reversed $29 million in prior period warranty approvals, primarily related to extended service contracts, reflecting lower costs for repair. Also, the standard warranty claim data on International’s newer products are trending favorably, the company says.

“During the first nine months of this year, warranty expense as a percent of manufacturing revenue was 4.2 percent, compared to 7.7 percent for all of last year,” says Navistar CFO Walter Borst. “We are on course to achieve our goal of decreasing warranty, as a percent of manufacturing revenue by four percentage points (this fiscal year).”

To drive success in the third quarter of 2013, Navistar COO Jack Allen says the company needed to address three important areas that were dragging down results. Warranty costs were high on the list.

“First is the quality of our products and warranty expenses, and we are ahead of where we thought we’d be at this point in the quarter,” he says noting the other two areas were cost structure and improving sales.

“Here we have made significant strides in rebuilding relationships with customers. It started by taking care of the trucks in the field, and then getting our customers the right products to run their business,” Allen says. “With the introduction of the severe service SCR in July, all of our major SCR products are now in production, and we will continue to introduce more applications and variations throughout 2015.”

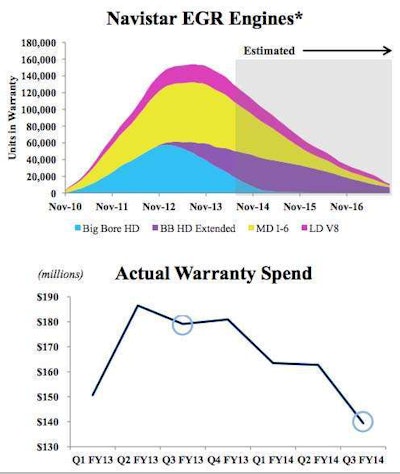

Navistar’s third quarter warranty spend dropped 22 percent year-over-year and has slid 14 percent since last quarter, and Allen says the spend is coming down for three reasons.

“The cost of each repair is declining due to better repair practices; the improved quality of the new SCR engines is driving a lower warranty spend on these engines, and to a lesser impact, fewer EGR engines are in the warranty period,” he says. “We believe this lower warranty spend rate is sustainable and will result in spend and expense at levels consistent with industry norms.”

“I think it is worth to note that warranty spend is coming down and it is coming down for the right reasons,” Clarke says. “The trucks we have fixed are staying fixed. So the repairs and kind of reengineering that we have put into making the EGR product better has worked. Our cost of repair is coming down, and it is coming down because we have engineered better processes.”

Newer trucks, even newer International EGR trucks, haven’t had the same kind of warranty costs early in their life that the older trucks dis, Clarke adds, helping further reduce warranty claims.

“And then certainly the SCR products are another step better than those, as well as now that we do have a percentage of purchased engines in the portfolio, we have a mix issue that starts to work in our favor,” he adds.

Borst was quick to point out that declining warranty costs are not solely due to a shrinking population covered EGR trucks, and prefers to focus on the higher quality of repairs and newer covered models.

“We are past the peak of what we view as being our warranty expense period,” he says. “But we still have a vast majority of the EGR big bore engines that we built in warranty. I think it’s over 90 percent remain in either their standard or their extended warranty period.”

Navistar has also set high expectations for its remote diagnostics product, OnCommand Connection, in its efforts to keep warranty costs down.

“It helps to increase vehicle uptime and supports quicker repairs, and helps to control maintenance and repair costs,” Allen says. “More than 50,000 vehicles across 75 customers are now supported by OnCommand Connection. One of our fleet customers, who has used the diagnostic data for six months, experienced a 28 percent reduction in down days, and 31 percent reduction in repairs. These are all leading indicators of improved performance, and we have also launched a standard offering of OnCommand Connection, on all Diamond Renewed used trucks.”

![A_ProStar_White[1]](https://img.ccjdigital.com/files/base/randallreilly/all/image/2014/01/ccj.A_ProStar_White1.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)