And it’s a good feeling to actually fill my pickup all the way and drive around with the gas needle resting on “Full” for a change.

Lower fuel prices in recent months are good news for consumers and fleets alike: Consumers catch a break and ease some very real strain on their pocketbooks and smart fleets are taking full advantage of this massive break in operating costs – making hay while the sun shines, as the old saying goes.

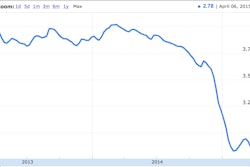

Funny how the massive drop in the price of crude oil has struck at a time when fleets and the driving public at large were finally wrapping their heads around the concept of forever-high fuel prices. And it may very well be that this unforeseen break in fuel prices will serve as one fond, last shimmering look back a Golden Age of cheap fuel that is about to be gone forever.

If this sudden fuel price drop teaches us anything, it is to underscore the extreme volatility and unpredictable nature of global energy markets today. Crude oil is a commodity traded on global markets much the same way pork bellies or cotton are. So, naturally, its price fluctuates according to supply and demand, just as other commodities do. However, it is always important to remember that the pool of people bidding on that barrel of crude oil has increased exponentially over the past 20 years. I’m looking at you, China, India, Russia and Africa. The more interested parties bidding for a commodity, the higher the price goes. That’s Economics 101.

But – and here’s the catch – oil is also a strategic resource that is absolutely vital for a country’s defense and economic well being. Like it or not, our modern global economy is powered by oil. Which makes manipulation of supply and pricing a powerful tool when a nation wants to put economic pressure on a political rival. Case in point: The U.S. economy continues to gain ground, while Russia has toppled in recent months.

And a lot of positive trends here in the U.S. are starting to bear fruit on the fuel economy front. New cars are getting smaller. And even larger models like pickups and SUVs are offering buyers unprecedented fuel economy numbers. This holds true for trucking as well. Current aerodynamic trucks are routinely racking up mpg numbers that would have defied belief just a few years ago. And the next generation of GHG trucks and engines promise to stretch the fuel economy envelope even further.

Other positives are out there too: Increased domestic production (particularly in North Dakota) has definitely helped bring fuel prices down. And while I’d like to suggest that these production boosts will eventually be enhanced by new access to previously hands-off oil fields in Libya and Iraq, I wouldn’t hold my breath, given the current political and religious instability in those regions. Nonetheless, that oil is out there, waiting. Somebody, someday, is going to bring it up out of the ground and find someone to sell it to.

All of this leads me to suggest that all evidence points to more wild swings in fuel prices with an inexorable overall trend toward consistently higher prices at the pump. Fleets (and consumers) who stay the current course on enhancing fuel economy in their operations and daily life will be in much better shape to weather the storm once gasoline and diesel start trending upward again.