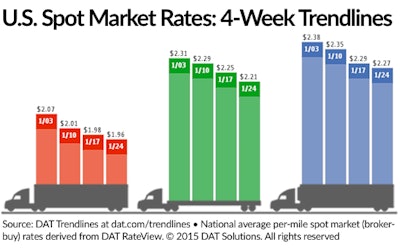

Diesel’s recent price decline has dampened rate growth in recent months as fleets adjust their fuel surcharges.

But, as carriers know, the final number doesn’t tell the whole story: Despite spot market rates flattening somewhat in recent months, the base rate — the linehaul portion of the final rate price — still saw double-digit growth in 2014, says DAT Solutions’ Mark Montague, effectively meaning a greater net benefit for carriers, despite stagnant gross rates.

And those soaring spot market rates should translate nicely to rate increases on the contract market, Montague says.

CCJ was able to talk with Montague recently about diesel price’s impact on rates, where he sees rates headed in 2015 and how cheaper diesel could change freight flow in the U.S.

Here’s the Q&A:

Fuel prices’ effects on rates

CCJ: Fuel surcharges are putting downward pressure on rates, but fleets still are effectively bringing in more money, right, as the base rate is still climbing?

Montague: The linehaul portion of spot market rates is up substantially. Year over year, 2014 vs. 2013, the linehaul portion of spot market van rates was up 16.4 percent — flatbed and reefer were both up 12.6 percent.

DAT’s latest rate report showed linehaul rates slipping some due to a rise in capacity and a drop in load volume.

DAT’s latest rate report showed linehaul rates slipping some due to a rise in capacity and a drop in load volume.Rates we saw on the linehaul portion in December on the spot market were as high as we’ve ever seen. We had three peak periods — March, June and December — when van hit $2.08.

But what was different in December was that only 39 cents of that was fuel surcharge, whereas in the other months it was much higher.

How that translates into 2015 pricing on the contract side — the forecast is for about a 4 to 6 percent increase in the base rate, the linehaul portion, as opposed to fuel surcharges or accessorials.

What this will do is support things like new equipment acquisition and hikes in driver pay, which is what fleets need to do to maintain their size or grow modestly in 2015.

Rate outlook

CCJ: Do you see the spot market rate increases continuing this year?

Montage: The spot market is going to be more stable. The rate increases really were a function of not having enough capacity. At least in the first half of this year, there’s this little window of opportunity for spot market rates to stay high.

The contract rate has lagged, but I do think the contract rate is going to see some changes and increase in the first half of the year. In other words, the spot market and the contract market have a relationship, and the spot market adjusted pretty quickly in the last quarter. The contract rates have some catching up to do.

Changing freight flow

CCJ: You mentioned in a recent blog post that the drop in fuel prices could also change freight patterns a little in the U.S. What do you see changing?

Montague: We had a strong I-29 pattern, which is the Interstate from North Dakota down through Kansas City, and then further down to I-35 in Houston— those were growth states in 2014.

The Port of Houston

The Port of HoustonThe big driver was pipeline construction, oil machinery — all that stuff just took the regular numbers from potato production, corn and building materials and added that on top of it to make it the growth corridor for the country.

Early signs in 2015 show growth in the old steel belt, if you will. Indiana, Ohio, Detroit, Chicago — the automotive part of the country. It also includes parts of the Southeast: Tennessee is heavy in auto production. Birmingham still has steel. If it has steel or is associated with automobiles, we saw at the end of the year — November, December, January — those numbers were strong.

Another thing that’s come into play is the Port of Houston as a diversion point for cargo. Instead of taking it to the West Coast, which has been slowed, you can sail through the Panama Canal and offload in Houston.

More and more companies are bringing in freight through the Panama Canal, either from Houston or the East Coast ports. It’s exciting to watch that.