A few trucking economic indicators reported recently:

[gttable cols=””]

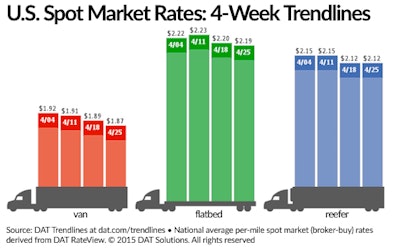

Rates dip: Spot market rates fell slightly in the week ending April 25, with van rates falling 2 cents and flatbed falling 1, according to DAT Solutions weekly rate update. Reefer rates were unchanged in the week.

DAT partially attributes the decline to an increase in capacity, which rose 4.5 percent in the week, and a decline in available loads in both van and flatbed segments.[/gttable]

[gttable cols=””]

Trailer build increases, orders ‘soft’: Net trailer orders in the U.S. in March tallied 22,000, FTR reported this week. That’s a 7 percent drop from February and a 25 percent drop from last March.

The trailer build rate, however, rose 7.5 percent from February, FTR reports, and backlogs still remain “at a high level,” the firm says. Trailer orders in the previous 12 months now total 340,000.

“Orders remain subdued, but when you consider how many orders have been placed in the last twelve months, and that backlogs are near record levels, this market has tremendous strength,” says FTR’s Don Ake. “OEMs are booking orders late into Q3 and Q4, and there are even some orders getting booked now for 2016.”[/gttable]

[gttable cols=””]

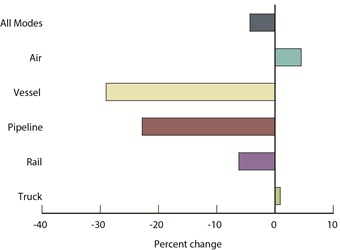

Trucking continues to carry more cross-border freight: Freight movement between the U.S. and North American Free Trade Agreement Partners Canada and Mexico totaled $85.7 billion in February, according to numbers released last week by the DOT. Truck was one of only two modes of transportation that moved more cross-border freight in February 2015 than the same month last year.

Trucks carried 63.1 percent of the total — $26.9 billion in imports and $27.2 billion in exports. That’s just shy of a 1 percent increase from the same month last year.[/gttable]