LoadSmart gives shippers instant pricing for hundreds of thousands of lanes for immediate booking

LoadSmart gives shippers instant pricing for hundreds of thousands of lanes for immediate bookingRicardo Salgado experienced the pain points in logistics at an early age. His parents owned a paper company in Florida; as a shipper, getting quotes from brokers and carriers was a time-consuming process.

After getting an engineering degree from Georgia Tech, he spent 13 years investing in and restructuring companies as a managing director of Goldman Sachs. Trucking firms were among his clients.

In 2014, he started a technology company with brokerage authority. The goal for the startup, Loadsmart, was to create a different — and much more efficient — experience for shippers to book loads with carriers. Ideally, the experience would be as easy as buying an airline ticket or a ride across town.

The lowest airfares are instantly available for booking when using websites like Kayak.com and Orbitz.com. A mobile app called Uber gives passengers instant rates between any local origin and destination and connects them to drivers to make a pickup within minutes.

How could booking a truckload shipment ever been this easy?

Many shippers and freight brokers already use load boards, websites, mobile apps and e-mail to obtain rates, tender loads and track freight from carriers. What these methods lack is an Uber-like experience of having instant visibility to prices and an option to book loads with minimal effort.

Automation is difficult in a highly fragmented industry like trucking. Ninety percent of motor carriers operate less than six trucks. Small carriers typically lack information systems that make their rates and equipment visible to an online audience. Further complicating matters is that five different players are involved in every freight transaction—the shipper, the broker, the dispatcher, driver and consignee.

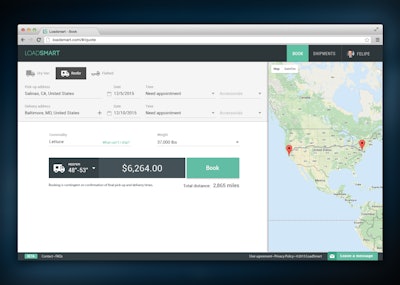

After recruiting a team of software engineers and spending a full year writing code, Salgado says that Loadsmart is able to instantly calculate pricing for truckload shipments in 900,000 paired lanes across the United States.

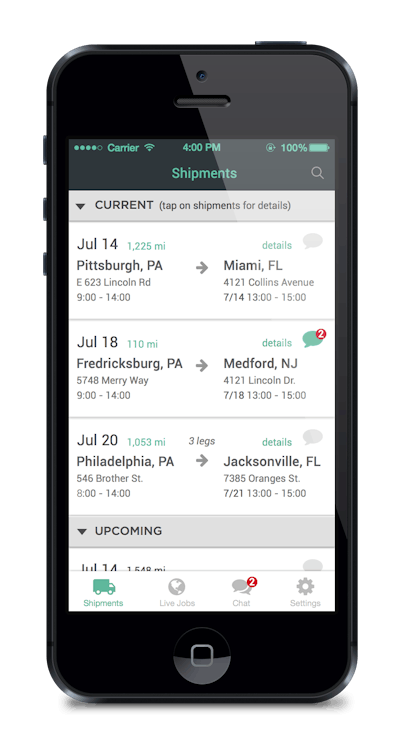

Carriers that use LoadSmart are required to have tracking capabilities. One option is to use a mobile app.

Carriers that use LoadSmart are required to have tracking capabilities. One option is to use a mobile app.LoadSmart’s algorithm uses real-time and historical data to determine pricing. All a user does is enter the origin and destination of a shipment. A price is shown instantly for the nearest pickup and delivery date. If interested, the user clicks a “Book” button, at which point the website asks for additional information about the load and the shipper.

“We want to make this as easy as possible,” he says.

The company has enough confidence in its pricing and service capabilities that the instant “Book” option is available for about 50 percent of lanes in the United States with a heavy concentration of loads East of the Mississippi River, Salgado says.

If not enough information is available on whether or not Loadsmart can meet the service requirements of the load, users still see an instant price. But instead of a “Book” option they get a “Talk to Agent” button.

Once a load is booked, the website shows a shipment dashboard with status updates. Load tracking is provided by a mobile app that drivers use. The app doubles as a fleet management tool for driver messaging and to capture and upload proof-of-delivery documents for billing.

“We want all of these guys to be tracked. If not, we won’t accept you in the platform. That is very powerful to provide visibility to a shipper on where their cargo is,” he says.

Ultimately, Loadsmart’s biggest asset is its reputation, Salgado says. Like any transportation company, its technology means nothing unless customers have on time, damage-free service for the price they pay.

The reputation hinges on the quality of the motor carriers it uses. DOT safety ratings and insurance credentials of carriers are closely monitored. It also keeps score of carriers’ on-time performance to calculate a reliability rating. This rating is similar to how passengers rate their Uber driver and is used to determine future load offers.

Likewise, motor carriers also rate shippers in the system, he says. To help attract and retain carriers, the company offers a free, Web-based fleet management system to dispatch their equipment and drivers. Similar commercial systems typically cost carriers about $40 per truck, he says.

To date, Loadsmart has thousands of trucks signed up to its platform and over 100 shippers have booked loads, he says.