U.S. Bank launched the Voyager Mobile app earlier this year. Fleet managers use it primarily to monitor drivers’ fuel buying decisions; drivers use it to choose their fueling locations

U.S. Bank launched the Voyager Mobile app earlier this year. Fleet managers use it primarily to monitor drivers’ fuel buying decisions; drivers use it to choose their fueling locationsJudging by the money it takes to acquire electronic payment providers, the technology has a bright future in the fleet market. As two examples, WEX purchased Electronic Funds Source (EFS) for $1.1 billion in October, 2015. In August, 2014, FleetCor bought Comdata for $3.45 billion.

For more than 30 years, electronic payment systems have been synonymous with fleet cards. A physical card had to be carried by drivers to pay for fuel and other expenses. Perhaps the reason investors are paying a premium for companies in this space is because a rapid evolution is underway.

The companies are now focused on delivering mobile apps. Managers use the apps to monitor fuel buying, to send cash advances to drivers and other transactions they would normally have to do at their desks.

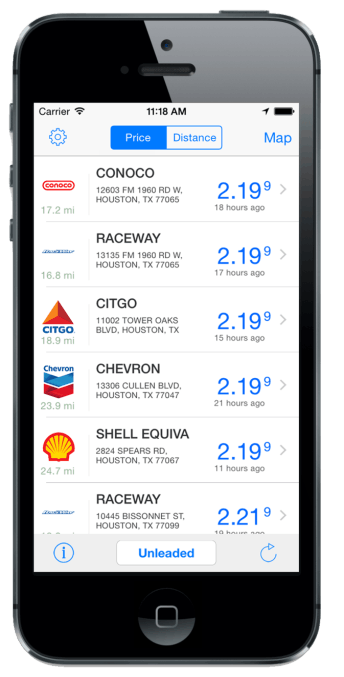

Meanwhile, drivers are using the apps to plan their routes by locating fuel stops, checking fuel prices, and getting information like parking availability and truck stop amenities.

“A lot of stuff becomes pretty important to drivers,” says Jeff Pape, senior vice president at U.S. Bank, which offers the Voyager Fleet payment card and network. This past summer, U.S. Bank launched the Voyager Mobile app.

Fleets that use the Voyager network can restrict the fueling locations drivers see in the app to their own fuel network. Once drivers perform a search and select a fuel location, the app can automatically open navigation apps on the phone such as Google Maps.

Comdata’s FleetAdvance app allows a driver to search by current location or city and state to find the lowest fuel prices in the area. With a registered Comdata card, the app will display the best net price available to the driver.

The app compliments Comdata’s web-based FleetAdvance product that gives each fuel transaction a 1 to 100 score. The score shows how each fuel transaction compares to the lowest possible transaction at another location, in the same market segment of the customer’s fuel network. Fleet managers can view fuel transactions as they take place on a Google Map display.

Mobile payments

One of the most anticipated new features of mobile apps is the payment options.

WEX serves all sizes and types of fleets. Its WEX Connect mobile app is used primarily by fleets with local operations but the company also serves the over-the-road market through its EFS and Fleet One properties.

Fleet One has a mobile app drivers can use to make low-cost fuel purchase decisions, but “there is a lot more we can do from there,” says Phil Baker, manager of product management at WEX, Inc. One possibility is to enable drivers to use the mobile app to authorize fuel transactions. This functionality will largely depend on how quickly the point-of-sale (POS) systems can be updated to support this new infrastructure.

Mobile payments are an opportunity to create by capturing additional data about fuel transactions.

Mobile payments are an opportunity to create by capturing additional data about fuel transactions.Baker sees two primary pathways developing. The first is to use near field communications for the phone to talk directly to the POS system. The alternative is to have a payment system that is more cloud based, he says. The app on the phone would communicate to a gateway in the cloud that is connected to the POS system to authorize the transaction according to the fleet’s controls.

“We are looking at both right now,” he says.

In the consumer space, it is not more convenient or secure to pay for items with a phone versus a traditional bank card. The main reason consumers use mobile payment systems like Google Wallet and Apple Pay is for their loyalty rewards programs, he explains.

By comparison, mobile payments in the fleet space have an added value opportunity. They can be used to capture additional data from the transaction such as driver identification, location and odometer readings.

Increasingly, mobile devices are the display units for fleet’s telematics systems. Since a telematics device communicates the location of the vehicle, POS systems of the future could instantly verify that the mobile device the driver uses to initiate the transaction is at the same fuel pump location as the truck. This verification could be an additional security layer for fuel transactions, he says.

“Mobile is the direction we are all headed,” Baker says.

Note: This story was originally published in December 2015.