For more than 30 years, fuel cards have given fleet operators control over the second largest and most volatile expense. Fleets can also collect detailed information to streamline fuel taxes and other accounting functions.

With the arrival of the Internet, electronic payment providers had a conduit for integrating the data collection and control functions of fuel cards with transportation management and other third-party office systems.

One of the biggest, and most recent, advancements is “cardless” fueling. These systems have added more security and efficiency to truckstop fueling by using infrared and RFID technology to assure the proper vehicle is at the pump to authorize a transaction.

Companies that provide electronic payment systems continue to fine-tune the technology to bring more opportunities for savings. Here are five areas where the technology continues to evolve.

1. Card funding

Early electronic payment systems lacked visibility and control as drivers received funds in the form of a cashier’s check.

U.S. Bank offers two fleet cards with a feature for transferring funds to drivers’ cards in real time. Since drivers use the cards to buy fuel and other items, additional restrictions can be placed on how the funds can be used, such as restricting fuel purchases to pre-approved locations and for ancillary items like tires and diesel exhaust fluid (DEF).

U.S. Bank offers the Voyager card for light-duty fleets with cars and trucks. Its OTR card network is for fleets with heavy-duty vehicles.

2. Instant analytics

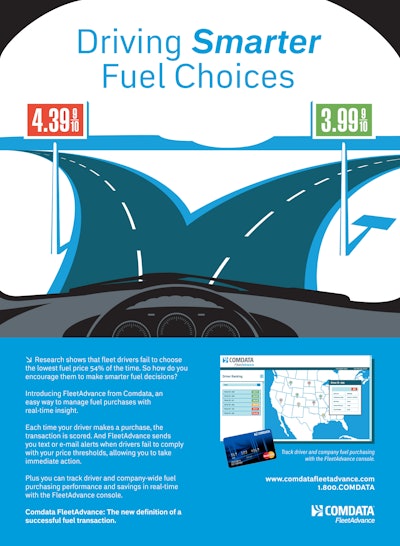

Comdata offers a tool called FleetAdvance that gives each fuel transaction a score based on the net price customers have negotiated with truckstops – cost plus, retail minus, etc. — at 175,000 retail locations across the country.

The score on a scale from 1 to 100 shows how each fuel transaction compares to the lowest possible transaction at another location in the same market segment of the customer’s fuel network. Fleet managers can view fuel transactions as they take place on a Google Map display.

Each transaction is color-coded in green, yellow or red for easy reference. Instant e-mail or text notifications can be sent when a transaction scores below a preset threshold, such as 80.

“The scores and analytical tools give fleet managers data that illustrates tangible savings targets which they can use in conversations with drivers to maximize fueling efficiency,” says Randy Morgan, executive vice president, Commercial Fleet Payments at Comdata.

Comdata also recently launched a feature in FleetAdvance called the Advisor that plots the best fueling locations along a route based on the tank capacity and current fuel level of a truck.

3. Custom validation

The trucking industry is one of the most sophisticated payments markets because of the amount of data capture and validation that takes place within an integrated system for purchasing fuel and other items.

Payment providers receive real-time transactional updates from fleet management systems, such as the time, date, gallon amount and location of where to authorize fueling. The updates “enable us to perform unique controls, prompts, and validations at the merchant or truck stop point-of-sale,” says Scott Phillips, chief executive officer of EFS. Fuel transaction information is also streaming back to fleets’ systems in real time.

4. Mobile apps

Increasingly, payment providers are developing mobile apps for drivers and fleet managers.

With EFS’ mobile smartphone apps, carriers are able to activate and deactivate cards, add and remove funds, perform location overrides, view reports and more. Drivers are able to see available funds, see the card load history, and, if applicable, dynamically manage or transfer payroll funds to external bank accounts, Phillips says.

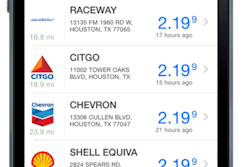

One of several menu options in the TruckerTools driver mobile app from Randall Reilly provides instant access to the nearest fuel locations and the lowest prices highlighted on a map. TruckerTools is used by more than 240,000 drivers.

WEX Fleet One is launching a mobile app this summer that it says will provide fleets and drivers real time fuel pricing information. Fleet operators will be able to log in and add their contracted pricing for drivers to see when comparing locations.

5. Tolls management