Load Delivered has an Innovation Department focused on creating new technologies that add value for its shipper and carrier customers.

Load Delivered has an Innovation Department focused on creating new technologies that add value for its shipper and carrier customers.At the age of 14, Robert Nathan was creating paper manifests and loading freight onto trucks at a warehouse owned by his father. After graduating from college, he started his career at a large freight brokerage firm.

The job involved a lot of phone calls and faxes, and seemed nearly as manual as sorting freight in the warehouse.

“I was amazed at the inefficiencies and lack of innovation, not just within the organization, but in the (transportation) industry,” he recalls.

In 2008, he co-founded Load Delivered. In 2015 the Chicago-based third party logistics firm’s revenues were approximately $82.5 million. This year it moved to a new office building in the technology epicenter of Chicago to begin the next stage of growth.

Nathan, its 34 year-old chief executive, plans to grow revenues from $100 million in 2016 (projected) to $1 billion with a staff of fewer than 500.

“The only way to do that is with technology,” he says. Load Delivered currently has 91 employees. The 3pls with $1 billion in revenues today have about 1,500 employees, he says.

Automation is a 100-step process, he explains, and Load Delivered is methodically trying to get there. The company has an Innovation Department with a team of 15 employees focused on developing new applications and integrating systems. A lot of time and money is being spent on projects to solve pain points for customers and to make the company easy to do business with, he says.

The department is working on solutions for what Nathan believes will be a “very large” capacity crunch in 2017 when enforcement kicks in for the electronic logging device (ELD) rule. On the upside, ELDs in more trucks will mean more connectivity to third parties like Load Delivered.

Load Delivered recently moved to a new office in the tech epicenter of Chicago to attract top talent.

Load Delivered recently moved to a new office in the tech epicenter of Chicago to attract top talent.In advance of the capacity crunch, the company is making significant investments to improve its carrier interfaces to source capacity and track freight, he says.

Load Delivered is not the only 3pl moving towards automation. During the past year, a number of well-funded freight brokers and 3pls have been trying to crack the code to automate freight transactions.

First things first

Some companies have developed software that can provide instant, bookable rates to shippers with less-than-truckload and truckload freight moves. The user experience of these websites and apps appears to be nearly as easy as booking a ride across town with Uber or purchasing a flight and reserving a hotel with Travelocity.

Nathan respects the technology of these startups, but says an Uber-like experience for moving freight may only be feasible in large markets like Southern California or New York City with a lot of freight density and capacity.

“In our industry, it is so complex to create one piece of technology that will do everything,” he says. “There are so many different processes within each individual function.”

Freight brokers and 3pls that can provide customers and prospects with instant, reliable pricing will be leading the next evolution of growth through 2020, he believes.

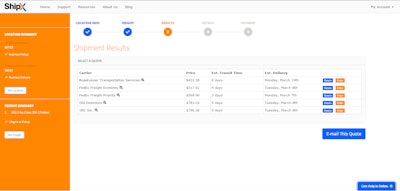

ShipX is able to provide instant pricing and booking options for LTL freight.

ShipX is able to provide instant pricing and booking options for LTL freight.It’s not just 3pls and freight brokers going after this opportunity. ShipX recently went live with an online pricing and booking service for LTL freight. Its website, and the underlying systems that support it, have been in development for more than a year, says Augie Grasis, chief executive of the Kansas City, Mo.-based business.

After entering a few shipment details, ShipX provides the user with instant, bookable rates from leading LTL carriers with nationwide and regional coverage. ShipX gets the instant quotes by connecting to the pricing systems of carriers through web service APIs developed by Project44, he says.

ShipX has built-in intelligence to simplify the quote process. When users enter the dimensions and weight of the freight, the software automatically determines the freight classification.

Unlike a broker, ShipX has transparent fees. Each shipment booked through its site carries a $25 fee. Users pay up front with a credit card and payment is sent directly to the carrier upon delivery.

Competing with Amazon

E-commerce is another area where transportation and logistics is becoming extremely competitive, and where the middlemen are gaining ground. The market leader, Amazon, is making bold moves and making it difficult for others to keep up.

Over the past year, Load Delivered has become more than a freight brokerage provider by adding supply chain engineering, omni-channel delivery, and a higher level of managed transportation services to its portfolio, he says.

Load Delivered fulfills online orders of LTL-sized freight, such as outdoor furniture, for omni-channel retailers that spend between $3 and $10 million in transportation annually; these companies are often looking to outsource logistics.

“All of our customers are competing in e-commerce against Amazon,” he says.

Amazon has become a competitive threat to transportation and logistics providers of all kinds, says Ryan Peterson, chief executive of Flexport, a San Francisco-based freight forwarder. For instance, Amazon China has entered the freight forwarding business, making it easier for Chinese companies to get products into the United States and sell them through the Amazon platform.

Amazon is now consolidating shipments for companies in China and shipping them directly to its distribution centers in the United States. Previously, companies that sold through Amazon had to come up with their own strategies to get freight to Amazon’s distribution centers.

Flexport is using software to differentiate its services and prices, Peterson says. The company is focused on retail customers with big-name brands that are not likely to use Amazon as a freight forwarder since they want more customization in their supply chains, he believes.

The evolution of Amazon will impact motor carriers as well, he says, since fewer trucks will be needed to deliver containers from ocean ports to Amazon distribution centers due to the consolidation of shipments at the origin. In December 2015, Amazon rolled out a large fleet of 53-foot trailers that motor carrier partners in the U.S. will be pulling between its various fulfilment and sortation centers.

In summary, motor carriers that have a presence in e-commerce will either be pulling Amazon trailers or working for a 3pl that competes with Amazon.

For a roundup of more companies that are looking to develop an Uber-like experience for freight transactions, see Todd Dills’ coverage in Overdrive, CCJ’s sister publication here.