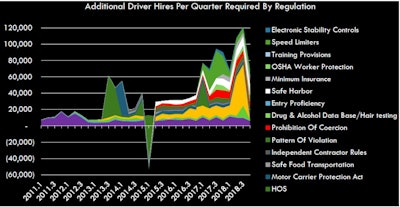

Larkin said coming regulations by the DOT will strip industry productivity. This slide shows his predictions for how each regulation will impact the number of new truck drivers needed by the industry to fill the regulatory void.

Larkin said coming regulations by the DOT will strip industry productivity. This slide shows his predictions for how each regulation will impact the number of new truck drivers needed by the industry to fill the regulatory void.A regulation-driven capacity crisis will slam trucking sometime in mid-2017 to as late as 2018, John Larkin, managing director, Stifel Financial Corporation, told fleet executives at the CCJ Spring Symposium this week. Consequently, “shippers may think this is their last chance to push prices down before they get hit with all of the regulations that will hit capacity” and drive rates up, he said.

For instance, spot markets, after holding steady through 2015, “have really softened up,” he said, with some shippers now demanding rate cuts as deep as 10 percent.

Since the Great Recession, freight rates in all sectors have continued to increase, Larkin said, with rail instituting huge price increases and truckload doing reasonably well in recent years. Intermodal and LTL have had less success on rates, Larkin said, although he predicts LTL will go through a renaissance in the coming years due in large part to the growth in e-commerce where order sizes are smaller and lend themselves to LTL.

That shift in retail from brick and mortar to e-commerce will have a big effect on trucking beyond LTL, Larkin said. At current growth rates, the share of retail handled through e-commerce is set to nearly double by 2020 to just under 15 percent market share. “That’s bad news if you’re a big carrier using distribution centers,” he said.

Another trend Larkin cited is the migration of Americans away from states that aren’t business-friendly, such as New York, Michigan and California, and to areas with greater job opportunities such as Texas, North Carolina and Florida. At the same time, more people are moving back to cities.

John Larkin speaking during the 2016 CCJ Spring Symposium.

John Larkin speaking during the 2016 CCJ Spring Symposium.“This changes distribution patterns,” he said. As e-commerce expands and population density builds in cities, fulfillment centers are increasingly located in the urban core. At the same time, Amazon is going into competition with trucking, starting a truck brokerage in Chicago and buying trucks, trailers, ships and planes.

Looking to the future, Larkin pointed to Big Data and the Internet of Things as the largest game changers, citing the results of a survey of 250 transportation professionals. In the same survey, Uber for freight transportation, drones, and self-driving trucks were seen as less revolutionary over the next decade.

For the near term, Larkin sees slow, steady economic growth as the most likely scenario. “The only shock (to the economy) would be a terrorist attack,” he said. Longer term, he predicts a “tight truckload supply-and-demand dynamic,” with all other sectors also benefiting from that scenario.

By 2018, a host of regulations – such as speed limiters, the drug and alcohol database, independent contractor rules and hours of service – will drive so much productivity and capacity out of the market that trucking will need an additional 120,000 drivers per quarter to handle the shortfall, according to analysis Larkin shared from Noel Perry with FTR.

One way to recoup some of that lost capacity is improved shipper and carrier collaboration, which Larkin calls a “largely untapped reservoir for incremental productivity.” But for the time being, “rate bashing is more in vogue,” he said.