The Motus platform helps companies automate the process of tracking mileage and reimbursing employees for business use of personal vehicles.

The Motus platform helps companies automate the process of tracking mileage and reimbursing employees for business use of personal vehicles.Recent changes to state labor laws, especially in California, are challenging the business practices of motor carriers and other companies that have mobile workers.

The trucking industry has been hit by a 2014 decision from the 9th Circuit Court of Appeals that ruled carriers must provide California-required meal breaks and paid rest breaks for their drivers. A number of carriers have been ordered by courts to pay large settlements.

Another California labor law, section 2802, requires employers to reimburse their employees for all necessary expenses or losses they incur for the job. Reimbursing employees for their use of personal vehicles for work is where the law gets complicated.

Salespeople, mechanics, fleet executives and managers as well as drivers who travel for business often use personal vehicles. These and other employees cannot simply turn in receipts for vehicle mileage, depreciation and fuel. The line that separates business and personal use of a vehicle can get blurry as well.

Illinois is adopting a labor law that is nearly identical to California section 2802 on Jan. 1, 2019. The law sets penalties for non-compliance at two percent of the underpayment to employees per month. The period for underpayment could go back months, even years, to when employees were hired.

Massachusetts and Montana also have statutes in their labor laws that are similar to California’s, says Danielle Lackey, chief legal officer of Motus, a cloud-based vehicle management and reimbursement platform.

A safe harbor

One option for reimbursing employees is to use the standard IRS mileage rate. The rate is currently at 54.5 cents. The problem with this approach is “you could potentially be overpaying for certain populations and underpaying for others,” she says.

A salesperson for a fleet may travel 40,000 miles a year for work. In this instance, the IRS rate would far above the employee’s actual costs. In other instances, a different type of employee might be able to prove his or her vehicle costs were higher than the IRS rate used for reimbursement. This could be true in certain geographic areas like California that have high gas prices.

The IRS rate is therefore not a safe harbor for labor laws, Lackey says.

An alternate option is to pay employees a monthly flat allowance for use of personal vehicles. This practice is also unsafe since companies would not have definitive proof that they fairly reimbursed employees.

The labor laws do not say that employers have to reimburse for exact vehicle expenses, however. They have some flexibility that allow for cost inputs to be used for the type of vehicle that is reasonable for the job. A salesperson may drive a Chevy Suburban, for example, but a company can reimburse for the equivalent rate of a Ford Focus if this type of sedan is reasonable for the job of a salesperson.

Motus is one of several companies that have software for automating the data capture for vehicle mileage reimbursement. Motus uses the Fixed and Variable Rate (FAVR) method to calculate a mileage-based rate based on the lifecycle costs for a type of vehicle that is reasonable for the job, not the actual vehicle a worker uses.

The method breaks down fixed and variable costs for a chosen vehicle into six components that include depreciation, maintenance and fuel costs. The cost of fuel is based on the zip code of where the employee is located.

The reimbursement doesn’t have to be entirely in cash. Employers can pay for fuel costs by loading a prepaid debit card with the calculated costs for an employee’s previous month of work-related activity. Motus has an integration with fuel card provider FleetCor that simplifies this process.

Businesses that use a mileage reimbursement system based on the FAVR method are protected in court, says Lackey, since they have the data to prove they fairly paid for vehicle expenses.

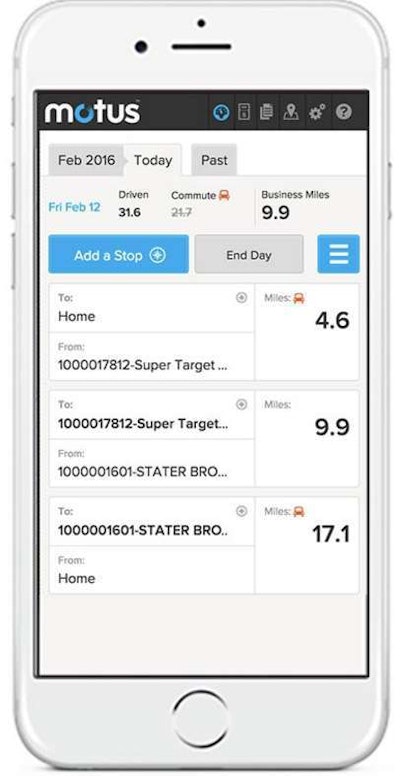

To capture mileage, Motus has an app that employees use on their smartphones or tablet devices. Employees use the app to clearly delineate when they use their personal vehicle for work. They can manually start and stop each business trip and can make adjustments between business and personal use of their vehicle as needed. The app and the GPS on their devices do the rest.

Cost savings are another reason to use mobile apps and the FAVR method for reimbursement. Studies have shown that mileages reported by employees for business use of their vehicles drops by 15-20 percent when using mobile technology to track mileage, she says.