For Class 8 truck orders, the last 24 months have been a tale of two markets. After setting multiple record highs both for monthly orders and twelve-month rolling averages, fleet orders for Class 8 trucks hit a wall, tumbling in late 2018 to lows not seen since the Great Recession. They’ve remained suppressed through 2019.

Fleets ramped up orders starting in late 2017 to try to counter 2018’s capacity crunch and to take advantage of a strong economy and a new tax law that incentivizes equipment purchases. When the market regained balance last fall and as truck build backlogs grew, truck orders slowed significantly.

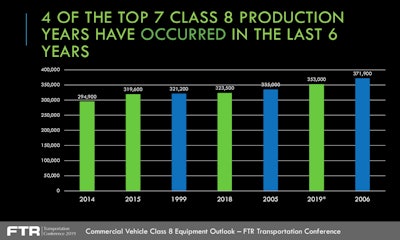

Ake pointed to this chart Wednesday to show that, though order numbers are low in 2019, the truck build rate is at a historic high.

Ake pointed to this chart Wednesday to show that, though order numbers are low in 2019, the truck build rate is at a historic high.“We were abnormally high, and now we’re abnormally low,” said Don Ake, vice president of commercial vehicles for FTR, speaking at the 2019 FTR Transportation Conference on Wednesday. But averaging the two years together, order numbers are still above the seven-year average, he says. “It’s not a crash. [It’s] trying to recover to some sort of normal level.”

Though 2019 has been a poor year for order numbers, it’s likely to be a record year for truck build rates, says Ake, second only to 2006 — a huge production year due to the truck pre-buy ahead of 2007 emissions standards. Also, despite record orders, cancellations were held in check this year — meaning that fleets are taking the trucks they ordered. “I thought once we got into the middle of this year, we would see cancellations spike,” said Ake. “What we saw was cancellations increase, but not spike. They’re taking most of these trucks, which is a very good sign for the market.”

For truck orders, the next few months will be pivotal in determining the health of the market, says Ake, particularly October — the month that fleets typically put orders in for the coming year. “October is a key month,” he said. “It’s a good month for looking at 2020. Because if orders don’t pop up in October, then there’s a problem.”

Ake says FTR forecasts a strong third quarter for order activity, but a weaker fourth quarter.

Ake, who spong alongside FTR CEO Eric Starks, said FTR predicts the truck build rate to total 265,000 in 2020, then decline in 2021 and 2022 to 255,000 and 245,000, respectively. “Our forecast is slightly optimistic. It’s based off of a slightly more optimistic economic forecast.” Ake says. “We do not see the market crashing.”

Should the economy dip more sharply than expected, build rate numbers likely will miss FTR’s forecast, he said.

The firm predicts a normal replacement cycle for orders, says Starks. “And a replacement market right now is somewhere in that 240 to 250 type of numbers.”