Many brick and mortar stores rely on strong holiday sales to make or break their fiscal year. Black Friday, after all, is “Black” Friday because the day’s sales can pull retailers out from months of operating in the red.

graphic via Convey

graphic via ConveyBut technology has changed the face of peak bargain shopping and brought with it a boon to the last-mile delivery segment.

The U.S. Postal Service expects to deliver 800 million packages between Thanksgiving and New Year’s Day. UPS will handle about 32 million packages per day from Nov. 29 through Dec. 30 – 60% more than the rest of the year.

FedEx expects to handle more than 33 million packages Monday.

Deloitte’s 2019 Holiday Shopping Survey, a national sample of 4,410 consumers, indicate Cyber Monday shopping – which largely takes place online the Monday following Thanksgiving – has surpassed Black Friday in post-turkey day shopping relevance, with 53% of respondents saying they plan holiday shopping around Cyber Monday, versus 44% who say they plan around Black Friday.

Deloitte forecasts up to $149 billion in digital retail sales this year and estimates e-commerce holiday sales will grow 14-18% percent over 2018.

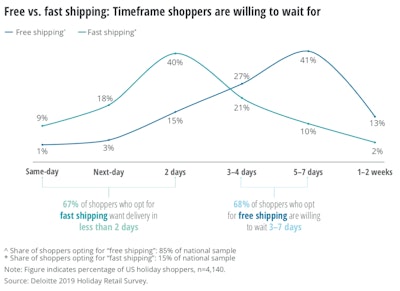

Online shopping means on-road shipping and shipping means trucks, but unsurprisingly the general public – some of whom may have just dropped upwards of $1,000 on a new television – doesn’t want to pay for having it brought to them. A full 85% of Deloitte’s survey respondents said they prefer free shipping over fast shipping. Among shoppers who prefer free shipping 80-plus% are willing to wait three days or more.

Similarly, an annual consumer survey conducted by delivery experience management firm Convey this year found that more than 65% of shoppers would accept slower delivery services if delivery was free. And not just free delivery. Free two-day shipping, according to 80% of Convey respondents (thanks, Amazon).

“This last-mile supply chain, or how the product is delivered to consumers, has become another key battleground. In early communications and advertising for the 2018 and 2019 holiday seasons, delivery and fulfillment communications are moving to the forefront,” the Deloitte survey noted.

Convey’s survey found that four in 10 shoppers said late delivery was their biggest concern this year, ranking it ahead of having the package stolen by a porch pirate.

“For brands that like to think they aren’t competing with Amazon, the data clearly suggests that shoppers think they are,” said Convey Chief Growth Officer Kirsten Newbold-Knipp.

As much as the trucking industry derides government regulation, the expectation that Amazon has set for on-demand delivery has eroded any remaining flexibility.