The demand for diesel technicians continues to outpace entrants into the field – a problem compounded by the fact that the number of would-be applicants is beginning to decrease.

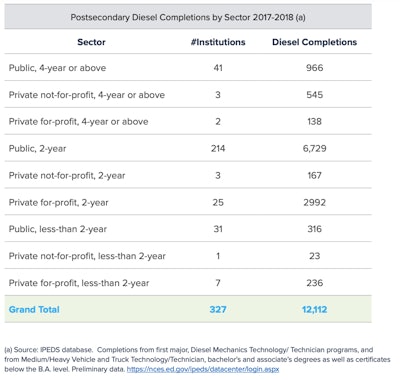

According to data compiled by the TechForce Foundation, the number of students who completed a certified diesel program totaled 12,112 in 2018, reversing the annual upward trend in the number of program graduates that dates back to 2012.

TechForce Director of National Initiatives Greg Settle, who authored the report, tied the drop in program completions to a “gut feeling that it has to do with the very low unemployment rate we had been seeing pre-COVID, when this data was collected,” he said. “Traditionally, when unemployment is low, young men and women don’t think as seriously about school, because they can get entry-level jobs easily.”

TechForce estimated that 170,000 diesel technicians will be needed industry-wide between 2020 and 2024, but the post-secondary system is on pace to produce less than 50,000 assuming the rate of completion continues to fall at about 5% annually.

Calhoun said marketing the benefits of a career in the field has been, to-date, a struggle despite the many efforts of trucking and trade education stakeholders.

“There is much work to be done in terms of image, updating of schools, streamlining of onboarding by employers, matching expectations to reality, the list is seemingly endless,” he said. “As industry, education and state government we collectively have failed. The good news is that education and state government are ready to change. It is up to industry to finally come to the table in a meaningful way and show the other parties the direction of travel. We cannot simply leave them to guess at our needs.”

The number of diesel technicians employed from 2010 to 2018 has climbed an average of 2.23% annually and, driven by a stronger-than-expected economy, employment growth in the diesel sector has outperformed both the automotive and collision sectors over the period.

“Diesel had enjoyed an advantage because they were paying higher wages to attract young men and women,” Settle said. “However, as entry-level wages went up for other jobs, I believe diesel lost the wage advantage that they previously held.”

Additionally, diesel is also the only sector among the three that forecasts demand for new positions attributed to growth (versus retirements and turnover) over the entire period through 2024.

Settle said there are indications of increased interest in technical program enrollments, as many of those jobs were deemed essential during pandemic-spurred shutdowns.

“The current high unemployment numbers and the fact that we are essential may in fact be the silver lining,” agreed Calhoun, “but we have to deliver that message in a loud and consistent manner.”