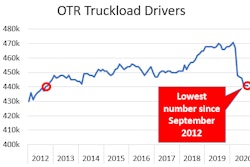

The supply (capacity) side of the freight market has become very tight in 2020, but not because equipment is scarce. A driver shortage, more than anything else, has put the trucking industry in a position to chase rate increases for perhaps the next two years.

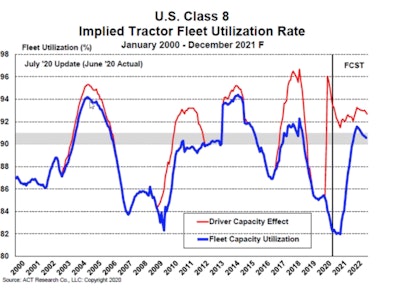

Paul Kroes, market insights leader, North America, for Thermo King, showed this chart to note the imbalance between asset utilization and available drivers.

Paul Kroes, market insights leader, North America, for Thermo King, showed this chart to note the imbalance between asset utilization and available drivers.“The driver shortage is driving the current environment,” said Paul Kroes, market insights leader, North America, for Thermo King during a webinar on Tuesday.

The trucking industry has about 80,000 fewer available drivers compared to a year ago, he said. The federal stimulus increased unemployment benefits and “couched” a lot of drivers who discovered they could earn more by staying home than being out on the road, he said.

The CDL Drug & Alcohol Clearinghouse removed 40,000 drivers — about one percent of the driving force — from January to September due to failed drug test results, most of which were from marijuana use. If the Department of Health and Human services publishes a hair follicle testing rule, Kroes predicts that five to 10 times as many drivers will become ineligible for employment.

Additionally, the industry has seen a 40% drop in CDL training due to closures — about 20% of truck schools are still closed — and the remainder are graduating fewer students due to social distancing.

During the webinar, Kroes showed a chart comparing the equipment utilization rates for carriers, which typically hover at 90%, to available drivers. At the end of the third quarter, the chart showed there are “not nearly enough drivers to do the work,” he said, and “the driver shortage will be the driving factor for the foreseeable future.”

Another contributing factor to driver shortages is a record migration from fleet payrolls to owner-operators to chase opportunities for higher pay in the spot market. Analysis by FTR of new motor carrier registrations shows an increase of nearly 10,000 in the third quarter, which is an all-time record.

Kroes credited the Trump tax cuts for “bumping” up the freight cycle up in 2017 and 2018. Market conditions softened and 2020 was supposed to be a rebalancing year for supply and demand. Going into 2020, economists were predicting a reversal of demand of 10 to 30 percent, he said. COVID-19 made things worse, at least for a brief period, but freight volumes spiked in April due to the hoarding of consumer goods.

Demand fell just as quickly, but then recovered in the third quarter as supply chains were replenishing inventories . According to the U.S. Census bureau, sales to inventory ratios are now lower than at any point during the last five years.

Publicly traded carriers showed record price (rates) to earnings ratios during the third quarter. Carriers have been ordering equipment due to the likelihood of tight capacity remaining through 2021. Trailer orders hit a record amount of 50,000 units.

All signs point to a favorable outlook for the next two years for freight volumes and higher contract and spot rates. Kroes predicted industry consolidation will increase for large fleets to continue to grow. Past 2021, the distribution of a vaccine for COVID-19 will determine if economic recovery will continue to be even greater, he said.