The cancellation rate of trailers continues to backslide with January taking a turn for the worse at 3.2% from an already high rate of 1.7% in December, according to ACT Research.

Seasonally adjusted, January’s orders fell to 12,400 units from 15,400 in December. On that basis, orders decreased 28% month-over-month, said Jennifer McNealy, CV Market Research & Publications at ACT Research. Several markets led the way, including dry vans at 4.2% backlog and lowbeds at 1.5%, she added.

“Clearly, with markets swimming in capacity, no one needs a higher trailer-to-tractor ratio.”

TL Carrier DatabaseACT Research

TL Carrier DatabaseACT Research

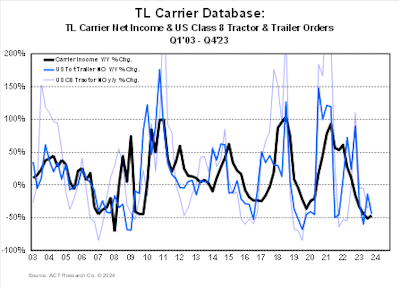

It comes down to weak carrier profits, said Kenny Vieth, president and senior analyst at ACT.

“Additionally, some trailer segments are impacted by specific economic markets," he said. "For example, softer oil prices are trailer-type specific and responsible for tank trailer weakness. There has also been a pullback in power-only brokerage, which is a driver for dry van demand.”

In comparison to cancellation for truck orders, Vieth noted that rates for Class 8 was high at 2.1% of backlog, 12% relative to new orders, with weak carrier profits also driving the rates.

Carriers are reducing capital expenditure plans in 2024. Schneider National reduced its CapEx in 2024 to be in the range of $400 million to $450 million. This is considerably down from $574 million in 2023 because of the “catch-up with the OEMs and the age of fleet,” Mark Rourke, Schneider president and CEO, explained in an earnings call.

Werner Enterprises decreased its CapEx to be between $260 million to $360 million from $409 million last year. Werner President Nathan Meisgeier noted, “This is within historical ranges in dollar terms, although expected to be lower, as a percent of revenue of growth in our asset-light business continues to outpace truckload growth.” By doing so, the carrier had reduced the average age of its trucks to 2.1 years in 2023 with an aim to stay near two to five years throughout 2024.

At J.B. Hunt, CapEx investment will range from $800 million to $1 billion, which took a dip from 2023’s $1.6 billion. In an earnings call, CFO John Kuhlow, noted that the carrier planned investments in intermodal and real estate operations. However, it also needed “elevated levels of replacement demand as a result of equipment challenges experienced over the last two years.”

[Related: Fleet earnings Q4 2023: Carriers feel the impetus of freight market recession]

The COVID-19 pandemic ripple effect

“Covid threw everything for a loop, obviously,” said Eric Starks, chairman of the board at FTR. “The expectations were that orders or these cancellations would start to settle down because most people would have already cancelled the items that they feel like they didn’t need, but clearly that has not completely stopped."

As carrier’s revenues take a hit, Starks pointed out that companies are re-evaluating where to place capital.

“Is it better for me to hold on to in cash, or is better for me to buy a piece of equipment and sit there and have it depreciate," he said. "Ultimately, it costs more to buy that piece of equipment. So not only was the equipment more expensive, but then the holding cost goes up.”

One of the reasons we have not seen truck order cancellations go higher is the fundamental replacement demand, Starks said.

“The other part is the way they have their backlogs now set and where the build slots are," he added. "They basically have two quarters of their production completely filled, so if somebody wants equipment, they need to make sure that they stay in the backlog so they can get that equipment when they want it.”

Coming out of the pandemic has been bizarre in that aspect, Starks commented. He said FTR expected things would begin to normalize as it got to about this point, but it hasn’t.

“We anticipate that we’ll start seeing some modest freight growth in the second half of this year. That should really start to show up and be felt by the equipment market by 2025,” Starks said. “For example, we are in a traditional normal peak period right now where we anticipate that orders for trailers would be very high, and they’re not. We actually saw January take a hit, and January taking a hit is not abnormal, but it’s usually coming off of high levels."

“What’s abnormal is that we’re at really low levels for orders in general," he continued. "People are just holding back, and so I think we’re going to feel that as we move to this year. It’s only going to be at the second half of 2024 when orders start to normalize.”

DAT Principal Analyst Dean Croke also pointed out that the challenge is that there hasn’t been substantially more freight overall, and there’s more than enough capacity to meet demand. “Shippers have been in a position to negotiate better terms with their transportation providers since early 2022,” he said.

“Carriers are accepting more tendered contract loads, and we’ve also seen more carriers provided dedicated service. The result is less freight falling to the spot market and weaker volumes than previous years,” Croke added.

Vieth echoed Starks' sentiments of unusual activity as pandemic ripples continue to impact demand.

Typically, the segments tend to cycle together, Vieth said. As the industry’s largest segment, for-hire TL market weakness is broadly understood.

“Offsetting that weakness, the implosion of Yellow is benefitting LTL profitability and thereby new vehicle demand,” Vieth said. “Vocational markets are still experiencing some pent-up demand even as the CHIPS and Infrastructure subsidies are boosting construction activity.”

At the same time, Vieth pointed out that pandemic-era supply chain breakdowns continue the expansion of manufacturing reshoring, of which Mexico has been a major beneficiary, driving significant demand in that market.

So, should fleet owners be wary or take risks in upcoming months? Vieth and Starks both agree the tide is turning.

“We believe the freight cycle is on the cusp of improving as those economic sectors that drive freight are projected to move higher in 2024,” Vieth said. “Consumer spending on goods is poised for a better 2024, and government policies are supporting construction investment while continued nearshoring and the end of retail inventory destocking should also benefit growth as the freight cycle moves from its late-cycle 2023 stance to early cycle positioning this year. We have not yet had a material pullback in equipment demand, so the recovery in freight will be into a still over-capacitized market, likely muting the velocity of the recovery.”

EPA’s 2027 Clean Truck mandate is one to watch for medium-duty and heavy-duty vehicle buyers too.

“We expect MD and HD backlogs will start tightening later in 2024, and when that tightening begins, we expect the escalation to be rapid," Vieth said.