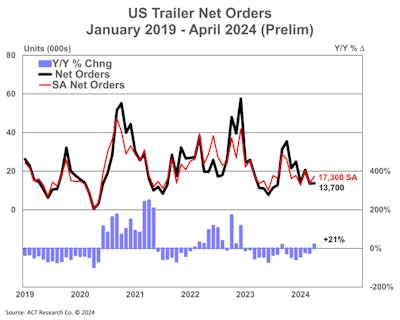

Trailer orders seem to have slightly steadied in April, according to ACT Research. Preliminary net trailer orders were nominally changed from March to April at 13,700 units, though orders were higher 20% from April a year ago.

Compared to a year ago, with high demand beginning to decline and supply chain congestion mostly resolved, Jennifer McNealy, director of commercial vehicle market research and publications at ACT, said that order activity continues to meet expectations.

McNealy said despite the positive year-over-year comparison, net orders are still facing difficulties because for-hire trucking profitability is low, although some “green shoots of improvement” are beginning to show.

For the past several months, trailer manufacturers and suppliers have noted a slowdown, said McNealy. “They have shared that orders are coming, but at a more tepid pace when compared to the last few years," she said.

ACT Research

ACT Research

Though ACT expects fleets to be more profitable later this year, thereby enabling them to buy more equipment, the impact might not make a significant boost. With EPA’s implementation of 2027 regulations coming up, McNealy noted that companies are more likely to spend on new power units, which she sees has already started.

McNealy added that anecdotal information from the trailer industry suggests a period of stagnation is expected during “this year of transition.” The industry is still facing significant pressure, such as continued fluctuations in order cancellations as dealers and fleets adjust their inventory and immediate needs. Other external forces, like U.S. and Mexico presidential elections and high interest rates, are also factors to closely monitor.

[Related: States challenge latest EPA, CARB truck emissions rules]

Meanwhile, FTR reported that trailer orders increased in April by 1,069 units to a total of 13,016 units, which is a 9% increase month-over-month and 45% year-over-year.

However, despite the increase, trailer orders were still 20% below the average for the last 12 months. The number of trailers ordered over the last 12 months increased to just over 199,000 units.

FTR data also showed that trailer production decreased by 3% month-over-month in April, totaling 22,975 units. Production was down 12% year-over-year. The build data aligns with average April levels over the past five years.

“With the truck freight market facing challenges, solid growth in April for both total van and major vocational trailer orders offers a few green shoots of optimism,” said Dan Moyer, senior analyst for commercial vehicles at FTR.

Unless the growth continues in the coming months, Moyer said that decreasing backlogs and high dealer trailer inventory levels will put further downward pressure on trailer build rates.

Trailer forecast affected by overcapacity

Looking ahead, the trailer forecast for the year is significantly downgraded, said Kenny Vieth, president and senior analyst at ACT.

Based on the first quarter earnings reports of publicly traded carriers, profit margins collapsed to a 14-year low 2.6%.

“The opening stanza of 2024 was notably bad for the very good carriers who make up the group,” said Vieth.

Vieth pointed out that while the profitability drop was partially seasonal, an overcapacity of trucks in the market from 2023 and into this year has pushed carriers to lower rates, and negatively impacted corporate profits. He added this adds pressure by carriers’ tendency to spend on Class 8 units in anticipation of an expensive EPA mandate in 2027.

“We revisited our trailer forecasts based on these near-term considerations: carrier profits, overstocked trailer dealer inventories that are proving hard to move, a short and soft peak order season, and increasingly diminished backlogs," said Vieth.