The reality of the administration’s tariff policy, along with shifting justifications and timelines, is that it is affecting businesses and freezing the ability to make business decisions, said Jonathan Starks, CEO, FTR Transportation Intelligence, at a webinar on Thursday.

As tariff policies continue to shift rapidly, FTR analysts say they’ve not only had to date their findings but also time-stamped them for accuracy.

On Feb 4., the U.S. was set to impose a 25% tariff on imports from Mexico and Canada, along with a 10% tariff on Chinese goods. while most of these tariffs were initially paused, they were later reinstated earlier this month, including a 10% tariff on Canadian energy products, and 10% tariff on Chinese imports.

The administration exempted automakers covered under the United States-Mexico-Canada-Agreement (USMCA) earlier on March 6, delaying their inclusion in the tariffs until April 2. At that point, a new round of 25% reciprocal tariffs is expected to take effect, covering automobiles, parts, semiconductors, and pharmaceuticals, and tariffs targeting the European Union.

Additionally on March 12, Trump enacted 25% tariffs on steel, aluminum and fabricated metal parts, with no country-specific exemptions and little clarity on when enforcement will begin.

“This amount of uncertainty continues to create additional problems,” Eric Starks, chairman of FTR board, said. “You’re going to have to pay very close attention in your business to understand what impact looks like.”

FTR analysts also pointed out that the U.S. is proposing substantial fees on Chinese ships docking at U.S. ports. Chinese ocean carriers would be charged $1 million per container ship arrival, while operators of Chinese-built vessels could face fees from $500,000 to $5.1 million per port visit, depending on the proportion of Chinese-built ships in their fleet.

Other nations have responded with retaliatory tariffs and export controls, including:

- China: Imposed a 15% tariff on coal and liquefied natural gas on Feb. 10, along with a 10% tariff on crude oil, agricultural machinery, and large-engine vehicles. On March 4, additional 15% tariffs were placed on chicken, wheat, corn, and cotton, with a 10% tariff on other agricultural products. China has also implemented export controls on five rare earth minerals, which make up about 40% of U.S. imports.

- Canada: A 25% tariff on U.S. imports, initially delayed due to the U.S. pause, went into effect in response to the steel and aluminum tariffs imposed by the U.S. on March 12.

- European Union: Plans to impose retaliatory tariffs in response to U.S. steel and aluminum duties. Targeted goods include motorcycles and bourbon, with broader measures expected by mid-April. In response, Trump has threatened a 200% tariff on alcoholic beverages from Europe.

Looking at the current economic environment and risks, FTR analysts discussed that the situation feels similar to the October 2008 economic downturn.

“The difference here is that that was something within the broader economy that was starting to collapse,” Joseph Towers, senior analyst, rail, said. “And this one is where we’re entering the market that is actually relatively healthy, and this is being collapsed by on individual who’s putting on a trade war.”

Freight market

Spot rates indicate little market activity, particularly in the dry van segment, noted Avery Vise, VP of trucking. While there was a typical holiday increase, it was not as strong as usual and has since stabilized. Current all-in spot rates remain within the high end of pre-pandemic levels but do not suggest any significant market momentum.

The refrigerated segment, which is less impacted by tariffs, also saw a holiday spike but has since declined sharply, reaching its lowest broker-posted rate since June 2020. Flatbed rates are showing some growth, but they remain below year-over-year levels, despite reaching their highest point since July.

There is no clear evidence that shippers are accelerating orders in response to tariff concerns, Vise said. Meanwhile, border crossings between the U.S., Canada, and Mexico, which provide insight into trade volume, have not shown significant increases. Although tariffs on Mexican and Canadian imports were announced in late November, there has been no major surge in freight activity ahead of their implementation.

Vise pointed out trade volumes did see the expected seasonal rebound in January, but the increases—2.7% for Mexico and 2.4% for Canada—were relatively modest and within normal historical patterns. Larger year-over-year increases have been observed at other times in 2024, suggesting no extraordinary rush to move goods before tariffs take effect.

Commercial vehicle implications

FTR analysts noted that the U.S. imports 41.4% of its aluminum from Canada, a dependency that makes tariffs on metal particularly impactful.

“It’s a big deal,” said Eric Starks, noting that a proposed 50% tariff would have severely disrupted the aluminum market, while a 25% tariff will still have significant issues. Even with just a 25% tariff on aluminum and steel, FTR analysts expects truck and trailer prices to rise.

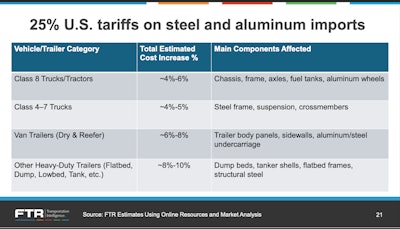

Class 8 truck prices are projected to increase 4-6%, said senior analyst Dan Moyer, while medium-duty trucks will see a 4-5% increase. Dry and refrigerated trailers are expected to cost 6-8% more, with other heavy-duty trailers seeing an 8-10% increase.

About half of the Class 8 trucks built in the U.S. and Canada are affected by tariffs, Moyer said, and the impact is already visible in order trends.

Net orders for 2025 Class 8 trucks are down 26% year-over-year, with retail demand declining. At this point, ordering a new truck without tariff-related cost increases is no longer an option, Moyer said, but some fleets may still find relief by purchasing from existing Class 8 retail inventory.

“Whether on an order basis or even on a retail demand basis, fleets are hitting the pause button, or at least some of them [are pausing] on making purchases or making orders,” said Moyer.

The analysts also touched on the Trump administration’s announcement of reevaluating environmental regulations, including the Phase 3 greenhouse gas rules and NOx emissions standards.

Moyer said it would add a relatively modest change in forecast. Vise pointed out, “We’re not in an environment where we’re following normal practice,” adding that while the rollback might seem beneficial at first, it ultimately creates more uncertainty. Details on how and when the rule will be undone remain unclear, and legal challenges could further complicate the process.

With this uncertainty, Vise said fleets may assume the rule won’t be enforced and scrap plans for any pre-buy strategies.

“The biggest takeaway is just it adds a whole more uncertainty into the whole market for the next year or so,” he concluded.