Truck freight volumes showed mixed results during the first quarter of the year, according to a U.S. Bank Freight Payment Index report.

Winter storms, wildfires, tariff uncertainty and soft retail sales led to declines in quarterly and yearly shipment and spend volumes.

Winter storms, wildfires, tariff uncertainty and soft retail sales led to declines in quarterly and yearly shipment and spend volumes.

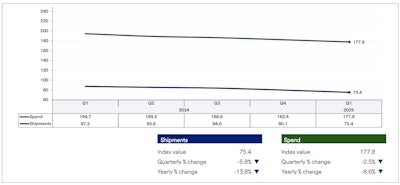

U.S. truck freight volume was down 5.8% overall, while spending slowed down 2.5% compared to the fourth quarter.

Although there had been signs of the truck freight market improving with the new year, the report noted that significant negative influences led to a ninth consecutive quarter with national declines in quarterly and annual shipment and spend volumes.

Lower housing starts and weather events negatively impacted the truck freight market during the first part of the year, said Bob Costello, the report's author and senior vice president and chief economist at the American Trucking Associations.

[RELATED: Fleets’ Q1 earnings show resilience, but headwinds persist]

Southern and Southeastern states were hit by unusually heavy snowfall, with some experiencing the most precipitation in many years. Since these regions typically lack the infrastructure to manage large amounts of snow, it severely disrupted highway travel and supply chains.

The report noted that one of the underlying themes from the quarter was a surge in imports and domestic product manufacturing as businesses sought to get ahead of tariffs on U.S. imports.

On the other hand, stronger retail sales and increased imports gave the Northeast a boost, Costello said.

Consumer activity was mixed in the first quarter, the report noted. There were signs of households advancing vehicle purchases ahead of any tariffs, but not enough to significantly boost freight volume since much of that demand was met with existing inventories.

Spot and contract rates ticked up modestly compared to Q4, according to the report. However, all were down on a year-over-year basis. Fuel prices dropped over the period -14%.

“All told, there are some signs of improvement amid persistent headwinds for the trucking industry,” Costello said.

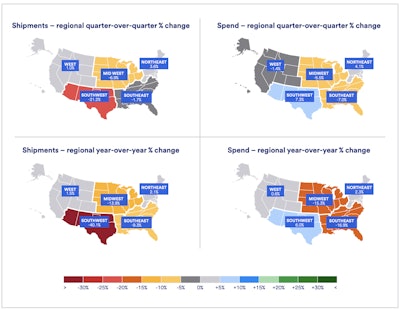

Regional freight trends

Volume dropped 21% quarterly in Southwest, while Northeast shipments soared.

Volume dropped 21% quarterly in Southwest, while Northeast shipments soared.

The Northeast region reported the best first quarter among all regions in both shipments and spend from the prior quarter and a year ago. The region saw a 3.6% quarterly and 2.1% annual increase in shipments – the region’s largest sequential gain since Q2 2022. It also saw a 4.1% quarterly and 2.3% annual rise in spending. The report attributed it to both strong manufacturing activity and consumer spending.

“While food service activity was off sharply, the remainer of retail sales was strong. This is one data point suggesting the expected transition from experience spending to buying more goods has begun, which would be positive for most carriers and shippers,” Costello wrote.

Robust port activity in New York also contributed, as January had 5% volume gains and February saw a 10% boost, helping freight levels in the region.

In the Southeast, shipments dropped 1.7% compared to the previous quarter and -9.3% year-over-year, and spending fell more sharply (-7.% quarterly and -16.9% annually). Unusual winter weather and weak demand for manufactured goods in the region affected truck volume, leading to a third straight quarter with declining quarterly and yearly shipment and spend volumes.

The West region saw a modest rebound, with shipments up 1% from the prior quarter and 1.5% year-over-year – the first annual increase since Q2 2022. However, spending dipped 1.4% quarterly but remained slightly positive at 0.6% year-over-year.

The devastating wildfires in Southern California also disrupted freight volume for nearly a month, although the West still managed a post overall quarterly gains in shipments in the 5% to 10% range with some pull forward of freight in anticipation of tariffs.

In contrast, the Southwest saw a significant 21.2% quarterly decline and 40.1% annual drop in shipments, impacted by winter storms. Multiple storms in Texas and declining manufacturing activity in February, along with soft retail sales, also affected volume in the region. However, spending rose 7.3% quarterly and 6.0% annually, likely due to supply chain disruptions.

The Southwest region saw the largest quarter-over-quarter and the year-over-year spend increases among the five regions.

“It was surprising to see that shippers spent more to move significantly less freight," Costello wrote.

The report noted that it could be due to a mix of factors, such as strong chemical production (which was 6.6% higher in January and February compared to the same period in 2024), with Texas as a huge producer of chemical, which are more costly to ship. Another factor could be that truck capacity left the region.

The Midwest faced a -6.9% quarterly and -13.9% annual fall in shipments, and a -5.5% quarterly and -15.3% drop in spending. Factors driving this activity could be lower volumes from Canada (which dropped more than 20%), winter weather, weak manufacturing activity, and a 30% decline in housing starts.