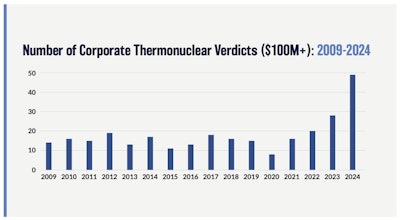

U.S. trucking companies remained heavily targeted by lawsuits last year, with verdicts frequently exceeding $100 million, according to a report.

“Thermonuclear verdicts,” or those greater than $100 million, according to the study by Marathon Strategies, rose to a record of 49 cases in 2024, compared to 27 in 2023.

Large-scale verdicts appeared in 34 states last year, up from 27 in 2023. State courts issued $20 billion across 85 cases, while federal courts awarded $11 billion in 50 cases. The top five states by total award value were Nevada ($8.4 billion), California ($6.9 billion), Pennsylvania ($3.4 billion), Texas ($3 billion), and New York ($2.1 billion).

According to the report, the trucking and automotive sectors experienced 15 substantial verdicts totaling more than $4.1 billion in 2024. The analysis indicated that these industries faced disproportionate exposure to large-scale judgments, primarily in wrongful death and negligence litigation.

Notably, several 2024 cases involved product liability claims focused on allegations about defective designs.

Most notable was when trailer manufacturer Wabash faced $450 million in punitive damages related to a 2019 fatal crash where a passenger vehicle hit the rear of a 2004 Wabash trailer. A St. Louis jury reduced this amount to $108 million and the case settled out of court earlier this month.

The second case saw an Alabama jury award $160 million in 2024 against Daimler Truck North America in a product liability lawsuit. The case involved a driver who suffered quadriplegia following a 2022 rollover crash. Daimler responded by defending its safety standards and announced plans to appeal.

Product liability emerged as the leading category among 2024’s top 10 corporate verdicts, comprising $13.1 billion in 32 cases, according to the report.

The rise of product liability cases in the transportation sector marks a fundamental shift in how truck cases are litigated and has increased the legal exposure for trucking companies, said Donald R. Fountain Jr., a founding partner of Clark Fountain.

“Fleets are no longer judged only by driver behavior. They are judged by the quality and condition of their vehicles, by the records they keep, and by whether they followed through on known maintenance or defect issues,” Fountain said.

When crashes occur, data from real-time GPS and telematics systems can either prove compliance with safety protocols or reveal patterns of neglect, Fountain pointed out.

“In a lawsuit, that data often becomes the key piece of evidence. Sometimes it exonerates the company. Other times it confirms exactly what went wrong,” he said.

Trucking companies and component manufacturers can reduce exposure by establishing clear accountability throughout their supply chains, he added.

AI as the new unknown?

The report identified emerging risk areas poised to contribute to rising verdicts: “forever chemicals,” obesity, algorithmic liability, cryptocurrency, and cybersecurity.

Artificial intelligence also poses a significant uncertainty, the report noted. Some analysts warn that AI could intensify an already litigation-heavy environment. AI may amplify class action litigation as plaintiff lawyers and third-party litigation funders use it to help identify viable cases more efficiently.

Other lawsuits are also challenging how AI companies utilize copyrighted content.

Additionally, changing jury demographics are also reshaping verdict trends. The influx of millennial and Gen Z jurors is significant, as the report noted that these generations tend to favor plaintiffs more than the prior generation, less trusting of the average American company, and place emphasis on ethical considerations when considering which company to trust.