Tech giants continue to boost artificial intelligence spending. Google has projected capital expenditures of $91 to $93 billion for 2025, a significant increase from its earlier forecast of $85 billion. Microsoft’s spending rose 74% to reach $34.9 billion this year. Meanwhile, Meta’s investments climbed from $9.2 billion to $19.37 billion year over year.

According to Allianz Commercial’s The Data Center Construction Boom report, the surge in AI demand has triggered a construction boom. Construction costs have escalated from $200 million to $300 million projects to projects exceeding $20 billion.

Construction experts at Allianz Commercial noted that average-sized facilities now range between $500 million and $2 billion to build.

“Freight brokers and specialized carriers have noted an uptick in oversized loads, many destined for new or expanding data centers in remote areas,” DAT Freight & Analytics principal analyst Dean Croke wrote in a market update report in October.

While DAT’s spot market load board doesn’t list data-center construction as a specific commodity type, Croke said they have observed regional clustering of demand around emerging data center hubs. These include Northern Virginia; Dallas-Fort Worth, Texas; West Texas; Phoenix, Arizona; Atlanta; Ohio; Chicago, ; Lincoln, Nebraska; Mount Pleasant, Wisconsin; Rosemount, Minnesota; Kansas City, Missouri; North and South Carolina; Pennsylvania; Las Vegas; Oregon; and Washington.

Croke analyzed inbound spot rates for open deck loads into the locations and found rates running 2% above the national average.

Croke also pointed out an interesting finding in volume trends: While total volume of open deck loads across all markets increased 2% year over year, the volume of loads into the areas related to the data center construction surged 20% during the same period.

Since owner-operators and small fleets make up the bulk of its carrier network, Croke said, “our current view is that the specialized cohort within our carrier base is benefitting the most from this market growth, especially when over-dimensional loads are involved.”

“Over the next few years, we don’t see an end in sight to the growth in this market, given the unprecedented computing needs of artificial intelligence and record-breaking investment and construction volumes,” he said.

Boom or bubble?

Allianz Commercial’s report noted that the rapid expansion of data center construction faces potential headwinds.

“Unpredictable AI demand, technological advances, and implementation barriers have raised concerns about potential over-investment and stranded assets,” the report noted.

In June, construction spending on U.S. data centers reached $40 billion, according to a Bank of America Institute report.

While data center construction has undeniably exploded in recent years, Jason Miller, a professor of supply chain management at the Eli Broad College of Business at Michigan State University, pointed out that this boom has been offset by a sharp decline in warehouse construction.

“The slowdown in warehouse construction actually outweighs the increase in data center construction,” Miller said.

As of July 2025, according to Census Bureau data, the seasonally adjusted annual rate for warehouse construction stood at $54 billion compared to $41.2 billion for data centers.

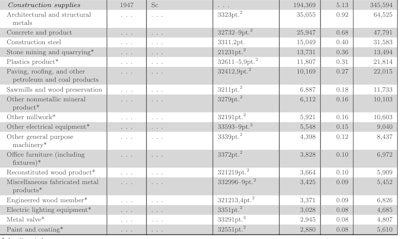

Industrial production of construction supplies saw a slight increase of 1.2% year over year, remaining below the 2022 seasonal peak, Miller noted.

Looking at the breakdown of construction supplies, key inputs like architectural metal, concrete products, and construction steel show divergent trends. Miller pointed out that construction steel is up and has rebounded to near-2021 levels, consistent with data center construction. In contrast, concrete and product production has declined, likely reflecting weakness in housing starts. Architectural and structural metal production has also increased, aligning with data centers being built.

So how does this scale of investment translate into freight demand?

“AI data center construction is contributing, at most, just a percentage point to for-hire trucking demand,” Miller said. “While the $41 billion annual figure seems large, it is actually rather small in the grand scheme of construction spending, which is $1.6 trillion (annualized) for July 2025. In other words, data centers represent just 2.5% of construction spending.”

The uptick in construction steel and architectural metal products may be supporting some flatbed demand, Miller said, though he doesn’t see signs of a “robust market” from DAT’s linehaul spot rate for flatbed.

There has also been strong growth in both domestic production and imports of electric equipment that is needed to power these kinds of facilities, Miller said. Domestic output is up roughly 25% since 2017, while imports have risen 20% from 2023 and doubled since 2017.

“I strongly question how sustainable this investment activity can be, especially at the current rate,” Miller said.

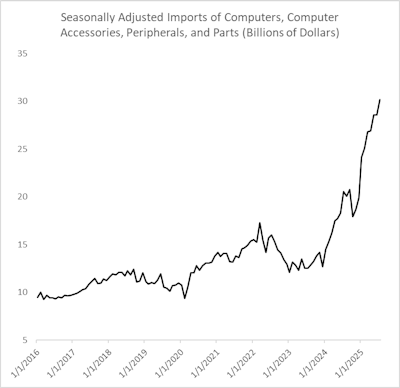

Imports of computers, accessories, peripherals, and components have skyrocketed 132% above 2023 levels.

“Such growth doesn’t seem sustainable,” he concluded.