Historically, driver turnover rates have aligned with freight market conditions. When freight rates and volumes are going up, turnover increases from drivers searching for better job opportunities. During a recession or periods of uncertainty, drivers tend to stay put.

True to form, in March 2020 driver turnover screeched to a halt when states issued lockdown orders attempting to slow the spread of COVID-19.

Stay Metrics (SM), which is now part of Tenstreet, tracks the retention rates of drivers on a monthly basis. The retention rate of drivers hired by carriers in March was higher than any month in 2019 or 2020.

SM tracks retention rates with an index, the Stay Days Table, that serves as a “survivor” chart that shows how long driver hires remained at their carriers using 7-day, 30-day, 60-day and 270-day milestones.

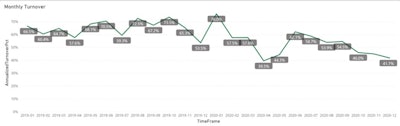

The company also tracks annualized monthly turnover using the same group of 30 carriers it selected based on their lengthy duration as clients and the quality of their data.

In April 2020, the monthly turnover rate fell precipitously when fears around the pandemic were at their height.

Overall, the 7-day milestone had five different months at or above 99% (including December) despite the fact that fleets significantly changed their process for onboarding drivers due to the pandemic. In 2019 the highest 7-day retention rate was 97.8%.

Stay Metrics data shows that driver turnover fell in 2020 despite a strong rebound in the freight market in the second half.

Stay Metrics data shows that driver turnover fell in 2020 despite a strong rebound in the freight market in the second half.

In 2019, monthly turnover rates fluctuated in a range of 20 points with a high of 73.5% and a low of 53.5%. In 2020 the range increased by more than 36 points, but followed a downward trend from 62.1% in June to 41.7% in December.

Bringing down turnover

Tri-State Motor Transit (TSMT), the largest carrier of the Roadmaster Group, downsized its fleet of owner operators slightly during 2020. This contributed to the company’s driver turnover rate in 2020 that was still below 40%. Most drivers across the industry stayed due to concerns about where freight was headed, said Michael Fisk, Roadmaster’s director of marketing, hiring, driver development and safety.

For TSMT, 2020 happened to be one of the company’s most profitable. It was also lucrative for drivers. About 13 percent of drivers in the fleet made over $100,000 and the top 64% averaged $78,000.

Tri-State Motor Transit created an annual bonus to aid with retention. On average, drivers are getting paid between $6,000 and $7,000 in a lump-sum bonus.

Tri-State Motor Transit created an annual bonus to aid with retention. On average, drivers are getting paid between $6,000 and $7,000 in a lump-sum bonus.

In 2021 the company is hiring more drivers than 2020. The fleet is currently at 450 trucks and 700 drivers with plans to grow it by 10 percent this year and beyond.

“The freight demand out there is just ridiculous,” said Fisk.

Industrywide, most driver turnover occurs in the first six months. Several years ago, Roadmaster started a guaranteed driver pay plan that helped to reduce early turnover and this year increased the minimum to $1,200 a week. With this pay change and other initiatives, turnover within the first 90 days has fallen to around 8 percent.

Turnover begins to increase at about the six-month mark and hits the highest point between 280 and 320 days. In 2019 the company started an annual bonus to help get drivers to the 12-month mark. The annual bonus is tied to drivers’ production. After 12 months, on average drivers are getting paid between $6,000 and $7,000 in a lump-sum bonus.

“For a lot of drivers this is almost life-changing money,” he said.

The annual bonus has been helpful to get drivers to stay beyond “emotional triggers” that happen when they are upset with a dispatcher, home time or other problems that can be corrected.

“If we can get drivers past that, we can normally figure out what the root of the problem is,” said Fisk who notes that money is not always the solution for retention. “If you don’t have the culture, management, and willpower to execute it doesn’t do you any good.”

Driver gamification strategy

Roadmaster is working on another initiative to retain drivers by making them feel more connected, empowered, respected and valued on a daily basis. The company plans to develop new features in its mobile driver app that will gamify the driving experience by using performance data tied to rewards.

“There is going to be a lot of self-improvement,” he said. “The key to the driver mobile app is that three to 10 times a day we want the mobile app to reward points anytime the driver does something good.”

Fisk said Roadmaster plans to develop a system that awards points to drivers for improving efficiency, safety, on-time percentage and other measurement categories. The mobile app will have a “cha-ching” sound each time drivers accumulate points. Drivers will be able to redeem their points on a wide variety of items in a marketplace of the future rewards platform.