The seismic disruption to freight markets caused by the COVID-19 pandemic in the second quarter of 2020 created a hole that the fleets making up the 2021 CCJ Top 250 would spend most of the year climbing out of. By the end of the year, however, fleets were able to recoup most of their revenue losses, thanks in part to federal stimulus packages and the reopening state economies.

Excluding package behemoths FedEx and UPS, revenues fell 2.1% in 2020 among the 2021 CCJ Top 250 fleets that self-reported or publicly provided revenue information in consecutive years. While the impact of the initial COVID-19 shutdown and subsequent stay-at-home orders was felt across the entire trucking industry, the worst of the economic crisis wasn’t shared equally across all market segments.

SEE the 2021 CCJ Top 250 here.

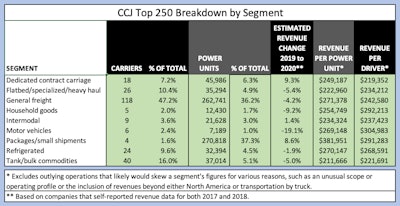

Six of the nine operating segments of the 2021 CCJ Top 250 turned in revenue losses, led by fleets in the motor vehicles group. The combination of manufacturing supply chain disruptions, plant shutdowns and a 14.7% drop in light vehicle sales in 2020 netted the six car and truck haulers in this group a combined 19.1% revenue loss year-over-year. The new light vehicle sales market has rebounded well in the first half of 2021 with a 29.3% increase, according to the National Automobile Dealers Association. Although depleted inventories offer hope for the remainder of the year, a prolonged microchip shortage threatens to eat away at freight volume for the segment.

COVID-19 also caused wild volatility in the U.S. housing industry. Although new and existing home sales cratered in March and April 2020, the new and existing housing sales market ended the year riding a three-month wave of near-record highs. Despite those late-year gains, the five carriers in the 2021 CCJ Top 250’s household goods segment sustained a 9.2% revenue loss in 2020.

Other segment revenue losers in 2020 include the flatbed/specialized/heavy haul segment (-5.4%), tank/bulk commodities (-5.0%) and general freight (-4.2%). Fleets in the refrigerated segment managed to net just a 1.9% revenue decline.

On the positive side of the line, the intermodal segment turned in a 1.4% revenue increase year-over-year in 2020, followed by strong gains by the packages/small shipments segment (8.6%). The dedicated contract carriage segment led all groups with a 9.3% revenue gain in 2020.

Also of note, there is a new No. 1 in this year’s CCJ Top 250 ranking for the first time in recent memory, as FedEx (CCJ Top 250, No. 1) has dethroned rival UPS (No. 2). In January 2021, UPS sold its less-than-truckload and truckload business, UPS Freight, to TFI International (No. 7). The $800 million deal resulted in FedEx grabbing the lead in both the driver and power unit rankings. While UPS still leads FedEx in North American transportation-related revenues, the selloff gives FedEx the edge in the driver and power unit counts, two of the three components that make up CCJ’s blended ranking methodology.

Doors open for acquisitions

Despite the continued market uncertainty since the CCJ Top 250 ranking was published in August 2020, there were no notable bankruptcies in the last year. There are, however, several major acquisitions involving CCJ Top 250 fleets are worth noting.

Aside from the UPS Freight selloff to TFI International, perhaps the biggest shakeup was Knight-Swift’s (No. 4) $1.35 billion acquisition of Dothan, Alabama-based AAA Cooper Transportation (formerly No. 49) earlier this summer. The move gives the Phoenix-based truckload giant a major presence in the LTL space, particularly in the Southeast and Midwest markets.

In the dedicated contract carriage segment, Penske Logistics moves from No. 19 to No. 12 with the acquisition of Chicago-based Black Horse Carriers (formerly No. 53). The late 2020 addition expands Penske’s dedicated capacity by roughly 2,000 power units and 3,000 drivers. Although terms weren’t disclosed, Black Horse self-reported $561 million in 2019 revenues for last year’s ranking.

10 Roads Express, which incorporated Eagle Express Lines (formerly No. 65), rocketed up the list to No. 28 with the acquisition of The Salmon Companies (formerly No. 72), a mail hauler with 1,500 power units and nearly 2500 drivers.

Want to see the full 2021 CCJ Top 250 list? Click here.

Bennett Family of Companies moves from No. 57 to No. 44 with the acquisition of Broussard, Louisiana-based American Eagle Logistics (formerly No. 137). The move opens Bennett’s doors to more than a thousand customers in the oilfield service areas along the Gulf Coast.

Foodliner/Quest Liner (No. 76) jumps 11 spots after its parent company McGoy Group closed an acquisition earlier this summer of W.W. Transport (formerly No. 190). The Burlington, Iowa-based carrier provides the fleet parent with an additional 500 trucks and roughly 450 drivers.

In the refrigerated segment, Hirschbach Motor Lines (No. 61) acquired Lessors Inc. (formerly No. 237), an Eagan, Minnesota-based carrier with roughly 300 power units. The deal will increase Hirschbach’s driver base from 2,200 to 2,400.

The 2021 CCJ Top 250 ranking is comprised from a large data set used to calculate the annual list, including revenues and counts on power units, trailers, drivers and other company information.

You can view the detailed information at CCJTop250.com and sort by primary segment type to get a closer look at a carrier’s performance relative to its peers. You also can view carriers by rank in several other categories.