Goaded by tightening emissions regulations, but stoked by rising labor costs and other factors, ACT Research forecasts medium- and heavy-duty vehicle costs will rise by between 12% and 14% as the EPA’s Clean Trucks regulation goes live in 2027.

"As such, we believe the OEMs will be at least partially successful in convincing customers to begin EPA’27 pre-buying in 2024," said Kenny Vieth, ACT’s President and Senior Analyst. “Starting pre-buying earlier should help moderate runaway demand into 2026, but risks prolonging the freight cycle downturn.”

The firm believes that “it’s different this time” as factors like ongoing pent-up vocational truck demand, strong tractor demand in Mexico, and labor hoarding, are at work in 2024 that will help support a fundamentally weak U.S. tractor market.

“Within the broader Class 8 and trailer markets, U.S. Class 8 tractors and van trailers bore the brunt of the markdowns as freight metrics have failed to gain traction,” Vieth said. "Less money in carriers’ pockets and lower industry build rates in 2024 also push down on 2025 and, to a lesser extent, 2026.”

If economic circumstances force the industry to materially cut production in 2024, thereby having to shed labor, Vieth said supply-chain integrity could be compromised.

"If layoffs do come to pass, it will be difficult for the industry to scale rapidly in 2025 and 2026 when U.S. and Canadian truckers and dealers will want all the equipment the industry can build," he said.

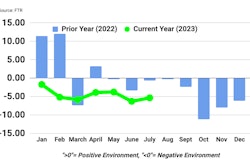

FTR reported preliminary Class 8 orders for September at 31,200 units, up 94% versus August but down 45% year-over-year. Both the month-over-month increase and the year-over-year decrease were expected given that build slots have opened for production next year and that the market continues to normalize after last year’s exceptional order volumes. Total Class 8 orders for the previous 12 months have equaled 270,000 units.

“Build slots have opened for 2024 production, and fleets are placing orders at a solid pace. Although a large increase in September was expected due to available build slots, it is still a positive indicator for the industry," said Eric Starks, FTR chairman of the board. "We saw increases across the board versus August – another indication that this is a broad-based gain for the market. Despite the weakness in the overall freight market, fleets continue to be willing to order new equipment. We did not anticipate matching the level of orders that we saw this time last year, but increasing orders confirm our expectations of replacement demand in 2024.”

Vieth noted that between reports of falling carrier income and margins, still sloshy load-to-truck ratios, weak spot rates reported by DAT, and a sense over the past six weeks that the U.S. economy’s year-to-date outperformance was starting to lose some momentum, "we were unsure how the market would respond when the 2024 order boards officially opened. One thing we did know was that nearly all the August-ending Class 8 backlog was scheduled for build in 2023, so strong orders are imperative for the industry to maintain current strong production rates very far into 2024.”