It’s safe to say that the vast majority of trucking industry professionals won’t be sad to put 2023 in the rearview mirror. The last year has been filled with slowdowns and roadblocks, from driver retention to combating rising costs in all areas of the business. For example, truckers have expressed that the U.S. economy tops trucking industry’s list of challenges including rates. While drivers wait for rates to stabilize, independent and small trucking owner-operators are at risk of falling behind. Managing their operational expenses in an environment where rates are lower and where rising prices for fuel, equipment and other essentials isn’t just a challenge, for some it’s an existential threat.

So, what does that mean for the trucking industry in 2024? Will the rough road continue or are there reasons for optimism that things will improve? What specifically can independent truckers do to apply lessons learned from 2023 into the future, and what factors will define the contours of the industry landscape moving forward?

Slowdowns and roadblocks

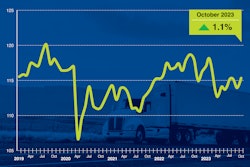

What went wrong in 2023? The true difficulty is that there is no single answer to this question. The last year was a case study in how a constellation of different factors can work together to make for a uniquely difficult environment—especially for small and mid-sized independent operators. It’s not just that rates plummeted, but truckers also had to navigate sustained higher fuel prices and an economic environment that included both high interest rates and inflationary pressures that affect not only new vehicle acquisition, but the cost of repairs, mechanical services, replacement parts, and other essentials. The cost of vehicles is 30-50% more than just a few short years ago and carrying that financing burden is no small challenge. While the supply chain is still somewhat dysfunctional, almost all of the COVID disruption has resolved. Pressure is largely coming from structural economic issues, not logistical problems. The bigger issue is less freight in the pipeline, combined with excess inventory at many large chains helping to drive down rates.

In the current environment, larger companies that can buy in volume and write their own insurance policies have an advantage. Small and mid-sized independent operators face a tougher road ahead. Approximately 80% of the market is 5 trucks or less – and more than a few of those operators have closed their doors or gone out of business permanently.

Bright spots ahead?

While the average trucker would be hard-pressed to find a bright spot in the past year, the silver lining is that pressure makes diamonds, and those operators who are still on the road are, by definition, the ones who have learned how to optimize efficiency and run their company successfully. Some of the speculators and industry newcomers who saw the opportunity to make a quick buck a few years ago have dropped out, contributing to a supply-and-demand shift. As truck counts drop, rates should increase organically, even without outside economic factors.

The good news is that almost all these trends are cyclical and virtually all analysts and observers see signs for economic optimism as early as the second quarter of 2024. Inventory trends could indicate a rise in demand after the holiday season depletes excess inventory. And regardless of your political affiliation, the fact that 2024 is an election year could work in the industry’s favor. Voices tend to be listened to in election years and political steps to help out may become more likely—whether that’s regulatory reform or economic measures designed to provide industry-specific stimulus. While it would be unwise to make specific predictions in that regard, it’s a definite possibility. .

Positioning for prosperity

While better economic times are likely ahead, every owner and operator should be looking back to move forward. Thriving in 2024 will mean not repeating past mistakes and sticking to best practices like understanding costs, keeping a cash reserve, keeping bills paid, and not settling on rates. The cost per mile for truckers that are running their trucks is so important—and understanding the impact of every decision industry professionals make on their rate per mile is critical. Even some experienced operators can benefit from examining that with nuance and precision.

Some operators might be wise to reduce their fleets and replace expensive units with cost-effective used alternatives or new units they can access at more competitive rates. Getting costs down with the right trucks and the right fleet in place and managing capital effectively will be essential. Financing rates are around 9-10% in a best-case scenario—and can be significantly and even dramatically worse for some.

One of the best ways to reduce costs is to identify a full-service partner with the technical infrastructure to get you paid quicker, a brokerage operation to get you higher paying loads, and help reduce operating expenses on the factoring side. Ideally, your provider will also supply insurance partners to get you faster and more favorable rates. The best partners work with teams and suppliers across a whole spectrum of opportunities to find modest savings for truckers in a whole host of places. While there is no magic formula, those savings can add up to significant and even game-changing totals, keeping you on the road and in the black as we head toward what will hopefully be a prosperous 2024 and beyond.