The economic volatility that's plagued practically every sector of the U.S. for the past three-plus years is not only a lingering concern for motor carriers, it's the top concern according to American Transportation Research Institute (ATRI) 19th annual Top Industry Issues report. The updated report was released Saturday at the American Trucking Associations Management Conference and Exhibition in Austin, Texas.

While "the economy" is a fairly straightforward concern, ATA Chairman Dan Van Alstine, Ruan Transportation Management Systems President and COO, said it is comprised of many components. "Costs were up and demand was down, all while we worked to navigate a number of workforce and regulatory issues," he said.

More than 4,000 trucking industry stakeholders participated in this year’s survey, including motor carriers, truck drivers, industry suppliers, driver trainers and law enforcement, among other groups.

The list also included of many familiar trucking themes: truck parking, fuel prices, driver shortage, driver compensation and, for the first time, zero-emission vehicles.

The state of the U.S. economy was the number one concern, but the lack of available truck parking reached its highest rank to date on the overall list, coming in second – up one spot from last year. The lack of available truck parking first appeared as a Top 10 overall concern in 2012 and has been a top-five issue since 2015.

ATRI’s 2023 Operational Costs of Trucking found year-over-year increases in the fuel cost per mile of 53.7%, with fuel representing 28% of the total operating costs – the highest since 2014. Despite that spike to the bottom line, fuel prices dropped two spots as a concern this year to third-place on the overall ranking.

Rounding out the top five this year were the driver shortage (down two spots from last year) and driver compensation.

The driver shortage, as an overall concern, dropped on the list for the second consecutive year, goaded somewhat by prolonged suppressed freight volume and rates, said ATRI President and Chief Operating Officer Rebecca Brewster. The last time the driver shortage saw a similar drop in ranking in ATRI's query was in 2008-2009 during the Great Recession when it reached its lowest point (No. 6). The estimates for the driver shortage this year were down from previous years, with an estimated 64,000 drivers needed.

Aggressive mandates and tight low- or zero-emission timelines put that issue on the top 10 list for the first time. Zero-emission vehicles ranked 10th overall and seventh among motor carrier respondents.

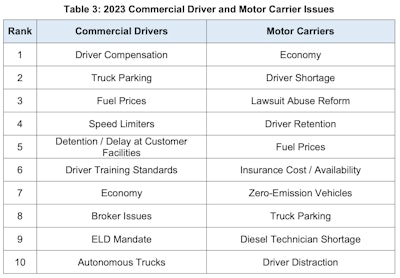

Among driver respondents, driver compensation, truck parking and fuel prices were the top three concerns, while motor carriers ranked the economy, driver shortage and lawsuit abuse/tort reform as their top three concerns. Lawsuit abuse/tort reform is one of three issues, along with fuel costs and driver shortage, that were ranked as Top 10 concerns in the inaugural Top Industry Issues Survey in 2005 and remain today. The need for lawsuit abuse/tort reform is closely tied to another top industry concern, insurance cost/availability (No. 6 by motor carriers), Brewster noted.

Driver distraction (No. 7) returned to the top 10 list for the first time since 2018. Driver distraction first appeared in the Top 10 list in 2014 at No. 10. It climbed to a peak of No. 7 overall in 2018 and then did not make the Top 10 list again until this year.

Driver retention dropped another spot this year to No. 8 overall, likely, Brewster said, another casualty of a softer freight market that started in late 2022. Even among motor carrier respondents, driver retention dropped two spots this year to their number four concern.

Detention/delay at customer facilities experienced the largest drop in ranking among Top 10 issues this year, down to No. 9 overall from number six in 2022.