Trucking news and briefs for Thursday, Dec. 21, 2023:

Truck tonnage dipped in November

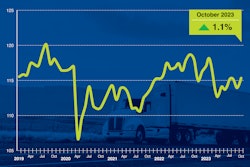

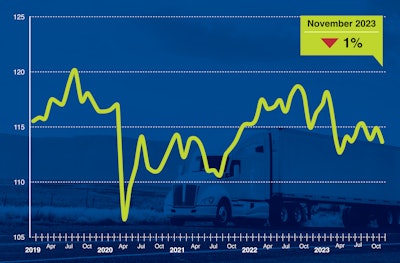

ATA's Truck Tonnage Index saw a 1% decline in November after a 0.8% increase in October, continuing the year's up-and-down trend.ATA

ATA's Truck Tonnage Index saw a 1% decline in November after a 0.8% increase in October, continuing the year's up-and-down trend.ATA

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1% in November after increasing 0.8% in October. In November, the index equaled 113.7 (2015=100) compared with 114.9 in October.

ATA Chief Economist Bob Costello said November was more of what’s been seen throughout 2023 with an up-and-down market.

“We continued to see a choppy 2023 for truck tonnage into November,” Costello said. “It seems like every time freight improves, it takes a step back the following month. While year-over-year comparisons are improving, unfortunately, the freight market remains in a recession. Looking ahead, with retail inventories falling, we should see less of a headwind for retail freight, but I’m also not expecting a surge in freight levels in the coming months.”

Compared with November 2022, the SA index fell 1.2%, which was the ninth straight year-over-year decrease. In October, the index was down 2.4% from a year earlier.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 113.2 in November, 5.1% below the October level (119.3). In calculating the index, 100 represents 2015. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

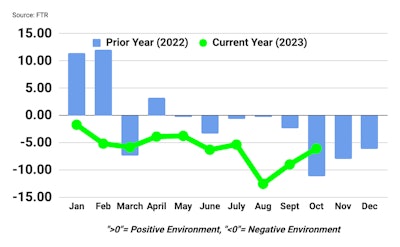

FTR noted market improvement for carriers in October

FTR’s Trucking Conditions Index in October improved to a reading of -6.07 from -8.97 in September, primarily due to falling diesel prices.

FTR's Trucking Conditions Index improved for the second consecutive month in October, mostly due to falling diesel prices.FTR

FTR's Trucking Conditions Index improved for the second consecutive month in October, mostly due to falling diesel prices.FTR

“The decline in diesel prices represented the only positive contribution to October’s TCI, although rates and cost of capital were less negative factors than they had been in September,” said Avery Vise, FTR’s vice president of trucking. “As we have discussed frequently, the combination of stagnant freight volume and surprisingly resilient capacity is thwarting a near-term turnaround for the truckload sector. Our analysis suggests that market conditions for carriers will not start to recover until the second half of 2024 absent an acceleration in the current rate of capacity loss.”

Lily Transportation collects Toys for Tots

Loading up the Toys for Tots donations at Lily Transportation's Needham, Massachusetts, corporate office are company employees, from left to right, Connor Dacey; Program Coordinator Valerie St. John; Sofia Morabito; and Brandon Holbrook.Lily Transportation

Loading up the Toys for Tots donations at Lily Transportation's Needham, Massachusetts, corporate office are company employees, from left to right, Connor Dacey; Program Coordinator Valerie St. John; Sofia Morabito; and Brandon Holbrook.Lily Transportation

More than 2,500 toys collected by Lily Transportation locations over the last three months for the U.S. Marine Corps Reserve Toys for Tots Program were recently delivered to local Toys for Tots centers throughout the country for distribution during the holidays to less fortunate children in the community.

Valerie St. John, Director of Compliance & Driver Retention who coordinated the effort for Lily, said this is the fifth year the company has brought the joy of Christmas to children, collecting more than 10,000 new unwrapped toys for the local Marine Toys for Tots.