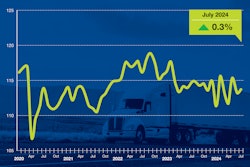

Trailer net orders increased 26% month-over-month to 5,961 units in July but were down 38% year-over-year, according to FTR Transportation Intelligence. Despite the sequential gain, July 2024’s net order total was the fourth lowest in the past four years. Cancellations as a percentage of total gross orders remained above 30% for the third consecutive month.

Though some trailer segments experienced monthly improvements in net orders, FTR noted that the challenging truck freight environment continues to subdue trailer demand. Total trailer build decreased by 10% month-over-month and 26% year-over-year in July, totaling an output of 18,203 units. The data is 19% lower than the average July build level over the past five years.

With net orders coming in below production levels, July backlogs decreased by 13,219 units, finishing just above 100,000 units. The slightly larger month-over-month decrease in backlogs compared to production caused the backlog-to-build ratio to dip to 5.5 months, the second-lowest level since July 2020 and about four-tenths of a month below pre-2020 historical average. This current ratio suggests only a limited incentive for manufacturers to further slow production, FTR said.

ACT Research reported that preliminary net trailer orders had an uptick of about 1,000 units from June to July. However, at 7,200 units, it was still lower compared to last July, down 37% year-over-year.

“This month’s data brings YTD 2024 U.S. trailer net orders to just under 82,000 units, a 26% contraction when compared to the first seven months of 2023,” said Jennifer McNealy, director CV Market Research & Publications at ACT Research.

While there was a sequential improvement in orders, McNealy said the July data continues to reflect ACT’s expectations of weaker demand. This is due to the high order activity in recent years, ongoing weak fundamentals in the for-hire truck market and dealer inventories that are already well-stocked.

FTR believes that some fleets may be prioritizing spending on new power units instead of new trailer equipment, possibly due to lower profitability or changes in trade cycles, said Dan Moyer, senior analyst, commercial vehicles at FTR.

Moyer noted that the upcoming opening of 2025 order books and a potential recovery in truck freight could improve market conditions, though this remains uncertain. A recent FTR survey showed that while dealer trailer inventories were lower in Q2 2024 compared to the previous year, they are still significantly above optimal levels. Given these factors, OEMs need to approach production planning with caution and precision.

McNealy noted that the industry is in the “weakest months of the annual cycle,” which means there’s little reason to expect stronger orders until the fall when the OEMs begin accepting orders for 2025.

ACT anticipates that fleets will begin to see improved profitability later this year, boosting their capacity to invest in new equipment. However, the recovery is from a very low point, with carrier profits in the first half of 2024 at their lowest levels since early 2010.

Looking at 2025, McNealy said that the trailer industry faces additional pressure from regulatory changes, as ACT anticipates fleets to prioritize purchasing new power units in preparation for the EPA’s 2027 regulations.

[RELATED: Fleets should plan for an emissions pre-buy, experts say, and it may be too late for some]

McNealy also mentioned that industry anecdotes suggest that the ‘pause button’ is likely to stay engaged for the rest of 2024, even though dealers are gradually adjusting inventory levels. Nevertheless, cancellations are still high, thereby raising concerns among trailer makers about how long demand will remain weak and whether the supply chain will be ready to meet demand when it rebounds.