The U.S. Class 8 market remains divided, according to ACT Research’s North American Commercial Vehicle Outlook. Ongoing overcapacity is causing historically weak conditions for for-hire tractors, while demand for vocational equipment is bolstered by stimulus and industrial policies.

ACT Research

ACT Research

Kenny Vieth, ACT’s president and senior analyst, noted that on one side of the market, demand for vocational equipment continues to benefit from long-term trends and government stimulus programs. The clean energy transition and advances in AI are driving investment in utility infrastructure, while government initiatives such as the CHIPS Act and the Bipartisan Infrastructure Law are fueling public infrastructure and reshoring projects.

He emphasized that many of these government programs are still in the early phases of grant distribution, meaning their positive impact on construction-related vocational equipment will likely be sustained over the long term.

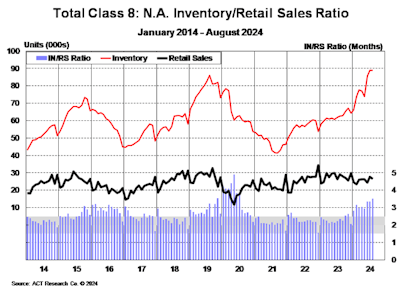

At the same time, Vieth noted that the U.S. and Canadian tractor markets are currently oversupplied with freight rates having seen only modest increases over the past year.

[RELATED: The economy is again trucking's top concern, driver shortage continues to fall]

“The result has been for-hire carrier profitability at the lowest levels since the global financial crisis,” he said. “For tractors, neither the current worst-in-15-years depression in for-hire carrier financial conditions nor the private fleet spending of the past couple years support strength into 2025, especially early.”

ACT also anticipates fuller dealer inventories going into 2025, which could further limit demand in the near term.

Used trends beats expectations

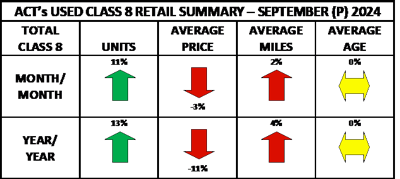

Meanwhile, although August’s preliminary Class 8 same dealer used-truck retail sales volumes dipped in expectations, September delivered an unexpected upside with an 11% month-over-month increase, according to ACT Research.

ACT Research

ACT Research

Underlying fundamentals have remained largely unchanged since August, said Steve Tam, vice president at ACT. Spot freight and freight rates are still high, but improving interest rates appear to have been sufficient to attract truck rates.

Tam added, “Seasonality called for an increase of about 2% month-over-month. Preliminary auction activity declined from August (-60%), as did wholesale transactions (-18%). Altogether, sales fell 9.4% from August.”