Despite the occurrence of a hurricane, which would typically disrupt freight operations and potentially push up demand, rates are still lower compared to the same period last year, said FTR Transportation Intelligence VP of trucking Avery Vise said in a webinar last week.

“Even with the additional effect, we’re still likely not in a particularly strong environment,” Vise said. “And of course, those effects, likely would dissipate, at least until we get to the holiday impact right before Thanksgiving and Black Friday, and so on."

Dry van has been in a soft environment relative to prior years for quite a while, said Vise. Though it’s up come up in the last couple of weeks, Hurricane Helene has affected the data. Refrigerated was a little bit stronger, compared to a year ago, while flatbed has been a lot stronger relative to last year. It also saw the largest single-week increase in flatbed the weeks of September 29 through October 14, which DAT also reported, following the Hurricane Helene cleanup efforts.

[RELATED: Helene cleanup led to higher demand for flatbed capacity, DAT reports]

A positive factor for carriers, Vise pointed out, is that recently, diesel prices have been lower compared to last year. As a result, there’s been significant year-over-year increases in all three major spot rate metrics, if you exclude the fuel surcharge from the calculations.

FTR

FTR

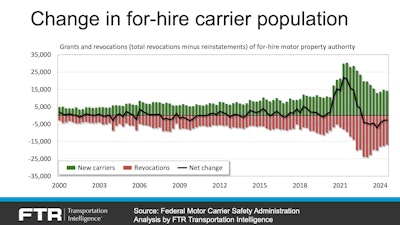

Vise said that there’s been a stabilizing environment in terms of the network carriers exiting the market, with a large carrier base that wasn’t present before the pandemic. Looking at data on the Federal Motor Carrier Safety Administration, Vise said there’s been an almost 14% increase of carriers to where it was in March 2020.

Consumer outlook

Looking at the consumer economy, Vise said that inflation continues to be fairly mild. Though there’s been little change in the services sector, services are still elevated and at a point higher than before. Meanwhile, Vise said that goods have come down in terms of pricing. “It’s not exactly like prices are plummeting, but to a large degree, inflation on the goods side, is not much of an issue.”

With that in mind, Vise noted there’s a disconnect between total retail sales and inflation adjusted retail sales, where the former was rising sharply in 2021-2022. Over the last year, they have been more aligned, with FTR seeing more growth in retail trade sales.

Overall, consumer spending, is slightly above trend, in both services and goods, said Vise. “We’re doing that because services spending has continued to sort of move higher, whereas goods spending has sort of flattened out.”

Vise pointed out the steady rise in the spending on software and accessories category, which had an increase at the beginning of the pandemic and had flagged down a bit but continues to still go up. He said, “logically, this is not a category that creates any freight at all, maybe a low-density type of freight. So, when we look at the spending on durable goods, we have to take into account, how does that really translate into freight?”

FTR

FTR

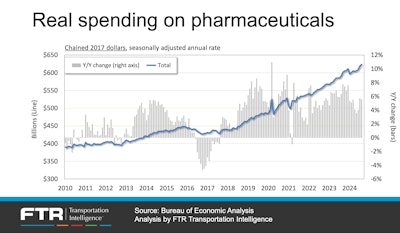

Another aspect that FTR sees steadily increasing is real spending on pharmaceuticals, going back well before the pandemic. “We’re up about 40% in spending on pharmaceuticals since 2019,” said Vise.

Pharmaceuticals is a large import category that is mostly imported by air freight. On the freight demand side, Vise noted that pharmaceuticals tend to be high value and thereby not stimulating freight demand in the system. “That’s one reason why we point out many times that the industrial side creates a lot more freight than the consumer side does,” he said.

The personal saving rate is also concerning on the consumer side. Vise pointed out that it was below where it typically was before the pandemic, indicating that consumers are likely spending more. “In fact, they are spending more as a percentage of their disposable income, and that would imply that they might be able to continue to do so,” he said.