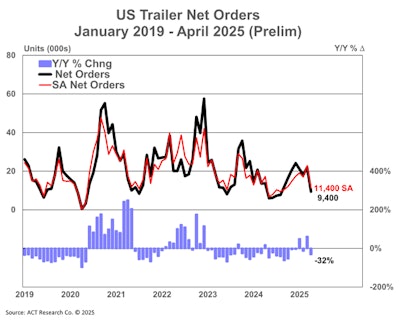

U.S. trailer net orders faced significant pressure last month, including volatile tariffs, uncertainty in the economy and the truck freight market. As a result, according to FTR Transportation Intelligence, net orders dropped sharply to 10,699 units, down 50% month-over-month and down 23% year-over-year, but still far exceeding typical seasonal patterns.

Despite the downturn, trailer orders outpaced Class 8 net orders for the third consecutive month. Year-to-date trailer net orders for 2025 reached 76,901 units – a 27% increase over the same period last year.

Dan Moyer, senior analyst of commercial vehicles at FTR, stated that U.S. tariffs and lingering potential retaliatory measures could drive up costs for imported materials, straining OEMs and suppliers through higher production costs, tighter margins, and potentially weaker demand.

“Some fleets may delay new trailer purchases – reflected in the sharp decline in April net orders – and extend equipment lifecycles, boosting aftermarket activity,” said Moyer.

Moyer added rising costs could spur consolidation and shift sourcing strategies toward domestic suppliers, and companies that adapt to supply chain disruptions and pricing pressures may gain a competitive edge.

[RELATED: Tariff plans could disrupt truck production and pre-buying activity]

ACT Research’s preliminary data echoed similar sentiments.

Jennifer McNealy, director of CV market research and publications at ACT Research, said after a surprising uptick in March, lower April net order intake was anticipated as it’s historically a weaker month for orders. However, the sharper year-over-year decline is concerning given the state of industry backlogs.

FTR’s data indicated that total trailer production in April decreased 1% month-over-month and fell 26% year-over-year to 17,619 units. for the year, 2026 YTD trailer build down 30% year-over-year at 63,756 units, averaging 15,939 per month. With net orders falling well short of production, trailer backlogs declined by 6,562 units (-5% month-over-month, -19% year-over-year) to 120,350 units. The larger decline in backlogs versus build lowered the backlog-to-build ratio to 6.9 months.

McNealy pointed to several headwinds: weak for-hire truck market fundamentals, low used equipment values, elevated inventory levels, high interest rates, and ongoing policy uncertainty. With those in mind, ACT projects “subdued build and order intake levels during 2025 remain intact," she said.

“While speculative, what we thought may have happened in March was a pull-forward of orders in advance of possible tariff-related cost increases to come. While good news for last month, pull-forward, if that is the case, means orders placed will not need to be placed at a later date, and may be a contributing factor to the greater-than-expected drop in April,” McNealy said.