Here's what you should know:

- Demand is strong for late-model, low-mileage units, pushing prices higher.

- The market is stabilizing, but tariffs and regulations remain key factors.

There’s been sharp year-over-year inventory declines across both used trucks and trailers, particularly in sleeper trucks and reefer trailers in April, according to a report from Sandhills Global.

The report noted that the used heavy-duty market showed mixed signals. Inventory levels remained largely flat on a month-over-month basis, increasing 3.75%, yet showed a steep -23.05% year-over-year decline. Notably, used sleeper trucks had the most significant changes, with the highest month-over-month inventory increase at 4.07%, but also the sharpest year-over-year drop at -39.01%, signaling a rapid shift in supply dynamics.

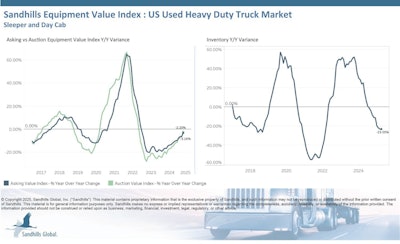

Asking values were relatively stable in the used heavy-duty segment, increasing slight at 0.2% month-over-month but down -3.16% year-over-year. Used day cabs were the weakest performers, experiencing both the largest month-over-month decrease in asking values (-2.2%) and the steepest year-over-year decline at -4.55%. Meanwhile, auction values were similarly steady, up 1.57% month-over-month but down -2.2% year-over-year. Used sleeper trucks saw a notable month-over-month auction value increase at 5.29%, while the used day cabs experienced a year-over-year auction value decline of -8.24%.

“New truck sales have been stagnant, with pre-buy behavior moving from 2025 to 2026,” said Truck Paper manager Scott Lubischer. “OEMs recognize this, and they have been cutting back production. Given the uncertainty clouding the global economy, many buyers are stalling, but inventory levels are stable, and deals are still being made."

Trailer market

The used semi-trailer market showed slightly more stability. Inventory levels rose by 1.03% month-over-month but dropped -13.39% year-over-year. Reefer trailers stood out, indicating the largest month-over-month inventory increase at 4.37%, but also the most substantial year-over-year decrease at -18.61%, highlighting a sharp turnaround in supply levels.

Asking values in the used semi-trailer market trended upward at 1.14% month-over-month but decreased -4.9% year-over-year. Reefer trailers again were distinct, having the largest month-over-month increase in asking values at 2.98%, but also the greatest year-over-year decline at -5.81%. Auction values showed growth, increasing 1.4% month-over-month and 0.54% year-over-year. Used drop deck trailers led the month-over-month auction value gains at 2.87%, whereas reefer trailers experienced the steepest year-over-year auction value decrease at -6.46%.

[RELATED: Strong demand drives up used truck prices and volumes]

What's driving buyer decisions in the used market?

Buyers competed for limited supply in the used truck market as fewer trucks were available in April, but prices rose anyway, especially for newer trucks with low mileage, according to J.D. Power’s May guidelines market report.

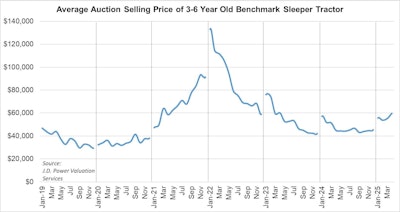

"If you were bidding for sleeper tractors at auctions in April, you probably noticed fewer trucks available. And if you were looking for trucks with low mileage, so was everyone else judging by hammer prices for those trucks," said Chris Visser, J.D. Power director of specialty vehicles. "Overall, supply was tighter, and pricing was higher, as end users traded out of their older trucks to take advantage of what could be the last of pre-tariff, pull-ahead freight activity.”

In March, auction volume and pricing used Class 8 trucks started off strong, but in April the number of trucks sold dropped while prices kept rising.

When looking at late-model sleeper tractors, J.D. Power's average pricing indicated that 2023 models jumped the most in price, up over 20.5%, while 2022, 2020 and 2019 saw smaller increases (from 0.5% to 5.9%). Only 2021 models (-6.7%) dropped in price.

At auctions in April, selling prices for the 4- to 6-year-old trucks sold for 1.3% more than in March and were 30.3% more expensive than they were in April 2024. Compared to pre-pandemic pricing in 2018, they are 19.4% higher in dollar terms, but -6% lower when adjusted for inflation.

Trucks with less than 300,000 miles sold for especially high prices, J.D. Power reported, showing that buyers want lightly used trucks. The demand for newer, low-mileage trucks likely drove the price jump for 2023 models.

CCJ parent company Fusable’s used commercial truck report for April also noted similar sentiments. Rusty Freeman, senior product manager for Price Digests and Central Analysis Bureau in Fusable’s Risk Intelligence division, said that the market is recently showing signs of normalization after years of high volatility.

In April 2025, the used commercial truck market saw widespread price increases across nearly all segments, breaking away from usual spring patterns, according to Price Digests analysts. While certain subtypes posted particularly strong month-over-month gains, most of the market saw consistent moderate upward movement in value. Model year 2021 units led at +12.8%, followed by 2022 (+9.4%) and 2023 (+9.0%), reflecting an ongoing demand for newer used trucks as new truck production remains constrained.

However, on a year-over-year basis, all model years still registered declines, with 2022 experiencing the steepest drop at -15.2%. In contrast, the newest models (2023 and 2024) held their value better, which analysts said underscores a clear buyer preference for late-model, low-mileage trucks.

Strategic fleet behavior is shaping demand, as buyers increasingly prioritize newer, lower-mileage and specialized vehicles, Freeman said. Price Digests’ data indicated that 2024 models and certain subtypes (such as paratransit vans and cabover tractors) saw modest year-over-year gains or stability, reflecting ongoing demand for late-model, purpose-built inventory.

Tariff uncertainty remains a wildcard

J.D. Power noted that the temporary rollback of tariffs on Chinese imports may help counter the recent slump. However, a 90-day trade truce between the U.S. and China doesn’t offer certainty for longer-term planning, keeping new truck buyers cautious.

Despite uncertainty, aging trucks still need replacement, Visser said, and this is driving improved conditions at auctions and dealerships, especially for low-mileage trucks that serve as viable new truck alternatives.

Looking ahead, Freeman said Price Digests anticipates continued normalization as inventories and new production levels return to historical norms. Demand will likely remain strongest for late-model equipment, especially as fleets seek to modernize and comply with regulations.

Freeman added that any developments around tariffs or regulatory policies will be key factors to monitor, as they could shift buyer interest between new and used markets and affect price trends.