Here's what you need to know:

- Tariff uncertainty are prompting businesses to make short-term decisions, which analysts warn could hinder sustained economic growth.

- Anticipation of higher tariffs led to surges in imports, trucking demand, and equipment investments in Q1 2025.

- Analysts project inflation to spike and unemployment to rise above 5% by 2026, warning that continued policy volatility could trigger a negative economic spiral.

Analysts warn that the whiplash from the administration’s back-and-forth on tariff policy is causing businesses to make significant responses to the environment with short-term decisions, losing out on long-term growth.

“We’re kind of in this fog of war,” said Jonathan Starks, CEO of FTR Transportation Intelligence, during its State of Freight webinar on Thursday. “There’s also a lot of fear out there, and that creates a bit of a crippling environment when it comes to making decisions.”

Bill Witte, chief forecaster at Witte Econometrics, said the situation is so unprecedented that his forecasts require a trigger warning as it paints a bleak outlook.

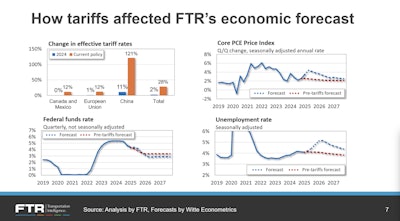

Avery Vise, VP of trucking at FTR, said FTR estimated U.S. tariff rate from 2% to 21% globally, driven by a 121% increase in tariffs on China. Canada, Mexico and the European Union saw a 12% rise.

“It seems inescapable that we’ll have some degree of inflation,” Avery said. FTR projects that the core inflation would surge sharply around 4%, before easing gradually.

Vise said FTR assumes that the Federal will cut rates to two this year, though they’re uncertain.

Looking at unemployment rate, FTR estimates its rise due to economic stresses. Currently, it’s at 4.2%, with Avery noting that they expect it to rise above 5% by 2026 and have a gradual easing thereafter.

One big risk for the economy, Witte said, is if the job market gets worse than expected, it can cause a chain of reaction: workers may become more worried about job security, so they spend less money. That drop in spending can then slow the economy even more.

[RELATED: Tariff concerns drive April job gains in trucking and warehousing]

Pre-buy effect drive demand

The import environment has seen a drastic distortion, Avery said, as businesses pull forward inventory in anticipation of higher tariffs that will increase the price of imported goods.

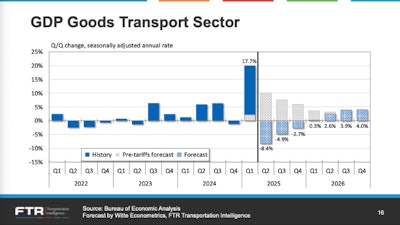

The spike in imports in Q1 dragged GDP down to -0.3%, Vise said. An effect of that is those goods still need to be transported by truck, which led to a 17.7% surge in GDP Goods Transport Sector, the strongest growth since the post-pandemic recovery from supply chain disruptions.

“That’s the beginning of the effect of the tariff situation,” Witte said. “You don’t have the effect of the tariffs themselves directly [yet]. What you have is the anticipation of the tariffs, which has produced a large increase in imports.”

However, shipments from China are already declining. TD Cowen analysts reported that ocean freight data from Asia to the U.S. have plummeted, with volumes down 40% on the West Coast and 12% on the East Coast. The firm noted that customers are taking a cautious approach.

This has prompted FTR to project a downturn for the GDP Goods Transport Sector: down 8.4% in Q2, -4.9% in Q3, and continuing in negative territory through year-end.

In the automobile market, vehicle sales are expected to decline, following a surge in purchases of cars and light trucks, which reached their highest non-COVID levels since 2017.

“Auto production is not keeping up with sales,” Avery said, “So, it does raise some question because that’s almost certainly going to come down again [next quarter], and the question is, how are automakers going to respond to that?”

Vise said consumers likely rushed to buy ahead of anticipated price increases, and businesses ramped up equipment investments. In Q1, equipment investment saw a strong 23% quarter-over-quarter jump.

“This was almost certainty a pre-buy effect due to tariffs,” he said.

Industrial production also saw a similar pre-buy trend in the first quarter, which Vise said is close to their forecast. They expect it to flatten in Q2 and decline over the next three quarters. Although it may return to modest growth next year, FTR’s outlook for industrial production remains weaker than prior forecasts.

Residential investment, which includes new housing starts and renovation spending, is expected to fall due to persistently high mortgage rates, Vise explained.

Starks noted that though Q1 had been a “good” quarter, “It’s a sustained negative environment that persists for a period of time, which is kind of the worrying part."

[RELATED: Uncertainty grows as shifting tariff policies disrupt business and freight markets]

Shifting policies bring volatility

“The picture going forward at least for the next year, year-and-a-half, and probably beyond that, is going to be driven by what’s happening with economic policy of Washington, and particularly, the tariffs,” Witte said.

Witte drew a parallel between the current economic landscape and the uncertainty of the pandemic era, when forecasting was difficult because the trajectory of the disease was unpredictable. Now, that same uncertainty stems from shifting policies in Washington.

“We haven’t seen tariffs at anything like these levels in memory and it’s beyond anything in our current available data,” Witte said.

The only thing that seems certain, Witte added, is the GDP volatility. While declining imports could boost GDP figures, the sharp drop in freight demand will weigh negatively for inventory accumulation and trucking volumes.

If tariffs and weakness in the labor market worsen, Witte said it may “create a kind of a negative spiral that could lead us into a real recession.”