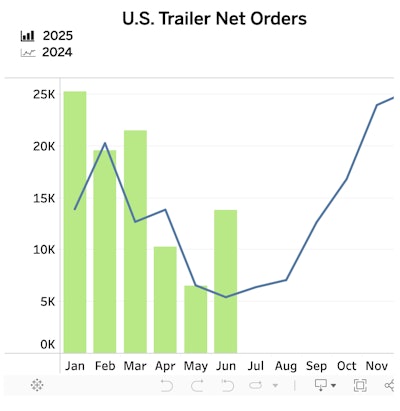

Preliminary U.S. net trailer surged in June, increasing by nearly 8,800 units from May – a 133% month-over-month rise, according to ACT Research. With 15,400 units booked, June orders were up 144% compared to June last year.

June is usually a slower month for trailer orders, and the jump was unexpected, said Jennifer McNealy, director of CV market research and publications at ACT Research.

OEMs have noted increased quote activity in recent months, McNealy said, which may indicate fleets are pulling forward orders ahead of anticipated price hikes.

Data from FTR Transportation Intelligence confirmed similar trends, with U.S. net trailer orders more than doubling month-over-month. Despite the improvement, June’s total still lagged behind the 2025 monthly average of 16,134 units, and cumulative orders for the 2025 cycle (September 2024-June 2025) are down 5% year-over-year, according to FTR.

FTR reported that order cancellations dropped to 17% in June, improving from May’s unusually high 39% rate. Total trailer builds rose 7% month-over-month in June, but were still down 13% year-over-year, with 18,071 produced. Year-to-date builds are down 26% year-over-year, totaling 98,773 units. Backlogs shrank by 4,520 units, with the backlog-to-build ratio now at 5.8 months.

[RELATED: Truckload market recovery slows amid freight volatility]

Tariffs cloud outlook

“Although this is good near-term news, supporting build rates in 2025, concern remains that weak for-hire carrier profitability continues to be an ongoing challenge to stronger demand,” said McNealy.

McNealy added that factors like low used equipment values, high inventories, elevated interest rates, and trade policy uncertainty continue to weigh on longer-term demand.

“Additionally, preliminary data shows cancel rates continue to be elevated, and in aggregate our standard notice that one month’s data does not make a trend is worth reiterating,” McNealy said.

ACT maintains its forecast for muted build rates and orders through 2025, emphasizing that one strong month does not signal a sustained trend.

The shifting tariff landscape is creating additional complications, according to Dan Moyer, senior analyst, commercial vehicles, at FTR. “The increase in tariffs on steel, aluminum, and fabricated components to 50% on June 4 will significantly increase production costs for OEMs/suppliers, putting further downside pressure on trailer demand," he said.

Lingering uncertainty over China tariffs, reciprocal and fentanyl-related tariffs that were based on emergency powers adds further strain, Moyer said. OEMs and suppliers face pressure to either absorb rising costs or pass some or all to fleets, potentially impacting fleet expansion and maintenance strategies.

Moyer said this could lead to fleets becoming more price-sensitive, delaying purchases, extending equipment life cycles, or shifting toward used or alternative configurations.