Here's what you need to know:

- Fluctuating tariffs, especially on Chinese imports, are creating volatility in trade and complicating long-term planning for freight and manufacturing sectors.

- Despite early-year strength, freight volumes are expected to remain soft through 2025, with goods-related transport seeing limited growth.

- High inventories of Class 8 trucks and weak retail sales are suppressing new truck orders.

While the year started off with a roller coaster of economic uncertainty, analysts said it’s starting to gradually stabilize, though sluggish freight volumes and excess capacity continue to suppress freight rates.

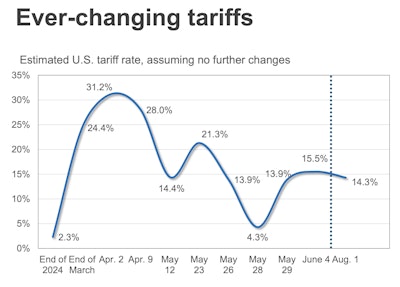

During FTR Transportation Intelligence’s State of Freight webinar on Thursday, Joseph Towers, senior analyst for rail, highlighted FTR’s chart tracking average global tariffs, illustrating how shifting U.S. import tariff activity has triggered fluctuations in the overall U.S. tariff rate.

Tariffs jumped from just 2% at the end of 2024, when trade conditions were relatively open, Towers said, all the way up to 31%. That surge reflected retaliatory tariffs, including a 145% rate on Chinese imports.

Tariffs have continued to fluctuate, but Towers said the changes have been less dramatic, hovering between 13% and 15%.

“It’s been more stable in recent months than it has been,” said Towers, "but it still isn’t a very clear environment on what international trade is going to look like for the next one to five years, which makes it very difficult for businesses to make decisions.”

FTR projects the average tariff rate will settle at around 14.3% for the year but recent policy moves could shift that outlook.

Vice President of Trucking Avery Vise noted the figure is likely to “be a floor, as opposed to a ceiling,” as FTR expects inflation to rise and interest rates to lower modestly in the latter half of the year. “It’s logical to assume that the effects that we will see from tariffs are still largely to come," he said.

Shifting containerized ocean imports in April and May compared to a year earlier has also created some volatility in economic indicators.

In recent years, container imports had seen a trend of companies moving from West Coast ports to East Coast and Gulf Coast ports, which reversed in 2023 and 2024. However, it’s moving back to the previous trend this year. East Coast ports saw the largest share, with 52.9% in May (the highest since summer of 2023), while West Coast saw 31.6% and Gulf Coast saw 15.4%.

“The implication of surface transportation is that there’s a big shift between demand for rail and for trucking," Towers said, "just based off of the length of haul for containers coming into the U.S.”

[RELATED: Tariffs trigger pre-buy behavior, analysts warn of steep freight decline]

Economic indicators

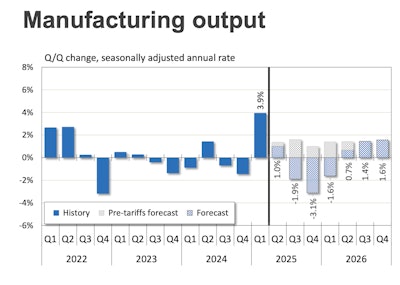

Economic indicators, like international trade activity, is being distorted by tariffs and expectations of tariffs, Vise said. Manufacturing, one of the big drivers of road freight volume, had a strong first quarter, with a recession appearing likely. FTR projects that a cooling of the trade war could bring near-term results that are not as negative.

Consumer spending is projected to grow, albeit sluggishly, Vise said. The outlook is even dimmer for goods-related freight demand, with much of the anticipated growth shifting toward the services sector, especially healthcare.

FTR anticipates GDP will remain choppy through 2026 as tariffs continue to create volatility in import and inventory trends. For 2025 overall, FTR is forecasting a 1.8% increase in GDP, which Vise described as “relatively solid growth,” though lower than the previous two years.

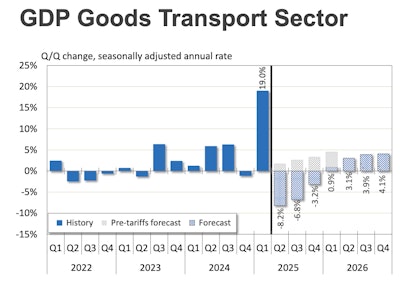

FTR’s goods transport sector, which removes non-freight producing services and includes freight-driving imports, benefitted significantly from an import boom as businesses tried to beat tariff in the first quarter, driving a 19% quarter-over-quarter spike.

“Now we do expect payback,” Vise pointed out. FTR projects a weaker second quarter and continued softness in the goods transport sector, through the third and fourth quarters. Still, due to the strong strength at the start of the year, FTR is projecting an overall 2.5% increase in goods transport for 2025.

Freight demand and rates

Dry van and refrigerated saw an unexpected uptick last week, said Vise, with dry van’s increase noted as the largest week-over-week increase in FTR’s data since February 2008.

“Does this mean an inflection in the market," he asked. "Are these the terms we are looking for?”

Vise said he remains cautious about labeling it a turning point for the industry, adding a week of strong performance isn’t a trend and sustained improvement over more weeks is needed.

Flatbed’s metrics were impacted from the pull-forward effect due to tariffs on steel and aluminum.

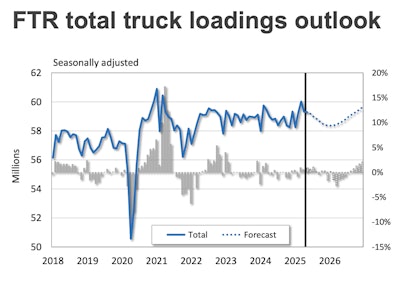

Total truck loadings outlook, which includes spot and contract freight, saw improved freight volume in Q1 due to strong manufacturing activity.

Freight forecast for truck loadings are still close to flat in 2025, with dry van forecast negative (-0.9%) year-over-year in 2025. Similar to GDP goods transport, FTR projects a “sort-of declining level for the rest of the year until we start to see recovery next year.”

Looking at the for-hire carrier population, more new carriers entered the market in Q2 2025, for the first time since late 2022. However, even though more new carriers are entering, the level of turnover is still worse than before the pandemic.

Vise said this isn’t surprising, given the strength in manufacturing activity, which resulted to an increase in jobs based on preliminary data in truckload in May. Vise pointed out that larger carriers (those with payroll employment) have more or less brought their capacity back in line with the market. "But we still have this big overhang of a large number of small carriers operating," he added.

Truck utilization is slightly above historical norms, though outlook remain soft due to forecasted weakening freight demand.

“But even before the tariff impact, we were seeing a recovery, but not a particularly strong one. So, we see a very modest gain in trucking,” Vise said.

Regarding the recent enforcement of driver English proficiency regulations, which took effect last month, Vise acknowledged it could potentially reduce the number of available drivers and, by extension, trucking capacity. However, "we’re skeptical based on enforcement alone if that will be a game changer," he added.

More likely to make significant impact, Vise said, are steep increases in insurance premiums. Vise also pointed out in a previous FTR webinar that elevated insurance costs could result in a loss of carriers, especially smaller fleets.

In its Analysis of the Operational Costs of Trucking report, the American Transportation Research Institute (ATRI) found that truck insurance premiums were up just three-tenths of a cent per mile in 2024 from the year prior, making up just more than 10% of a carrier's average cost per mile.

The effects of these hikes may not be felt until late this year or 2026, as carriers hit renewal cycles, Vise said. What’s critical, he added, is having more freight in the system.

Current forecasts suggest truckload contract rates will grow by less than 2%, which Vise said isn’t enough to keep pace with inflation. If those projections hold, Vise said more carriers could downsize.

[RELATED: Logistics industry urged to stay agile as trade war continues]

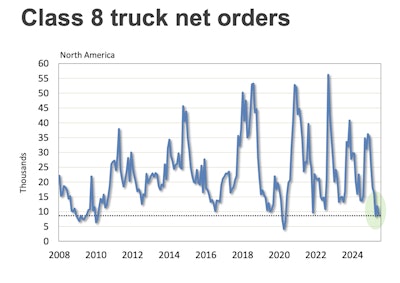

Class 8 orders

Class 8 net orders also present a worrying indicator, with net orders plunging in April to the lowest level since early 2010. Though it saw some recovery in May, June saw a -36% drop year-over-year. Uncertainty over the freight market, tariffs, whether the EPA 2027 NOx regulations would be enforced, as well as tax legislation, are likely factors.

“That’s potentially an upside,” Vise said, "but it could set the stage later for a rebound utilization in tighter capacity if we have not invested enough in equipment.”

However, there is still an oversupply of trucks that have already been built, Vise said. Production has slowed over the past year, but so have retail sales. Even if the available trucks don’t perfectly match what buyers want, the fact that there are so many readily available is definitely affecting demand.