The truckload market is improving, but recovery is slow, according to the TA Trendline Report.

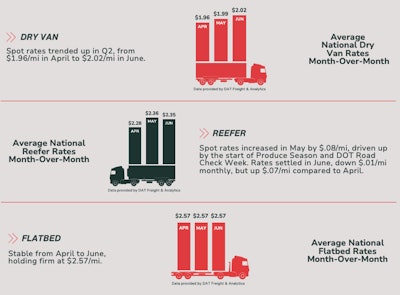

Dry van spot rates trended up in Q2 from $0.196/mi in April to $2.02/mi in June, according to the report, which offered an overview of freight demand and sourced data from DAT Freight & Analytics.

Chris Bahr, executive vice president and chief information officer at TA Services, said dry van’s modest increase is largely due to a decline in capacity over the past 12 months and increased routing guide volatility.

“We expect this outperformance to continue to a moderate pace through the remainder of 2025, with more significant rate movement likely beginning in Q2 2026,” he said.

Reefer spot rates increased in May by $0.08/mi, boosted by the start of the produce season and Commercial Vehicle Safety Alliance’s International Roadcheck week. Rates stabilized in June, down $0.01/mi monthly, but up $0.07/mi compared to April.

Reefer rates are climbing due to reduced capacity, Bahr noted, along with some degree of routing guide volatility, which is anticipated to remain strong and continue outperforming for the rest of the year.

Flatbed was stable from April to June, with prices holding at $2.57/mi. Bahr pointed out that the flatbed market peaked earlier than usual this year due to pull-forward volume tied to tariff concerns.

“While domestic steel continues to prop up demand, other key commodities like building materials remain soft,” Bahr said. He added that flatbed spot rates are projected to decline in the second half of 2025 compared to the first half, though they’ll still outperform year-over-year gains against 2024.

“Seasonal demand, regional imbalances and shifting import flows are creating new freight pressures across modes,” the report said. “While spot rates have stabilized in some lanes, short-term volatility and regional tightness are driving unexpected cost and coverage challenges.”

Looking at spot truckload volumes, DAT Freight & Analytics noted that volumes declined in June, signaling softer-than-usual demand for trucking services during a typically summer peak.

The June DAT Truckload Volume Index (TVI), which tracks the number of loads moved each month, retreated to levels last seen in March and April, following modest improvements in May. In June, the van TVI fell 2% month-over-month to 243, while the refrigerated TVI declined 5% to 191. Flatbed activity showed a slight increase, with the flatbed TVI rising 1% to 314.

June truckload volumes posted year-over-year gains.

The van TVI was up 4% compared to June 2024, while reefer volumes rose 10%, and flatbed activity increased 12% over the same period last year.

Despite the increases, shippers approached the market cautiously, wary of soft consumer spending and the potential cost impacts of tariffs and geopolitical tensions, including the Israel-Iran conflict.

“Many retailers and manufacturers continued to hold inventory at current levels or allowed it to draw down,” said Ken Adamo, chief of analytics at DAT.

As a result, Adamo noted that freight “moved in fits and starts” rather than building steadily toward the July 4 holiday, as typically seen.

Adamo noted that rising fuel costs and the enforcement of English-language proficiency rules for drivers had minimal impact on carrier exits in June.

Looking ahead, Bahr pointed out that enforcement of regulations such as FMCSA’s ELP mandate and B-1 driver audits could reduce available capacity.

In addition, tariffs and trade policy will surely have an impact, as it has prompted short-term sourcing shifts and routing disruptions, Bahr said. Longer-term, reshoring could drive domestic production and additional inbound freight volume.

“The truckload capacity is still in excess,” Bahr said, adding that it is keeping rates in check. As operating costs rise, carriers lacking pricing discipline may face greater financial strain.