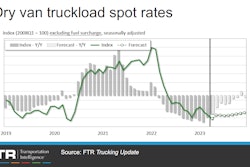

While April will likely mark the bottom of the spot rate downcycle, elevated Class 8 build rates will limit the near-term upside, according to the latest Freight Forecast, U.S. Rate and Volume OUTLOOK report published by ACT Research.

Data from Truckstop and FTR Transportation Intelligence for the week ending June 9 show an expected sharp recovery in volume and capacity in the week following Memorial Day week. Spot rates overall rose in May, but strong new equipment production will slow the ascent initially, according to ACT Research Vice President and Senior Analyst Tim Denoyer.

[Related: Roadcheck expected to 'help usher in a new freight cycle']

"Class 8 backlogs are sufficient for a while but are starting to dwindle as order activity has declined with industry profitability,” he said. “That spot rates have largely held onto the gains from Roadcheck suggests the freight market is close to the elusive balance, but the rebalancing so far has been mainly on the labor side.”

Class 8 orders for the past 12 months total 298,700 units, but the current level of order activity is below replacement levels. Essentially all 2023 build slots are accounted for and 2024 slots are not yet open.

“Though equipment capacity is still growing, labor capacity is tightening as some fleets shrink and others exit," Denoyer. said. "Aside from the pandemic capacity shock in April 2020, we are on track for a record contraction in labor capacity this year, which is key to the bottoming process.”

Despite the challenging rate and volume climate, Jason Miller, associate professor of supply chain management and interim chair of the Department of Supply Chain Management at Michigan State University, said a elevated total revenues for truck transportation has likely kept more capacity from exiting the market.

"Seasonally adjusted revenue for April 2023 is 32% higher than February 2020," he noted.

Despite higher operational costs during the same period, Miller said "there is also no denying based on available data that we just haven’t seen an exodus of capacity like we would expect given the depth of the current freight recession. This points towards the revenue situation not being as dire as some have predicted. Today is way better than Q4 2008 and Q1 2009 during the depth of the Global Financial Crisis. I’m increasingly hopeful that we are near the bottom of the current freight recession."

Though the near-term freight volume outlook remains muted, Denoyer expects seasonal increases in freight later this year will meet tighter capacity, "pushing the cycle forward," he said.