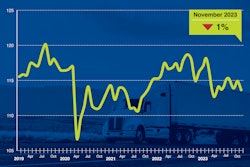

U.S. trailer net orders fell by more than 13,000 units in November, according to FTR, down 38% from the month prior

At 21,362 units, orders were down 45% versus November 2022, but were 7% above the current average for 2023. The number of trailers ordered over the last 12 months decreased to just above 276,700 units.

Not only were orders down materially from year-ago levels, ACT Research Director of Commercial Vehicle Market Research & Publications Jennifer McNealy noted that preliminary net orders, at 15,600 seasonally adjusted, were about 41% lower sequentially.

“After two months with orders above 30,000 units, it’s certainly disappointing, although not unexpected, to see orders drop, particularly amid a backdrop of weak profitability for truckers and anecdotal commentary from trailer manufacturers who have shared that orders are coming but at a slower pace than they have the last few years," she said.

Trailer production was 23,770 in November, down 12% month-over-month and down 9% year-over-year. Build was lowest since last year, but a drop in production after October is normal, and the average monthly build is still healthy at more than 27,200 units.

“With orders coming in under production levels, backlogs in November fell slightly, shedding almost 2,500 units to end at just over 140,000 units," said Eric Starks, FRT chairman of the board. "The more pronounced fall in production resulted in an increase for the backlog-to-build ratio to 5.9 months. This ratio is in line with the historical average prior to 2020 and suggests the industry is moving towards a pre-pandemic level of stability.”

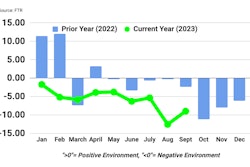

ACT Research cautioned last month that, while positive momentum for the industry, two months of robust orders does not guarantee the full year. "Although this supports our thesis that when fleets don’t make money, their ability and/or willingness to purchase equipment is muted, one month of lower orders doesn’t indicate a catastrophic year in the offing either," McNealy said. "Other indicators being watched closely include cancellations, which have returned to acceptable levels for most segments of the industry, and the backlog-to-build ratio, which in aggregate remains healthy at nearly six months. Some specialty segments have no available build slots until late in 2024 at the earliest.”

Supply and demand flip

Peak order season opened in September, and while November order levels were healthy, they lagged the previous two months. Unlike the last few years with challenges solidly on the supply-side of the pendulum, trailer industry concerns now rest on the demand-side, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report.

"Regarding orders and expectations for 2024, trailer manufacturers reinforced this month what they have been telling us for a while: negotiations are ongoing, but order placement is at a slower pace than what occurred the past few years," added McNealy.

November’s per day build rate decreased 3% to 1,178 from October’s 1,220-unit per day rate, according to ACT. Overall, build was more than 12% lower m/m, mostly due to two fewer build days in November. Supply-chain issues have essentially normalized, with OEMs reporting smaller, less impactful disruptions.

"Despite being in the third month of the new peak order season, build outpaced orders in November by about 2,500 units," McNealy said. "Trailer backlogs contracted 32% against 2022’s supply-chain constrained and pent-up demand heavy environment.”