Environmental regulations are prodding fleets that operate medium-duty trucks with transport refrigeration units (TRUs) to more quickly transition to battery electric vehicles (BEVs) compared to other industry sectors.

Effective January 2024, 15% of all TRUs sold in California have to be zero-emission units. The state’s clean air agency, CARB, has a slower timetable for the transition of medium- and heavy-duty truck powertrains, as only 5% of class 4-8 vehicles sold in 2024 must nix tailpipe emissions.

The zero emissions timeline speeds up for TRUs through 2030. By then, 100% of all TRUs sold in California have to be zero emissions, but only 30% of Class 4-8 trucks will have an emissions-free sales quota.

Refrigerated fleets will therefore be making an earlier decision for going electric. The debate will be whether to pair an electric TRU with an internal combustion engine or to skip ahead and go all-electric with TRUs that pull power from an electric chassis.

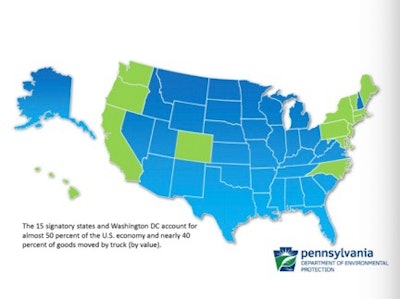

California has 12% of the refrigerated truck population in the United States but its CARB regulations drive the market. Last year, 15 states adopted a similar timeline for the zero emission transition by signing a memorandum of understanding (MOU).

The 15 states who signed the MOU for zero emissions account for almost 50% of the U.S. economy.

The 15 states who signed the MOU for zero emissions account for almost 50% of the U.S. economy.

With the bevy of options for battery-electric vehicles (BEVs) in the market for Class 2-7 trucks, fleets can start to plot their transition today. Complying with regulations is not the only consideration. Profit is the motivating factor by getting a lower total cost of ownership (TCO) from electric versus ICE vehicles. The TCO equation for electric vehicles will not be profitable until the cost of batteries reaches a certain number, Kroes explained.

Total cost of ownership

The return on investment for ICEs is higher than BEVs at present due to the initial cost of electric vehicles. The battery pack accounts for about half of a BEV’s sticker price, Kroes said.

Battery costs are projected to decline over the next five years and the price of combustion engines will likely increase due to regulations. When the cost of battery power for commercial trucks hits the $100 per kWh marker, the impact on upfront vehicle costs will be “meaningful,” Kroes said.

A fleet that purchases an electric Class 6 vehicle today will need to operate it for 12-13 years before getting payback versus an ICE vehicle, he noted. The batteries of electric vehicles are currently projected to last eight years, which does not extend beyond the typical 7- to 10-year trade cycle for a medium-duty ICE vehicle. After eight years a BEV would therefore not have much, if any, value in the secondary market.

By 2025, Kroes said the lifecycle of batteries are projected to increase by 50%, reaching 10-12 years. This would give BEVs a resale value and largely increase fleet adoption, he predicted. By 2030 the expected lifecycle for BEVs is 15 years or more, he noted.

In the short term, the purchase price of BEVs should be going down over the next four years, but “if you buy an electric vehicle in next couple years, you will not get a payback in the trade cycle,” he said.

Infrastructure is another hindrance. Fleets today are installing their own charging equipment, which is “the largest cost barrier” to BEV adoption, he said. Some states offer grant funds to utilities for subsidizing the installation of chargers at fleets, however.

The cost of battery-electric commercial vehicles is projected to drop significantly in the next five years, making them a more attractive investment for fleets.

The cost of battery-electric commercial vehicles is projected to drop significantly in the next five years, making them a more attractive investment for fleets.

Kroes said BEVs with integrated TRUs will need to have a real-time range prediction to help fleets go full electric. Range predictions could feed advanced route planning software that also accounts for ambient temperatures and accessory power consumption (from the TRU and other components).

To manage power consumption of an integrated BEV, Kroes said fleets and OEMs will need to evaluate options. Most truck manufacturers today want to shut off the power completely when a vehicle is turned “off” and not allow for accessory loads. However, if a TRU is integrated with the chassis, the TRU needs access to batteries at all times to maintain load temperatures.

Decisions will need to be made about when a vehicle should begin to mitigate the load on the refrigeration unit if a vehicle is experiencing low range.

“Having choice and flexibility between the chassis and refrigeration unit is going to be key,” he said.

Environmental paybacks

Besides complying with regulations and profit considerations, many fleets have their own environmental initiatives that will determine when and how they transition to zero emissions.

When evaluating the environmental benefits of BEVs, Kroes shared data that shows they are not significantly “greener” than ICE vehicles. Battery production of an electric truck produces 15% to 70% more CO2 emissions, or 30 to 40 tons of carbon, compared to production of an ICE truck.

The extra emissions for BEV production is made up within a few years of vehicle ownership, he said, because the carbon emissions for electricity that BEVs pull from the grid are 60% to 70% less than the emissions of an ICE, he said.

“As the grid continues to transition to renewable resources, that is where we will see a greater difference,” he said, noting that on a national level, natural gas makes up more than one-third of electricity production today. Coal makes up about one-fourth.

The Biden Administration and its Environmental Protection Agency (EPA) are likely to ramp up federal pressure on the transition to zero emissions, but national pressure will drive innovation and investment in infrastructure and could provide more funding to lower the cost of BEV ownership, he said, as well as accelerate the environmental benefits.

“If subsidies come out from the Biden Administration for wind, solar, etc., that will help the environmental case for running electric. It is not a free ride for running electric in emissions — at least not yet,” Kroes said.