I’ve had the question asked several times recently about what happens to the fuel tax as the marketplace transitions to electrified commercial vehicles EVs.

As you know, a significant portion of the price of both gasoline and diesel fuel is comprised of taxes that are levied at both the federal and state levels. With the advent of EVs, this source of revenue for federal and state governments goes away under the current rules.

The average tax per gallon of diesel fuel purchased today at the pump in the U.S. is about 65 cents/gallon. Of that, 24.4 cents goes to the federal government to add to the Highway Trust Fund. The rest goes to states in various forms. Depending on the current price of diesel, taxes make up about 15% to 20% of the total price you pay for a gallon of fuel. With an EV, there is no corresponding tariff or excise tax on the electricity that you use to charge the vehicle. Therefore, as the percentage of EVs in the total vehicle population increases, the revenue for making road repairs and improvements at both the federal and state level will go down.

It is also important to note that the federal fuel tax rate has not been increased since 1993, and the average fuel economy for all vehicles on the road has improved significantly during that time. If the federal diesel fuel tax rate had been indexed for inflation since 1993, the rate would now be about 44 cents/gallon – about 20 cents more per gallon and almost twice what it receives today.

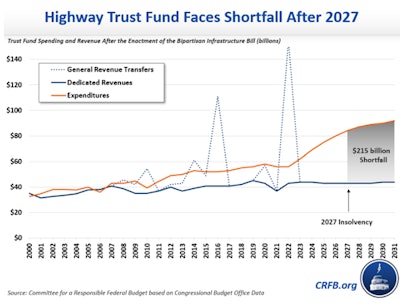

The solvency and adequacy of the Highway Trust Fund has been discussed frequently over the last few years. In fact, Congress has added funds from general revenues to the Highway Trust Fund periodically since about 2005 to keep it solvent. The most recent example of that is the Infrastructure and Jobs Act that added about $100 billion as part of the legislation, but also authorized increased spending for projects. This will keep the fund solvent until 2027 as shown in the chart below from the Committee for Responsible Federal Budget.

Given all this, is it a surprise that the deterioration of our roads and bridges is becoming more of a problem?

There are, however, a couple of other things to keep in mind as we talk about this subject. Part of the funding for the Federal Highway Trust Fund comes from the 12% federal excise tax that is levied on the purchase of new commercial vehicles. This amounts to roughly 10% of the total tax receipts that the trust fund receives. EVs cost more than their diesel-powered counterparts, so this price differential will increase this tax revenue somewhat. Depending on the price differences, this revenue might make up for the loss in fuel tax for perhaps two to four years of usage per vehicle.

As you know, there have been a number of groups lobbying for the elimination of this vehicle purchase excise tax recently, and that seems unlikely to stop anytime soon. So, what is the future for possible road taxes on EVs? I don’t know, but it seems to me that a solution that adequately and fairly funds both the Federal Highway Trust Fund and the corresponding state funds long-term is absolutely necessary to fund our highway infrastructure. This solution must take into account that there will be a number of sources for vehicle propulsion (gasoline, diesel, natural gas, electricity, hydrogen, propane, etc.) serving the market for the next few decades.

So, you might ask, when might a solution like this happen? My guess is that it will be a few years before any meaningful action is taken on this subject due to the current state of funding for the Highway Trust Fund over the next five years given the very large general fund transfer that was part of the Infrastructure and Jobs Act.

Kevin Otto is electrification technical lead for the North American Council for Freight Efficiency where he provides consulting services and has authored a number of Confidence Reports and Guidance Reports. Otto spent 40-years at Cummins where he held a number of key positions in Technical Service, Engineering, Quality and Program Leadership in several of the Business Units. Otto has a B.S. in Mechanical Engineering from Rose-Hulman Institute of Technology. He is involved in the Technology & Maintenance Council and was awarded the Silver Spark Plug in 1999.