Officially launched in late July 2022 as part of an effort to address the truck driver shortage, Safe Driver Apprenticeship Pilot Program (SDAP) would allow truck drivers under the age of 21 to drive and conduct interstate commerce; or Washington’s fancy way of saying they could cross state lines under certain conditions.

Originally proposed in September 2020, the three-year program is designed to help individuals ages 18, 19, and 20 explore interstate trucking careers and help trucking companies hire and train new drivers. The program caps at 3,000 participants but getting prospective drivers into the program is only half the problem. It also requires fleets willing to train them.

Fleets aren’t exactly beating down the door to participate. As of right now, there’s only 15 carriers listed on the FMCSA’s website approved to hire drivers for the SDAP program. Granted we’re barely six months in so there’s nothing conclusive that we can draw just yet.

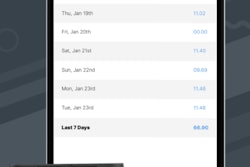

Contents of this video

00:00 Safe Driver Apprenticeship Pilot Program

03:03 Low participation in program

05:18 Moving more freight

07:50 Recruiting younger drivers

10:26 Obtaining trucks and trailers

Jason Cannon

This week's 10-44 is brought to you by Chevron Delo 600 ADF Ultra Low Ash Diesel Engine Oil. It's time to kick some ash.

After about six months, has the Safe Driver Apprenticeship Pilot Program made an impact on getting under 21 drivers on the interstate?

Hey everybody, and welcome back to the 10-44, a weekly episode from the editors here at CCJ. I'm Jason Cannon and my co-host on the other side is Matt Cole. Thanks for joining us and don't [00:00:30] forget to subscribe to this channel by clicking the subscribe button to my lower right, you're left, so you won't risk missing A future episode.

Officially launched in July of 2022 as part of an effort to address the truck driver shortage, the Safe Driver Apprenticeship Pilot Program or SDAP would allow truck drivers under the age of 21 to drive and conduct interstate commerce, or Washington's fancy way of saying they could cross state lines under certain conditions.

Matt Cole

Originally proposed in September, 2020, the three year program is designed to help [00:01:00] individuals 18, 19 and 20 years old explore interstate trucking careers and help trucking companies hire and train new drivers. The program caps at 3000 participants, but getting prospective drivers into the program is only half the problem. It also requires fleets willing to train them.

Jason Cannon

Fleets aren't exactly beaten down the door to participate. As of right now, there's only 15 carriers listed on the FMCSA website approved the hire drivers for the SDAP program. Now granted, we're barely six months in so there's not a lot conclusive that we can [00:01:30] draw just yet. But ACERTUS CEO, Trent Broberg who joins us this week on the 10-44, says it's sort of off to a slow start.

Trent Broberg

Given that the FMCSA was assuming somewhere or requesting some around a thousand motor carriers to sign up, it seems like it hasn't moved the needle much in the first six months. Most motor carriers, at least the major motor carriers, already have age limits that are above 21 years old. So as they've creeped down when it's a little bit harder to find drivers, that kind of [00:02:00] fluctuates up and down based on safe driving behaviors and how they're sourcing drivers. I think there's insurance challenges that will continue to persist here until the data speaks for itself.

But even after that, I know myself, I've been in logistics for over two decades and there was always challenges the farther or younger the driver community goes. There's anomalies everywhere. There's great drivers across the us, but at the 3000 limit, I'm not even sure that's [00:02:30] enough data to speak to from an insurance perspective. The way that I look at the industry and the lack of drivers in the industry, yes, that's challenging. And yes, it's a challenge to recruit drivers back into the industry after COVID, but it's really a utilization challenge that we have. I know at ACERTUS, we touch 8,000 carriers on a regular basis and it's really focused on their utilization. How do we load them? How do we get them moving? How do we get a lower detention rate [00:03:00] and really get their wheels turned until they're earning?

Matt Cole

By the end of '23, we'll have about 18 months of data from the pilot. But given that it caps at 3000 participants and that a percent of a percent of the truck driving population and the carrier participation rate is likely to remain relatively small, even if it doubles every six months, that's just 60 carriers by January, 2024. The kind of data that could determine the viability of under 21 interstate drivers might not be available.

Trent Broberg

There's 2 million tractor trailers on the road, Class 8 trucks [00:03:30] on the road today. They drive 140 billion miles per year. So it is a huge sample set and to your point, 3000 drivers is somewhere around 0.15% of the driving population out there. And unless there's a strong sample set of motor carriers and freight obviously that differs from one motor carrier to another based on their customer set, it's going to be challenging to get the data together on that.

Jason Cannon

Now, if you're just lying in wait, letting the early adopters of the apprentice program [00:04:00] work out the bugs, Trent says the only way to move more freight for you is to do more with what you've already got. He offers some tips on that after a word from 10-44 sponsor, Chevron Lubricants.

Protecting your diesel engine and its aftertreatment system has traditionally been a double-edged sword. The same engine oil that is so essential to protecting your engine's internal parts is also responsible for 90% of the ash that is clogging up your DPF and upping your fuel and maintenance costs. Outdated industry thinking still sees a trade off between engine and emission system protection [00:04:30] and Chevron was tired of it.

So they spent a decade of R and D developing a no compromise formulation. Chevron Lubricants developed a new ultra low ash diesel engine oil that is specifically designed to combat DPF Ash clogging. Delo 600 ADF with OmniMax technology cuts sulfate ash by a whopping 60%, which reduces the rate of DPF clogging and extends DPF service life by two and a half times. And just think what you can do with all the MPGs you're going to add from cutting your number of re-gens.

But Delo 600 ADF isn't just about after treatment, it provides complete protection extending drain intervals by preventing oil breakdown. Before you had to choose between protecting your engine or your after treatment system, and now you don't. 600 ADF from Delo with OmniMax technology, it's time to kick some ash.

Trent Broberg

First and foremost, I think this industry after 20 years, it's never in parity. There's always a supply and demand challenge, whether it's the drivers, whether it's the freight itself or as of late the assets or sourcing [00:05:30] assets for a lot of these motor carriers. I think really what I've focused on and what we focus on at a ACERTUS is really around, like I mentioned, the utilization of the driver, the utilization of the truck. How do we get them turned faster? How do we stack them? We participate in the auto haul space, so how do we get them turned and how do we stack those larger trailers, whether it's a nine car all the way to a flatbed? And understand how do we get them moving faster?

Even over my career, the average utilization of hours of service for a driver really has not increased. It might have gone from seven hours to seven and a half hours of their 11 total per day. So that is a highly underutilized workforce and it's upon the industry, not necessarily the federal government, but the industry to jump in and utilize these drivers and these assets better.

The majority of the drivers out there are paid based on mileage, [00:06:30] so they're aligned with the company. When, like I said, the wheels are turning they're earning. So the drivers and the company itself or the business itself, whether you're an owner-operator or a company driver, you're all aligned to make money when you're moving. So it's really upon the entities out there to leverage technology, technology to find freight, to find more efficient freight. It's upon the shipper community and actually using that technology and having those two-way conversations with their shippers out there. Because [00:07:00] oftentimes the shippers don't understand what the detention, the parking challenge is, the in and out gate, how they're affecting the drivers and how they're really affecting the business in itself. So what I've seen is really leveraging that two-way communication. We call it an outside in approach where we don't assume we know what the driver needs. We don't assume we know what the shipper needs, but let's have that conversation.

And then let's layer on some technology. There's plenty of technologies out there, whether it's homegrown or subscribe to [00:07:30] or purchased, that can really leverage some optimization engines. Some AI out there today that can really help the driver community. It can take your freight, it can stack others freight, so you're really keeping that driver captive within your community, which helps everybody. If you get them moving, you get them stacked, it helps everybody as long as obviously the rates are correct.

Matt Cole

Just drive more. Sounds easy, right? We know and Trenton knows, it's not that easy. Just like it's not going to be easy for the Safe Driver Apprenticeship Pilot Program to grease the skids [00:08:00] for a youth movement among the driver population that CCJ surveys and data show is close to 60 years old.

Trent Broberg

When you look at the federal government and how they class the population of workforce, it's typically in that 25 to 60 year old age. What you just described is the outer bounds of that, so it's a program that goes lower than a typical working age individual. And to your point, the average age of an over the road truck driver is 60 plus, [00:08:30] right? They're more of comfortable with being out of the road longer periods of time.

I think the challenge is really upon all the shippers and the logistics providers out there and carriers to understand once again that outside in approach. When you go into the millennial categories and even lower into those gens that are newer in the workforce, what do they want? What do they fundamentally need? How can we retrofit that truck to have high speed internet, [00:09:00] to have the things that makes it easier for the attraction of a younger population?

What you see in private fleets is I'm home every night, I'm home every other night, and that is really enticing. Plus, they're typically more salaried positions. They're less on demand and transactional relationships with those drivers. Where I've seen the most success is really on treating those drivers not as drivers, not as numbers, but as employees. That could be salaried opportunities, that could be really escalators [00:09:30] in how much they're driving. But it's really appealing, when I look at the workforce here that are in the office and I look at the workforce of drivers and CDL drivers out there, the wants and needs are not a lot different. COVID has changed the behaviors or the mindset of individuals. And I fundamentally believe that human face-to-face interaction is what creates relationships and what creates bonds.

And I had that question the other day in my [00:10:00] response, how a remote work has gone for ACERTUS? And I said, "Well, have you ever made a best friend over Zoom?" And that applies to drivers as well. It's about taking the time. It's about having them in the office and making them part of the business because that will fill those millennials and those Gen Ys and Zs as it goes farther down into age of the workforce community. You've got to make them part of the company and not just a driver.

Jason Cannon

Rates have just started to firm up. New truck and trailer build log jams have [00:10:30] sort of started to ease and maybe the economy's not going to hit the depths that were forecasts several months ago. So if you're one of the carriers out there waiting for a significant swing in capacity, Trent says you're probably in for a long wait.

Trent Broberg

The meaningful percentage of trucks out there based on the supply and demand needed for the freight movement really hasn't materially changed. The biggest challenge lately is obviously just obtaining assets, whether they be trucks or trailers out there. There's ton of demand for assets out there and will continue [00:11:00] to be a ton of demand through 2023. I think regardless, a lot of vehicles, we participate in the automotive sector and it's just like the OEMs out there that were unable to produce vehicles out on dealership lots because of supply chain challenges that persisted on the Class 8s. I don't see a meaningful change happening. I think it's a challenging environment to get equipment and it will continue to be a challenging environment to get equipment.

And like you mentioned, Jason, rates are leveling [00:11:30] off right now across most sectors, even in the auto haul space. And what we're really trying to do is service our customers better and really create and foster those relationships. And hopefully just as ACERTUS and many other providers out there, whether you be a motor carrier or logistics provider, you weren't gouging your shippers when you could have and you created and fostered those long-term relationships because it's never in parody. It's the shippers or carriers market and it's really [00:12:00] about those relationships in the industry.

Jason Cannon

That's it for this week's 10-44 and you can read more on ccjdigital.com. And as always, you can find the 10-44 each week on CCJ's YouTube channel. If you've got questions, comments, criticisms or feedback, please hit us up at [email protected] or give us a call at (404) 491-1380. Until next week, everybody stay safe.