Social media and regular media seem convinced that a 2027 pre-buy is a reality, necessity, inevitability — pick your description. I picture the carnival barker announcing, “Get your diesels while their still hot!” Posturing will likely be that the pre-buy will be your last chance to buy a diesel on your terms. It doesn’t seem to matter what the facts are. That’s the nature of sales and marketing.

One of the myths being propagated is that somehow a pre-buy will lower the cost of trucks. Let’s unpack that a bit. If there is a significant pre-buy as some predict, build slots will be at a premium. What happens when there are more orders for trucks than manufacturers can build? Supply and demand generally means that OEMs and dealers have no reason to bargain on pricing. Residual values on trade-ins similarly will not have much room for negotiation because a high volume of new truck purchases also likely means a high volume of used truck inventory being traded in.

The back-end of the pre-buy cost savings myth is that somehow 2028 and 2029 will be cost effective years because of pre-bought trucks. But those trucks eventually will need to be traded into a market that is less interested in higher-emission trucks.

Model year 2027 trucks are expected to have longer warranties under the regulations. That likely will mean an increase in first-ownership period — a longer time before trade-in. Instead of trading the trucks at 3, 4 or 5 years, because that makes sense from a maintenance cost standpoint today, the 2027 trucks may be traded at 5, 6 or 7 years. What is that going to do to the price of new and used trucks?

All truck purchases and sales also occur in an increasingly unpredictable economy. Do you recall that the 2007 pre-buy caused OEMs to substantially reduce production in 2007 and then we got hit with the 2008-2009 Great Recession, compounded by dramatic increases in oil prices? What did all that do to residual values? I remember seeing dealer lots full of long-and-tall, non-aerodynamic, low fuel economy trucks gathering dust as the market pivoted to better MPG aerodynamic ones.

It doesn’t really matter what your politics are, the market does what it does and fleets, OEMs and dealers have to roll with that. A pre-buy may look inevitable and smart to some, but a longer perspective might mean different things.

Let me play devil’s advocate for a moment. What if autonomous trucks take off post 2027? I expect they will be at a premium because of increased demand, short supply and inherent capital cost. What do you think your pre-buy diesel will get on trade in a market that wants autonomous vehicles?

Let’s say a particular company launches a truly viable long-haul electric Class 8 truck as they have been claiming they will since 2017. What will that do to the market for pre-buy diesels?

Predicting residual value of trucks is basically gambling. No one knows for sure. Do you remember when an OEM executive in the late 1990s bet the future on a guaranteed residual value. How did that work out?

What if all the 2027 regulations go away next year? What does that do to all predictions of a pre-buy? What will that do to all the OEMs who have incorporated 2027 features into their product plans already? What will that do to profit and loss expectations for dealers, OEMs, fleets and investors?

One of the fundamentals of trucking is that the future is always fairly murky, and the industry figures it out as it goes. Often all you know with any certainty is what today looks like. Everything else is educated or wild guesses.

Pre-buys have happened before. We have seen what that does to vehicle prices in subsequent years. Peaks in sales are followed by troughs. My experience is that peak demand increases the cost of trucks, and that subsequent troughs decrease residual value. Those troughs typically mean OEMs lower R&D investments and reduce staffing, slowing new product development. Suppliers are similarly challenged in the troughs. Smaller fleets and manufacturers tend to fail in troughs.

Is a pre-buy a reality, necessity, inevitability? If so, the subsequent trough it creates is just as possible.

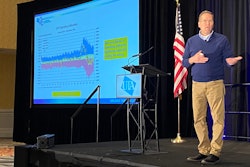

Truck sales over time tend to follow a rollercoaster shape, with peaks and troughs. That volatility has consequences to real-world OEMs, fleets and dealers.

In the ramp up to a 2027 pre-buy, I hope there is more discussion of the post-buy prospects.