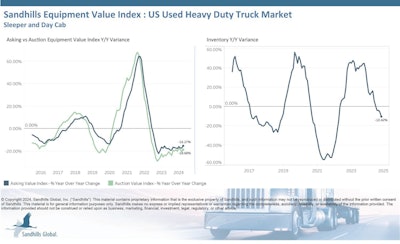

Used day cab truck inventory surpassed sleeper truck inventory for the first time, according to a report from Sandhills Global. The swing is driven mostly by the 5- to 10-year-old heavy-duty truck category.

In the overall market, inventory levels were down 2.28% month-over-month and 10.42% year-over-year, continuing months of decreases. Unlike day cabs, sleeper truck inventory trends have been declining or steady since January, and inventory has not yet reached pre-COVID levels.

Used heavy-duty truck asking values have been trending down for 25 months, according to Sandhills. Asking values were down 1.12% month-over-month and 15.27% year-over-year in October, with the greatest year-over-year decrease occurring in the sleeper truck category, down 15.94%. Auction values decreased 1% month-over-month and 18.68% year-over-year in October and are trending down. Day cabs posted the largest auction value decreases, down 23.5% year-over-year.

"Auction values have been falling quicker than asking values for heavy-duty trucks," said Truck Paper Manager Scott Lubischer. "While this is not uncommon, it's an important trend to monitor because auction values indicate where the market is heading."

The last couple of months have been tough ones for used trucks. September activity erased August’s strength in the average retail sale price for Class 8 trucks, according to ACT Research, which dropped 5.2% month-over-month. On a year-over-year basis, ACT Research Vice President Steve Tam said prices are expected "to remain stable at or around this lower level through 2024, transitioning to year-over-year growth in early 2025."

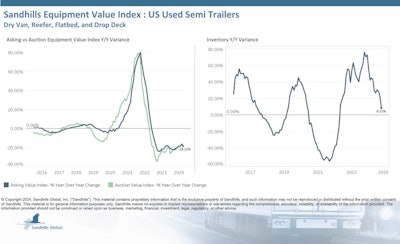

Trailers

In the used semitrailer market, Sandhills noted a shift from an upward trend to a steady trend in October. Inventory levels were down 5.84% month-over-month and up 8.52% year-over-year. The flatbed trailer category showed the largest year-over-year inventory gain, up 28.53%, while the dry van trailer category showed the largest month-over-month inventory loss, down 8.74%.

Asking values continued a 26-month-long downward trend, posting decreases of 3.48% month-over-month and 18.87% year-over-year in October. Used reefer trailers led the way, down 26.68% year-over-year. Similarly, auction values have been trending downward for 28 months in a row. Auction values dropped 2.27% month-over-month and 18.12% year-over-year in October. Used reefer trailers led the way in auction value decreases, as well, with values falling 6.99% month-over-month and 30.38% year-over-year.