This year’s ACT Expo certainly exemplified the Messy Middle. Unlike previous years where the focus was on zero-emission vehicles (ZEVs), this year’s conference seemed to be balanced among all the alternative powertrains.

One of the great things about attending a conference is the networking and side discussions with colleagues. I also like the espresso drinks that are offered, and, in my opinion, International Motors won the award for best espresso.

Out of all these discussions, my elevator speech on the conference and our current state of the industry is as follows:

- There still is significant investment and discussion regarding ZEVs. Fleets will continue to adopt ZEVs and optimize them.

- Alternate fuels such as compressed natural gas (CNG), renewable natural gas. (RNG), renewable propane, hydrogen, and biodiesel were very much on the front stage.

- Uncertainty regarding regulation, tariffs, and lack of battery electric vehicle (BEV) demand is causing some to rethink their strategies and product portfolios.

- These phrases were voiced throughout the conference: “We need customer-driven solutions. Don’t let perfection be the enemy of improvement,” and “We can’t be aspirational; our solutions must be practical.”

Point 4 really resonates with me. We are in the Messy Middle because there is no perfect, one-size fits all solution for the industry. BEVs are the right solution in some applications. In addition, renewable fuels are the right solution too. In others, we should focus on optimizing routes, driver performance, and the vehicle itself to improve fuel economy.

Our job is to innovate, create practical, low cost, and environmentally friendly solutions. Early in my career, I learned that, “Continuous improvement is better than postponed perfection.” This is how we should approach today’s challenges.

Here are some of the highlights.

ZEVs

There are still plenty of new product announcements of pure electric vehicles.

Toyota announced its third-generation fuel cell vehicle. The company indicated that this vehicle will be in production by 2027, and the production-intent design will soon be hauling freight in the company’s logistics fleet. The new design is said to be 20% more efficient and 20% more powerful than the previous design and intended to meet 600,000-mile heavy-duty requirements without the need for service.

Peterbilt and Kenworth announced their next generation products. They are designed for drayage, regional haul, and vocational applications with up to 625 kWh battery capacity, 250-mile range, and the ability to charge in two hours. They offer a three-stage regenerative braking option, an ePTO, and advanced driver assistance system. All the traditional OEMs (Daimler, International Motors, Volvo, Mack, as well newer North American entrants like Hyundai, etc.) also had exciting booths and product announcements.

New players such as Windrose and Tesla were present and discussed their unique center drive vehicles. Windrose’s design which competes with the Tesla Semi. Price starts at $250,000 per truck with a range of 400 miles when fully loaded. Tesla announced that its production facility is 1.7 million square feet and on track for delivering trucks in early 2026. The company also announced that it will have 46 megawatt charging stations along corridors in Nevada, California, New Mexico, and Arizona. It also showed some in Georgia and Illinois. You can see that the company is trying to make a play not only in the truck space but also the energy space.

Alternate fuels and hybrids

There clearly was an increased focus on CNG, RNG, biofulels, hydrogen, and hybrids. Here are some key takeaways.

CNG and RNG offer low NOx, simplified aftertreatment and lower CO2 emissions. The Transport Project announced that it will publish its 2024 data soon but expect that 86% of the natural gas used in transportation was RNG. That is huge. One panel indicated there are plans to produce 20 billion diesel equivalent gallons (DGE) in the future. It is often debated as to whether this will be achieved, but the panelist indicated a conservative estimate of 7 billion DGE, is likely and will be adequate for the expected demand.

The Cummins X15N was discussed. This could very well be a key contributor to long-haul decarbonization. I hear the projected X15N penetration could reach 10% of the heavy-duty market share in several years.

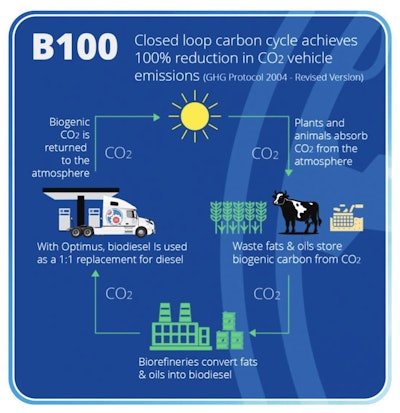

Optimus was on display. The company offers 100% biodiesel. See Figure 1 which illustrates CO2 reduction. The innovative, yet simple solution seems to be getting a lot of attention from some of the major fleets. It is offered as an aftermarket solution; fleets can act now and upfit their trucks and reduce emissions without having to purchase new trucks and infrastructure. One panelist stated that 174 million trucks are on the road, so this solution is an excellent way to decarbonize now.

On the medium-duty truck side, there were 7-liter engines on display, powered by propane. This is a low NOx, simple aftertreatment, and reduced CO2 solution with good payback for some fleets. Renewable propane is available.

Hydrogen engines also were discussed. Bosch, Cummins, Cespira, and Volvo are all making investments in hydrogen engines. Cespira indicated that its high-pressure direct injection system can achieve equal or better efficiency than diesel.

Last but not least, there was talk of hybrids. Major players such as BAE, ZF, ReVolt, Harbinger, talked about their products. Some of these are parallel hybrids; some are range extenders. Fuel savings varies by duty cycle but in some cases, hybrids are said to yield 20% reduction in fuel which translates to a 20% reduction in CO2. Engines can be downsized, and hybrids require significantly less batteries and infrastructure than BEVs. This will be something to watch over the next few years to see if hybrids become key players in the Messy Middle.

Figure 1: Illustration of CO2 reduction of Biodiesel, B100Presentation from Optimus during ACT Expo 2025 panel discussion

Figure 1: Illustration of CO2 reduction of Biodiesel, B100Presentation from Optimus during ACT Expo 2025 panel discussion

Other interesting things to note

NACFE’s Messy Middle fleet breakfast: NACFE held a breakfast about the upcoming Run on Less series. A total of 13 fleets will participate in this Run in September. The Run will feature trucks with petroleum diesel, renewable diesel, CNG and RNG, BEV, and hydrogen fuel cells. Each fleet discussed its operation. This series will be interesting to watch.

Use of artificial intelligence (AI) and data analytics: There were several discussions om which fleets talked about using AI to find the right solution. In the case of BEVs, fleets are using data analytics and AI to find the optimal routing, optimal charging time, and ways to squeeze every bit of range possible out of the batteries. This also can be used on engine-propelled vehicles and is a tremendous opportunity to maximize fuel economy.

Regulation: There was plenty of discussion about regulation. California Air Resource Board asserted that it would continue to work towards stringent regulation. I was happy to hear that there was some recognition for regulating at a full life cycle analysis or well-to-wheels level; several panelists commented that we need to measure our progress this way.

We definitely are in a phase of uncertainty regarding regulation. We should not become discouraged, however. It is our time to innovate and find solutions that meet both environmental and economic needs. Companies that are on the front end and work towards developing solutions will come out winners.